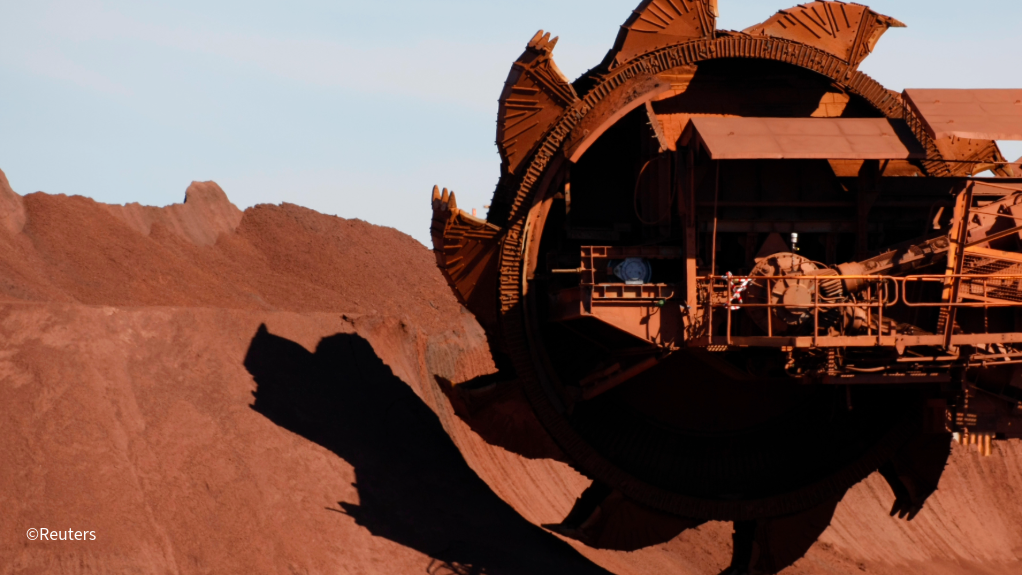

Zanaga iron-ore project, Congo-Brazzaville – update

Photo by ©Reuters

Name of the Project

Zanaga iron-ore project.

Location

The project is located 30 km west of Zanaga, a regional centre of the Lekoumou department of Congo-Brazzaville.

Project Owner/s

Iron-ore exploration and development company Zanaga Iron Ore Company’s (ZIOC’s), by its subsidiary Jumelles (100%).

Project Description

The project is a highly significant asset with a 6.9-billion-tonne resource and a 2.1-billion-tonne reserve, and a forecast production rate of 30-million tonnes a year of high-grade direct iron pellet feed and very low impurity levels.

A 2024 feasibility study confirmed its strong economic viability. The proposed project will be developed in stages.

Stage 1 involves development to an initial 12-million tonnes a year of high-quality iron-ore product. The Stage 2 optional expansion will entail an 18-million-tonne-a-year expansion to 30-million tonnes a year of total product.

The primary facilities will include:

- an openpit mining operation and associated process plant and mine infrastructure;

- a slurry pipeline to transport iron-ore concentrate from the mine to the port facilities and;

- port facilities and infrastructure – to dewater and handle iron-ore products for export to the global seaborne iron-ore market – located within a proposed third-party-built port facility.

Congo-Brazzaville’s abundant gas and energy resources create favourable conditions for potentially pelletising its high-grade iron-ore products.

The Pointe-Indienne Special Economic Zone – being developed by Arise, ZIOC’s port development partner – is well positioned for industrial operations such as pellet production. It has access to surplus electricity from the nearby Centrale Électrique du Congo power station, with which ZIOC has signed a memorandum of understanding to explore power solutions.

ZIOC has noted growing interest from parties in Saudi Arabia and the United Arab Emirates. On infrastructure development, ZIOC sees potential to build a buried pipeline with a 30-million-tonne-a-year capacity to support Stage 1 output. This would eliminate the need for a separate pipeline for the Stage 2 expansion, reducing capital costs by about $700-million. It would also lower environmental impact, speed up implementation of Stage 2, and facilitate funding through Stage 1 cash flow.

Regarding tailings management, while the base case includes a large wet tailings storage facility (TSF), ZIOC is exploring the use of thickened paste or filtered tailings to reduce water content. This could significantly lower long-term management costs and sustaining capital costs and allow for a smaller, simpler TSF that can be progressively rehabilitated. A feasibility study on this option has started.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a net present value (NPV) of $5.21-billion and internal rate of return of 26.7%.

According ZIOC, downstream pelletisation could boost the project’s NPV by as much as $1-billion.

Capital Expenditure

Stage 1 is estimated at $1.94-billion and Stage 2 at $1.87-billion.

Planned Start/End Date

Not stated.

Latest Developments

ZIOC has signed a binding term sheet with Red Arc Minerals (RAM) for a staged investment in the project.

The proposed funding is structured in two tranches and is designed to advance the project towards a final investment decision. Tranche one provides up to $25-million in cash, paid in five equal subtranches, in exchange for a 20% interest in Jumelles. This capital is intended to fund key technical work needed in the preproduction phase.

Tranche two gives RAM the option to invest a further $125-million within 18 months after completion of tranche one, in return for an additional 67.5% fully diluted interest in Jumelles. If exercised, RAM’s total ownership would increase to 87.5%.

If tranche two closes, Zanaga would receive a 1% net sales royalty on all project iron-ore concentrate sales, with RAM holding a buy-back option to repurchase 0.50% of that royalty for $50-million. Governance rights start at closing, with RAM receiving Jumelles board representation and reserved-matter rights, and majority board representation if its ownership reaches 50.1% or higher.

The transaction remains conditional on due diligence, definitive agreements, and shareholder and regulatory approvals. The term sheet also includes a fallback mechanism, enabling ZIOC to require a share exchange into ZIOC equity at 15 pence a share if RAM does not complete tranche closings within defined timeframes.

Overall, the structure is positioned to provide project-advancement capital without immediate shareholder dilution at listed-company level while preserving ZIOC exposure through a retained stake and royalty economics.

Key Contracts, Suppliers and Consultants

DRA (process plant study); P&C (FDSO evaluation process); Centrale Électrique du Congo (technical, economic and legal aspects required for power generation and distribution for the project's Stage 1 operations); and Arise Integrated Industrial Platforms (advance the development of onshore and offshore port infrastructure for the project).

Contact Details for Project Information

ZIOC, email info@zanagairon.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation