Zanaga iron-ore project, Congo-Brazzaville – update

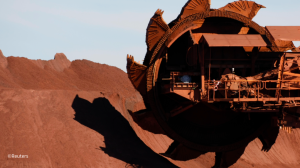

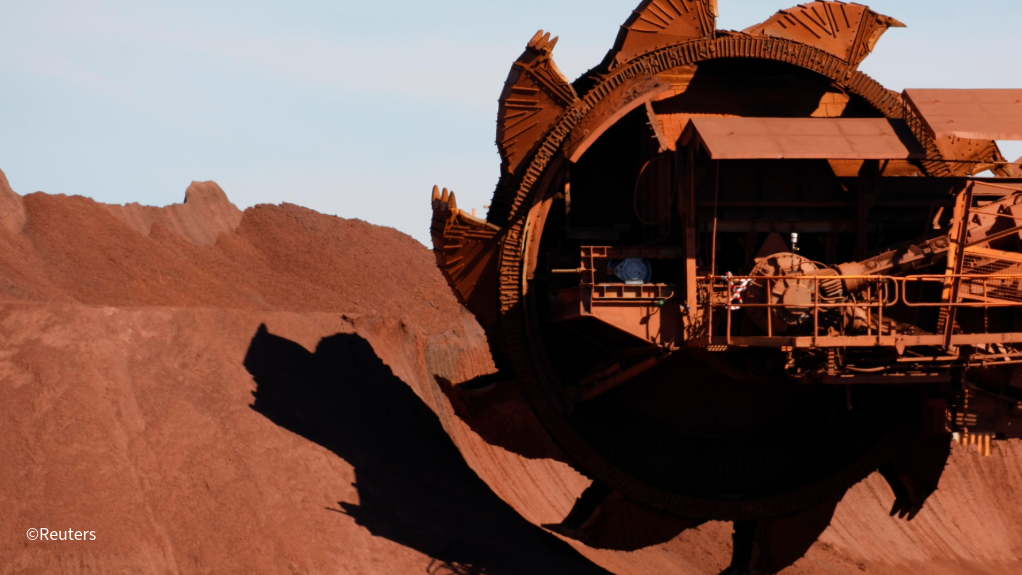

Photo by ©Reuters

Name of the Project

Zanaga iron-ore project.

Location

The project is located 30 km west of Zanaga, a regional centre of the Lekoumou department of Congo-Brazzaville.

Project Owner/s

Iron-ore exploration and development company Zanaga Iron Ore Company (ZIOC).

Project Description

The project is a highly significant asset with a 6.9-billion-tonne resource and a 2.1-billion-tonne reserve, and a forecast production rate of 30-million tonnes a year of high-grade direct iron pellet feed and very low impurity levels.

A 2024 feasibility study confirmed its strong economic viability. The proposed project will be developed in stages.

Stage 1 involves development to an initial 12-million tonnes a year of high-quality iron-ore product. The Stage 2 optional expansion will entail an 18-million-tonne-a-year expansion to 30-million tonnes a year of total product.

The primary facilities will include:

- an openpit mining operation and associated process plant and mine infrastructure;

- a slurry pipeline to transport iron-ore concentrate from the mine to the port facilities; and

- port facilities and infrastructure – to dewater and handle iron-ore products for export to the global seaborne iron-ore market – located within a proposed third-party-built port facility.

Congo-Brazzaville’s abundant gas and energy resources create favourable conditions for potentially pelletising its high-grade iron-ore products.

The Pointe-Indienne Special Economic Zone – being developed by Arise, ZIOC’s port development partner – is well positioned for industrial operations such as pellet production. It has access to surplus electricity from the nearby Centrale Électrique du Congo power station, with which ZIOC has signed a memorandum of understanding to explore power solutions.

ZIOC has noted growing interest from parties in Saudi Arabia and the United Arab Emirates. On infrastructure development, ZIOC sees potential to build a buried pipeline with a 30-million-tonne-a-year capacity to support Stage 1 output. This would eliminate the need for a separate pipeline for the Stage 2 expansion, reducing capital costs by about $700-million. It would also lower environmental impact, speed up implementation of Stage 2, and facilitate funding through Stage 1 cash flow.

Regarding tailings management, while the base case includes a large wet tailings storage facility (TSF), ZIOC is exploring the use of thickened paste or filtered tailings to reduce water content. This could significantly lower long-term management costs and sustaining capital costs and allow for a smaller, simpler TSF that can be progressively rehabilitated. A feasibility study on this option has started.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a net present value (NPV) of $5.21-billion and internal rate of return of 26.7%.

According to ZIOC, downstream pelletisation could boost the project’s NPV by as much as $1-billion.

Capital Expenditure

Stage 1 is estimated at $1.94-billion and Stage 2 at $1.87-billion.

Planned Start/End Date

Not stated.

Latest Developments

ZIOC has completed a value enhancement initiative, stating that the various workstreams have delivered significant value enhancement and strategic benefits across multiple areas of the project.

Throughout 2025, alongside other development activities, the company completed several workstreams to improve the construction, operations, strategic optionality and overall economics of the project.

Detailed design and costing assessments were completed with industry experts across four workstreams, including direct reduced iron (DRI) testwork, a pellet plant feasibility study, a feasibility study on a 30-million-tonne-a-year pipeline, and a study on establishing a thickened and dry tailings facility.

The company has said the completion of these workstreams has not only improved the economic potential of the Zanaga project but has also established a robust engineering and design foundation as the company progresses the project.

ZIOC has highlighted that positive results from the completion of four workstreams includes revenue improvement, with $11.33-billion of potential revenue upside identified over the initial 30-year life of the asset, owing to product grade improvement.

The company has also reported a total combined capital expenditure (capex) savings potential of $352-million.

This comprises the option to build a 30-million-tonne-a-year pipeline that would increase upfront Stage 1 capex by $349-million, but would eliminate $706-million of Stage 2 pipeline capex. It also comprises a minor increase of $5-million in capex associated with thickened and dry tailings technologies.

Another positive result is the total combined cash cost savings of $2.24-billion over the initial 30-year life of the asset.

Moreover, the company has noted that a combined, updated assessment of project economics will be released in February.

Other initiatives are not currently expected to deliver material incremental economic upside, but they do, however, provide strategic benefits and further opportunities to derisk the project.

The next milestones are expected in the first quarter of 2026 – as previously announced on December 30 – and include a project development strategy update planned for February.

This includes process plant front-end engineering and design (FEED) results, including updated capital and operating cost estimates, based on a DRI flowsheet developed in 2025. It also includes a fully integrated project development plan, including the economics of all project enhancements assessed to date, as well as an update on logistics and infrastructure solutions required to support development of Zanaga.

ZIOC is pleased with the progress being made in engaging several strategic investors interested in developing the project.

The company intends to secure initial offers from investors in the first quarter of 2026 and is targeting the announcement of transaction terms with a selected strategic investor in the same the quarter.

Key Contracts, Suppliers and Consultants

DRA (process plant study); P&C (FDSO evaluation process); Centrale Électrique du Congo (technical, economic and legal aspects required for power generation and distribution for the project's Stage 1 operations); and Arise Integrated Industrial Platforms (advance the development of onshore and offshore port infrastructure for the project).

Contact Details for Project Information

ZIOC, email info@zanagairon.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation