Woman-led Lethabo is mining iron-ore in Limpopo with offtake agreement in place

Lethabo Exploration CEO Mandy Malebe’s presentation covered by Mining Weekly. Video: Darlene Creamer.

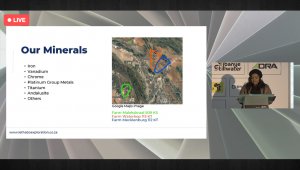

Six metals, thee sites.

Photo by Creamer Media

JOHANNESBURG (miningweekly.com) – Lethabo Exploration, which started out as an exploration company, has since transitioned into mining iron-ore, for which it has secured an offtake agreement.

Lethabo, which is 100% South African black-owned, has to date been 100% self-funded, which means the company has no external debt-funding obligations, Lethabo Exploration CEO Mandy Malebe told the Junior Indaba this week. (Also watch attached Creamer Media video.)

“Lethabo’s truly a first of its kind, with its director and executive body being local people born and bred in rural Limpopo, in the district of Sekhukhune, and having mining rights for projects and greenfield exploration in Sekhukhune, which takes in the areas such as Steelpoort and Burgersfort. That’s home and it’s also home to our mining projects.

“Being local people from Sekhukhune and mining in our home area, our commitment to the development that we want to see there is personal because of the background that we have and also being exposed to the poverty there,” Malebe said in a presentation covered by Mining Weekly.

Lethabo is affiliated to Minerals Council South Africa, of which it has been a member since 2020, and Malebe serves as one of the deputy chairs of the Exploration and Junior Miners Leadership Forum on the Junior and Emerging Miners Desk. At last week’s Minerals Council annual general meeting, Malebe was appointed as a council board member.

It is also associated to the Johannesburg Stock Exchange (JSE), where it participates in the entrepreneurial accelerator programme, sponsored by Minerals Council South Africa.

This programme is designed to help businesses to access investors and capital, as well as access funding through the option of listing on the JSE, which is seen as essentially increasing South Africa’s employment status as a nation and contributing to the economy.

The social economy which is within Lethabo’s immediate reach is that of Sekhukhune, where it holds mining rights for iron-ore, vanadium, chrome, platinum-group metals, titanium and andalusite.

Its mining rights cover the farms Malekskraal, Waterkop and Mecklenburg, situated on the eastern limb of the Bushveld Complex.

For mining continuity, it has secured the mining rights on the farms Waterkop and Mecklenburg, which are neighbouring farms along the R37 provincial route, and mining rights for iron-ore and its byproducts at Malekskraal. The three farms together cover 8 370 ha.

“As a self-funded company from inception to date, our progress and project development has been dependent solely on the success of other non-mining-related projects that we run and have used to provide capital.

“This is extremely difficult and challenging, especially because mining requires such high volumes of cash injection, not to mention the costs incurred to outsource expert opinion through consultants, geologists and surveyors,” Malebe explained.

Lethabo set out in 2007 when its first prospecting rights application was submitted to the Department of Minerals Resources and Energy (DMRE), finally executing its mining rights this year, “so that’s after 16 years of being on the receiving end of bureaucracy, litigation, no-access to funding and limited access to markets.

“As an emerging mining company, being black-owned and being women-led does not make us immune to the challenges that are common to the industry – access to markets, capital, human capital, and the DMRE’s legitimate intervention at a regional level. We are too young a company to even comment on the access’s real issues,” Malebe said.

Malekskraal is the only site where site establishment has been done, the construction of a weighbridge has been competed and opencast mining operations has begun.

Implementing this project was the outcome of many debates where Lethabo was faced with potential buyers resisting to commit to a project that had no existing operations.

With no access to project funding for mining, Lethabo resorted to starting “where you are, with what you have. Again, our success in other businesses that we run funded this project”.

It has more than 41 000 t of iron-ore on surface, 5 000 t of which is crushed and screened to the specifications that meet the requirements of its first offtake agreement.

“We started where we were with what we had…started mining, attracted the attention of buyers, and secured an offtake agreement.

“It’s been a tough journey for Lethabo Exploration to realise our vision regardless of the challenges, which on many occasions, posed a threat of sabotaging our progress,” Malebe added.

On Malekskraal, the land is 1 484 ha, 60 km northwest of Steelpoort. Access to the mine site occurs along a tarred road and then a gravel road, made to access the mining site.

Malekskraal has a magnetite deposit made up of iron, titanium and vanadium. Historically 15 vertical boreholes were drilled on the property and other samples were taken from stockpiles, which are a result of the opencast mining done and which present results of iron at 52% to 66%.

Funding is still required to carry out further studies on the longevity of the project.

“Lethabo is open to collaborating with other junior miners. We are open to supplying local mines which will carry our further processing on the ore for export and certainly welcome follow-up discussions with investors and funds.

“It would certainly be in our favour if the funders have funding requirements which are designed for emerging and junior miners, including junior exploration companies.

While we understand that this is your money, junior and emerging miners, including junior exploration companies, cannot be benchmarked against the same standards and the same requirements that are set for major mining companies.

“We’ve given the trucking to our clients to deal with. Our responsibility is to mine for ore and to make it available.

“Long-term, if we have the capacity to take that on, it will also depend on contributing factors, such as prices.

“But I don’t want to commit to that and give our client another impression. Until then, we’re going to stick to leaving that to the buyers.

“I do this with my father and my brother. Lethabo Exploration, to this point, has been a family business, hence we put our money where our mouth is.

“In terms of our stakeholder ecosystem, give credit to Minerals Council, which has played a huge role in directing us to the right opportunities, such as the JSE and the accelerator programme that we’re in.

“All of these programmes, though external, contribute to building the executive body of the business, and that’s where our growth is going to come from,” Malebe said in response to Indaba chairperson, Bernard Swanepoel.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation