Coolabah to unite Broken Hill assets, paving path to production

ASX-listed Coolabah Metals on Tuesday announced a strategic consolidation transaction that will unite two of the three key players in Broken Hill’s silver, lead and zinc mining sector.

Coolabah will acquire Broken Hill Mines, which holds agreements to acquire the operating Rasp mine and an option to acquire a 70% profit share joint venture at the Pinnacles mine. The company plans to change its name to Broken Hill Mines Limited.

“This innovative consolidation transaction is the result of extensive due diligence and negotiation, culminating in what is now a significant opportunity to bring Coolabah Metals into production status,” commented chairperson Stephen Woodham.

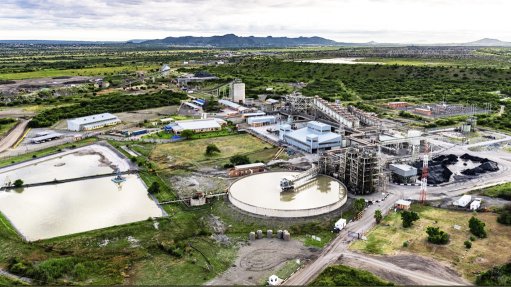

The Rasp mine has been a consistent cashflow producer for well over a decade, delivering high-quality silver/lead and zinc concentrates globally. The Pinnacles mine, which is currently on care and maintenance, is about 15 km from Broken Hill, and holds potential to be an additional source of high-grade silver, lead and zinc to feed into the currently underused Rasp infrastructure. Rasp's current throughput is about 400 000 t/y, with a plant design capacity of 750 000 t/y.

“Up until now, these Broken Hill assets have been operating as standalone projects. Merging these two assets for the first time in history will create strong synergies that will allow the material extension of mine life and production rates, creating significant operating cost advantages,” he said.

The transaction will also bolster Coolabah's team, adding significant operational and commercial experience in base metals operations. The company is proposing Patrick Walta as executive chairperson, Mark Hine and Brent Walsh as nonexecutive directors, while Woodham will also transition to a nonexecutive director role.

To acquire Broken Hill Mines, Coolabah will offer 125-million shares in the company and 65-million unquoted options. In addition to these securities, the company has agreed to issue further shares to the value of cash generated from July 1, 2024, up to the maximum value of A$5-million.

In addition, a 2% net smelter royalty will be granted to BHM RoyaltyCo.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation