Bushveld optimistic about next 18 months following corrective measures

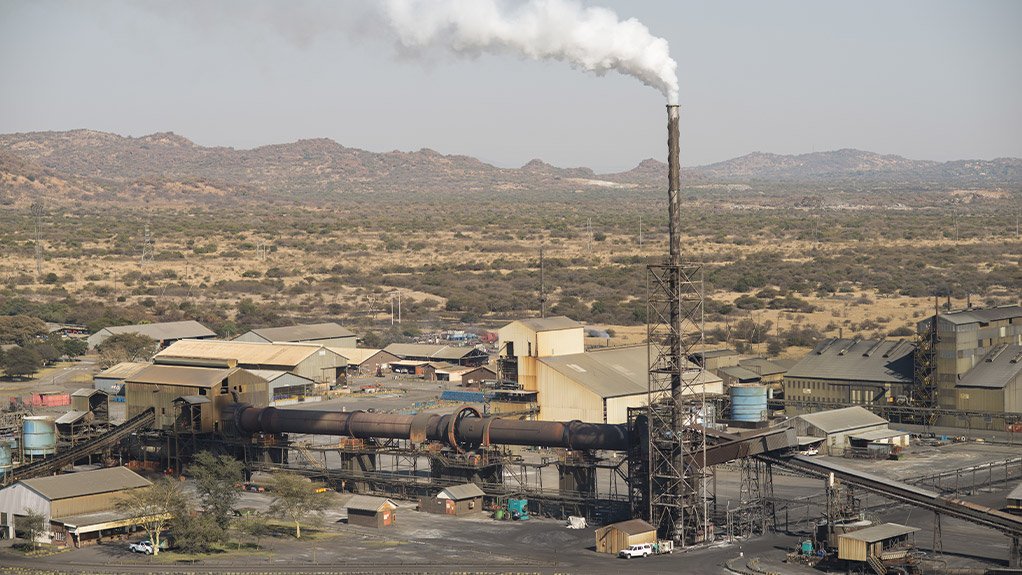

Ahead of the company's upcoming AGM, Aim-listed vanadium producer Bushveld Minerals has said the outlook remains positive for the remainder of this year into 2025 owing to the rationalisation of assets by cutting costs and reducing headcount, as well as making progress on the turnaround initiatives at the Vametco integrated mining and processing plant in the North West province.

The company said on August 6 that the programme had already resulted in improved production volumes and stability despite supplier challenges. It added that stabilised power supply from the local municipality had also enabled steady production.

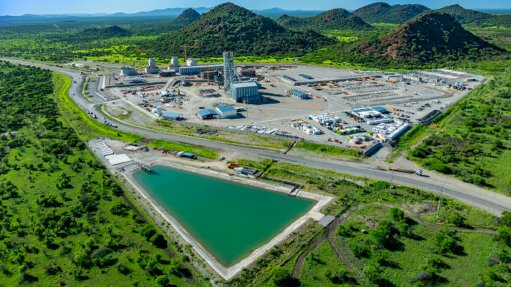

Bushveld also mentioned its new agreement with Orion Mine Finance Fund III, in which Orion agreed to provide further funding up to a maximum of $10-million, which will provide Bushveld with additional liquidity in the near term, coupled with the funds received from the disposal of Vanchem, in Mpumalanga.

The company also said it was moving forward with the process to dispose of investments in sectors unrelated to the production of vanadium, including the Belco electrolyte asset in the Eastern Cape, as well as the coal and energy subsidiary Lemur, which, subject to execution of binding documentation, is expected to provide an additional boost to Bushveld's liquidity through shedding about $4-million of debt held at these assets.

The company said access to additional working capital and liquidity provided by the financing from Orion and the sale of noncore assets would enable it to pay down its creditors and improve the state of the corporate balance sheet, which, in turn, would help Bushveld to maximise the value extracted at Vametco.

Bushveld admitted that it had endured a challenging period owing to various factors both in and out of its control, as vanadium pricing remained weak, while the creditor overhang brought about capital constraints and had a negative impact on costs.

However, the company said it believed it had set up the right foundations for enduring long-term success.

Following the conditional sale of Vanchem, Bushveld will have executed a strategic switch in direction that it said had resulted in a more streamlined and effective business model with a singular focus on being a pure upstream mining company.

Bushveld also said that it would remain focused on asserting effective cost control, and that the restructuring of the company's head office and significant changes in management were proving effective in reducing costs.

The company expressed optimism in “encouraging signs of a market rebound on the horizon”, such as the shift through new regulations in China relating to increased vanadium content in steel rebar used for construction.

To accelerate Bushveld's transition towards building a sustainable, cash-generating and low-cost production platform, the Bushveld board said it was performing a proactive in-depth review of all of its options and its business plan.

It noted that all commodities were cyclical in nature with variable cycle duration of peaks and troughs, with the long-term average vanadium price forecast in the $40/kg range.

At this level, Bushveld said it would be highly cash-generative and able to provide investors with an attractive total return which, at current price levels, remained challenging despite the planned cost-cutting measures.

"Bushveld is increasingly well-positioned to benefit from rising Vanadium prices as we continue our trajectory by strengthening core operations. We will look to engage with all our shareholders and work together to realise value within the shortest timeframe. We look forward to providing further updates on this process in due course,” Bushveld Minerals CEO Craig Coltman said.

The company also noted that it would be bidding farewell to board member David Noko and welcoming Mathews Senosi in his place.

Chairperson Michael Kirkwood has also indicated that he will step down once a suitable candidate has been identified. This process is under way.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation