50 more R105bn Hive Hydrogen projects still not enough if demand projections continue, says GM

Hive Hydrogen chairperson Thulani Gcabashe. Hive Hydrogen GM Colin Loubser was interviewed by Mining Weekly's Martin Creamer. Video:Darlene Creamer

Hive Hydrogen's Colin Loubser.

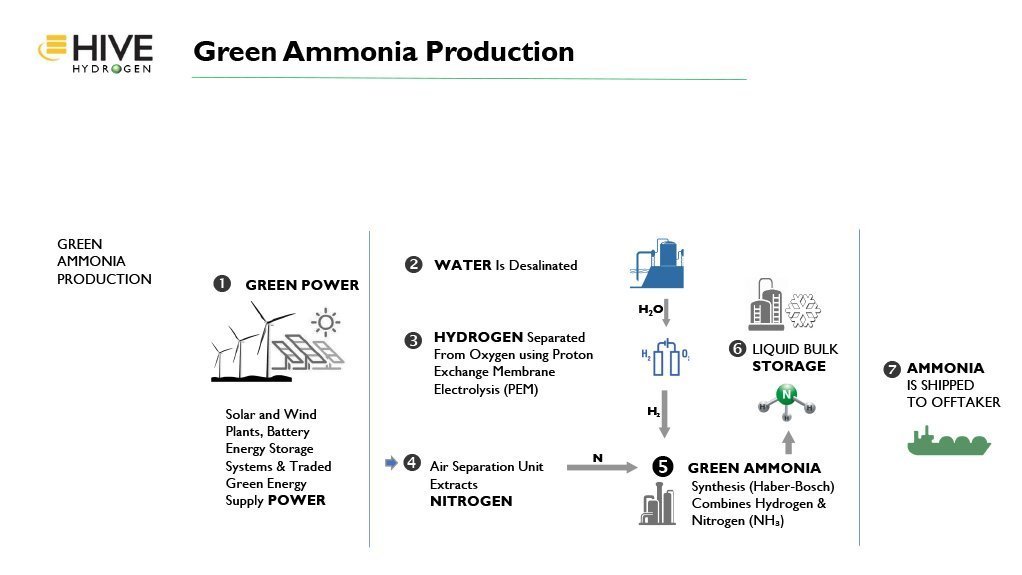

Green ammonia production.

Coega port in Nelson Mandela Bay.

JOHANNESBURG (miningweekly.com) – The R105-billion investment pledge by Hive Hydrogen at President Cyril Ramaphosa’s fifth South Africa Investment Conference was the biggest by far, resulting in Engineering News & Mining Weekly pursuing more information on it, only to find that the initial R105-billion is only Phase 1.

Remarkably, even 50 more R105-billion Hive Hydrogen projects would be far from sufficient to meet current demand projections for the green hydrogen-derived green ammonia product that Hive Hydrogen will sell to already confirmed Far East offtakers, Hive Hydrogen GM Colin Loubser told Engineering News & Mining Weekly in a Zoom interview. (Also watch attached Creamer Media video.)

The scale of what is required to turn around fossil fuel reliance in the maritime industry alone is what is driving Hive Hydrogen’s thought processes and already being studied by the Hive group are three more phases in the Eastern Cape, plus the feasibility of similar projects in Spain, Chile and Turkey.

The South African project, which was initiated in 2018, is seen as having the biggest socially positive early impact potential.

Its location at the enabling Port of Coega in the Eastern Cape is seen as putting the project in pole position to get the green ammonia that will be produced into international markets fastest and important for the Eastern Cape is that Hive Hydrogen’s initial socio-economic study indicates that Phase 1 of the project will employ a minimum of 20 000 people, with an estimated 50 000 being employed if all four phases go ahead.

Then Public Works and Infrastructure Minister Patricia de Lille registered Hive Hydrogen’s green project as a Special Integrated Project, or SIP, which means it will be prioritised for implementation while following an expedited path to delivery of 950 000 t/y of green ammonia, with set and shorter time frames for regulatory processes.

Hive Energy and Thulani Gcabashe's BuiltAfrica – together as Hive Hydrogen – as well as Linde plc, through its wholly owned South African subsidiary Afrox, last year teamed up to establish the pioneering Eastern Cape plant.

Sod turning for the construction of an effective 4 000 MW of wind and solar assets is scheduled to take place in April 2025 and planning and procurement preparation is underway for full project commissioning in January 2028.

“Overall, the project is making good progress,” Hive Hydrogen chairperson Gcabashe stated in an email to Mining Weekly.

Using green ammonia to supplement the needs for existing ammonia requirements in fertiliser and explosives for the mining industry is being studied.

But the key focus in the near future will be on green ammonia availability to replace heavy fuel oil and diesel in the maritime industry.

“That component is a very big part of our strategy. We're hoping to extend the R105-billion first phase into a further three phases, but if the demand continues to head in the direction where the projections are, we could extend the four phases we’re planning to 50 phases and still not be big enough,” said Loubser.

Mining Weekly: Are the ships that will carry your green ammonia to the Far East market likely themselves to be fuelled by green ammonia?

Loubser: Absolutely. That's a growing trend and two ships have already been launched for that purpose. There are, I think, 14 more on order at the moment and there was an announcement last week of a 65 000 t vessel to transport green ammonia, which will itself be powered by green ammonia, being built. The shipbuilding industry is obviously seeing a massive upswing in their business. By the demand for ammonia-driven shipping. There are moves as well to change existing heavy fuel oil and diesel fuel fleets into ammonia clean fuel.

How is Hive Hydrogen funding this project?

Obviously, it's a huge amount of money that Hive couldn't fund itself, but the development side we are finding ourselves. To date, we’ve fully funded Hive’s side and Hive is quite a substantial business. We’re in 22 countries with three big hydrogen projects and we've done exceptionally well in the renewable space over the last 14 years. We have international partners. We're working very closely with SMBC Bank, who advised on the Saudi ammonia project as well, and we have a large number of strategic investors, including two of the largest offtakers in the Far East. The development phase we’re funding ourselves but all the capital needed for the building of the plant will be funded by large strategic partners. We also have large international DFIs putting in debt funding and that’s all being arranged by SMBC Bank, and Mitsui Bank, in the UK and Japan. On top of that, we have a very significant scale black economic empowerment (BEE) investment to a minimum of 25% of BEE funding, which has been supported by international foreign investors. It's focused on community-based BEE stakeholders and funding them to acquire a stake at really good rates so that the long-term benefits are seen, and that's all about the Just Energy Transition for South Africa. We’re very much focused on getting investment in from abroad to help empower the BEE side as well, in the true sense. It's not just a single BEE investor, or someone borrowing money from someone international, it's actually a community-driven BEE investment that will help local people. It will help the gender gap to be filled, and it will help the mineworkers that in the future may be disadvantaged because of the move away from fossil fuels.

What is the project scope of Hive Hydrogen’s South African project?

Building a green ammonia project entails a huge amount of construction work, in the first place to deliver the water to the project. The water is used to make hydrogen. We then have an air separation unit which will extract nitrogen. We combine the two to make ammonia which is then stored and then exported. That's the basic base of the project but the big part of it is the renewable energy side, so about 60% of that R105-billion will be spent on wind and solar installations around Beaufort West and De Aar with some close to Coega or Nelson Mandela Bay. So, it's a very large project, but dominated by the scale of the renewable energy, which is the greenest part of the project. That's the component you need to make green ammonia – the power. That’s really why it's such a large amount of money. It's about 10% of what Eskom currently generates, the size and scale of the solar and wind that we are building out specifically for the project.

What are the advantages of this Hive Hydrogen project being afforded the status of Special Integrated Project, or SIP, project?

Everybody focuses on climate change and climate change is the imperative globally for these types of projects, but our project is even more meaningful because we’re focused on the social impact as well. This area, Gqeberha, Nelson Mandela Bay and the broader region is the lowest social impact area at the moment in terms of investment. So, bringing this investment here, in this very low gross domestic product area, with massive unemployment is transformative for the region. The social impact is what we are really focusing on to a large extent, creating jobs, enabling more industrial projects to come into the region. It has a broad-reaching effect, and that's the real benefit of it. The gross benefit as far as the world is concerned is to ensure that the transition from fossil fuels to green renewable energies becomes a reality, as well as clean fuel. Our focus on the green ammonia is to export to the Far East, where the green ammonia will be used predominantly as a green fuel, but also to make South Africa ready for green fuel bunkering, green ammonia bunkering, to cater for a world that is going to switch its maritime industry to either green ammonia or green hydrogen depending on the type of ship, and South Africa is at the forefront and will be one of the first to be ready for that.

Have you secured buyers for the 950 000 t/y of green ammonia that Hive Hydrogen is planning to produce?

Yes, we've got offtakers from the Far East secured for the project. We wouldn't be going ahead if we didn't. Offtake is a vital part of it. The road there is to complete the feasibility work, which is heavily under way. We’re currently doing over 20 environmental impact assessments, or EIAs. The development part is going very well and the offtake is contingent on ensuring we meet all the regulatory requirements. And you mentioned SIP earlier. That’s where SIP is so crucial. They're helping us through that process to ensure this project becomes a reality for South Africa.

Who are the offtakers?

We can't reveal that yet. It is subject to quite a strict nondisclosure. This market at the moment is really full of speculators, so we have to be very careful about what we say, because the moment we say something, it just inundates our offtakers with enquiries. What I am prepared to say is the offtakers are hugely bankable and globally accepted. They are already heavily active in the industry and they are main players in the industry. I don't want to steal their thunder either. We've agreed with them that they would make the announcements. It's always a sensitive thing and we would not have proceeded with the development without their support.

Are Hive Energy’s three other green hydrogen/ammonia projects at a more advanced stage than Hive Hydrogen’s project in the Eastern Cape?

I'm very proud to say that the South African project is leading the others by quite some distance. We’ve put together the basic design ourselves. We’ve put the project components and planning together. Our advisers are SMBC Bank and Allen & Overy international law firm. We've put all that together, and we have a very big project team here. We've got over 43 people working full time on the development of the project, plus all the consultants that come with it. In second place is our Spanish project. Spain is more about a mobility place so it's less about green ammonia and more about providing hydrogen into the pipelines. It is similar size in scale, but I'm very proud to say again, South Africa has better renewable resources and a better port setup than Spain. Our third project is in Chile. We've only just announced that a couple of months ago. That is in the Magellan Straits and that is a similar size of project, but it is not connected to the grid. In South Africa, we’re working closely with the grid connection capability at Eskom, whereas the Magellan Straits project is purely wind-driven green ammonia production in Chile, in the Magellan Straits, which is one of the highest, if not the highest, wind capacity factor in the world. The Magellan Straits project is totally different to us in South Africa, with other challenges – sometimes it’s too windy to build there. The Magellan Straits project’s renewable energies development is really well ahead, but the port structure, for example, has to be completely redone, and overhauled so, quite far behind where we are in the Eastern Cape. The third project that we've mentioned but hasn't been fully announced, will be in Turkey. That's our limit as Hive. We don't want to take on more projects at this stage, but we will be making some substantial investments in resources to enable us to take on more projects after September. At this stage, we're focusing on those four projects.

Is the Coega port already set up for green ammonia exportation or will there have to be additions and modifications?

Coega has the infrastructure to cope with the new technology that we need. They already have got a full environmental assessment on liquid bulk storage, but now we’re adding a cryogenic storage facility for the green ammonia and green ammonia storage. That environmental impact is being added and that's a good thing. They've already done the hard yards and we're quite confident of that position. The liquid bulk terminal is already in situ, but they've only built the fire retardant and firefighting part of it. They now have to do the build-out of the loading arms and the cryogenic unit for that, but the enabling infrastructure is in place, which means that we don't have to build something that's new. We just have to add to something that's already there. The storage tanks areas are cleared, and civil works and road access have been done. The ground has been levelled and landscaped, and the pipeline servitudes are all in place, so its significantly far ahead of other potential projects in Africa, and we've surveyed every single port in Africa and determined that Coega is best positioned to take advantage of this early stage development of this clean fuel project.

Very gratuitously, the Hive Hydrogen project will help to meet quite a lot of the water needs of the water-short Nelson Mandela Bay. How does that come about?

This comes about because we use a lot of water. We have a partnership with Cerebos, who produce salt, so we have a very good symbiotic relationship where we will produce clean water from seawater and they will take away the salt for their saltworks, which is a very large operation in Nelson Mandela Bay, and they’re looking to expand that operation. With that expansion, we're putting in larger equipment for cooling and production and one of the byproducts is that we will have a lot of surface water. We’re in discussions with the municipality on how we can best provide that surplus water to them and that'll help. In the first phase, we could fulfil 25% of the current shortfall just off the plant production itself.

Tell us how you will combine sun and wind energy to provide 3 200 MW of clean, green electricity?

There's a seasonal variance, so we will overproduce power because we want a lot more power in the low season from less available resource, to cover cloudy days or windless days or slow wind days. We’ve upsized to cover that and then there's also an overlap. We're looking to provide that overlap surplus power back into the grid. That will benefit Eskom because they'll have additional power at that time and various offtakers. That part of it is changing rapidly. When we started, we were just going to curtail and thought we'd lose that power, but fortunately the regulations are changing to allow sale back into the grid, which, I believe, will come about at the end of this year. To not curtail and to be able to use surplus power has really helped our business case, and we'll also use some of that surplus power to provide power into industry in Coega itself. One of the limitations is that there isn't enough power for large industry to come into Coega and this will help to ensure additional power to avoid loadshedding and to increase investment in the Eastern Cape.

Is the 3 200 MW the correct figure?

We’re closer to 4 000 MW. The load factor we require is 1 300 MW for the plants in the first phase, but the renewables don't have 100% capacity, so it's in the region of 3 600 MW to 4 000 MW of power.

What are the advantages of deploying proton exchange membrane, or PEM, electrolysers, which use South Africa’s prized iridium and platinum PGM metals?

PEM is a really good electrolyser because it reacts very quickly to fluctuations caused by renewable energy, so you look at the front layer of PEM, a second layer of alkaline electrolysers, and we’re also cognisant of the fact that iridium is not an easy mineral to get hold of, so we don't want to put stress on it. We would use the entire iridium capacity of our electrolyser partners on that, and we wouldn't want to do that, so there's a combination of PEM and alkaline electrolysers, but we're also working with solid oxide as a technology and reviewing that at the moment. It's really interesting because all these technologies are new in terms of scale. They're not new in terms of capability. The current largest PEM electrolyser installation is only 24 MW, and that's in Leuna, in Germany, which I've been to see, and so the scale of what we talked about is huge compared with where the world is, so there's a lot of catch-up, production and manufacturing to be done between now and then.

Will you be providing green hydrogen to Cerebos?

I think Cerebos is looking at all the different technologies that they would want to deploy for their business, including using green hydrogen as a clean fuel to give them baseload for 24-hour production. I'm not sure to what extent hydrogen will help them produce salts, but it certainly will help them to produce power for them to fire their plant.

Tell us about how Hive Energy and BuiltAfrica got together to develop the far-reaching Hive Hydrogen with the inclusion of Linde of Germany through South Africa’s Afrox?

It was a bit of hard work on our side. We had to work through it. BuiltAfrica came to us through our finance director, who was previously at Standard Bank, and had worked very closely with Thulani Gcabashe. David Humphrey, the former global sector head: power and infrastructure at Standard Bank, who's now retired and living back in England in his rural retreat, introduced Thulani Gcabashe to us and we're very thankful to him for that. Thulani Gcabashe was the former chairman of Standard Bank and retired at the end of last year, and, as you know, he was the former CEO of Eskom in the early 2000s to 2007, I think it was, so he has very strong background in the Eskom side of things, in the banking side of things, and obviously his BuiltAfrica, as a renewable energy business, was a real natural fit for us and it's been a fantastic relationship. The key as well to the success of the relationship is also their tremendous input that they're having on the BEE side. Not just by being our partners in the development company, but also in putting together a consortium of socially disadvantaged stakeholders in the plant, so this will affect people on the Just Energy Transition level massively, and BuiltAfrica is driving a process remarkably well.

Is Hive Energy a listed company?

No, Hive is a privately owned company in the UK, which was developed by Giles Redpath. He and his family are the owners of all the Hive businesses globally. He’s sort of the Richard Branson of renewable energy, if you want to put it that way.

What, in your view, should be the biggest takeaway from this interview?

There’s a lot of catch-up work to be done in terms of where the market is heading and what people see is actually in place. It’s a hugely developing scenario. They're not any big plants. There’s only one part that has actually reached financial close to date of this scale, and that's the green hydrogen-based ammonia production facility run on renewable energy in Neom, in Saudi Arabia. The takeaways are be patient. It is happening and it’s happening professionally, and it's a global transition. It's not just the South Africa transition. My takeaway is that South Africa is the best place and our site, particularly in Eastern Cape, in Coega, is the best place internationally to show an immediately socially positive impact. Many of these projects will be done in remote locations, whether it's Lüderitz in Namibia or the Magellan Straits in Chile, or Boegoebaai in South Africa, or in the middle of the outback in Australia. It doesn't really have a big social impact in the same way, so this is a leading driver of the Justice Energy Transition in South Africa. As a South African business, as Hive Hydrogen in South Africa, our takeaway is that social transformation is an imperative that we wish to ensure stays there and is very much part of the driver of this project. But the technology is changing and that change will help to bridge the gender gap, and it will certainly help the transformation from fossil fuel to clean energy in a better way, so if you stick to those principles, and then look at the detail of the project, it's a fantastic project.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation