Copper clash shows cracks in decades-old pricing system

Canadian miner Teck Resources and Japan’s Sumitomo Metal Mining are locked in a commercial dispute over a major copper supply deal, exposing cracks in a decades-old pricing system as the market endures a severe shortage.

The two sides have failed to agree on the sales terms for concentrated copper ores that Teck will supply to Sumitomo’s smelter in Japan this year, according to people familiar with the matter, who asked not to be identified due to the commercial sensitivity of the matter.

Lawyers have been appointed to seek out an industry expert to act as independent referee to resolve the issue, the people said. The dispute centers on the value of treatment and refining charges that will be deducted from the price of Teck’s concentrates to cover Sumitomo’s smelting costs.

Spokespeople for Sumitomo and Teck declined to comment.

The fees, known as TC/RCs, have plunged over to record lows over the past year, fueled by a surge in global smelting capacity that’s created stiff competition for mined ores.

The global copper industry has long relied on a single benchmark TC/RC set by major miners and smelters, with Chilean miner Antofagasta’s deals providing the reference for this year. Shifts in the benchmark have big implications for smelters’ margins, as TC/RCs typically account for about one-third of their incomes, according to Wood Mackenzie.

Late last year, Antofagasta and Chinese smelters struck a supply deal for 2025 with TC/RCs set at $21.25 per ton of ore processed, and 2.125 cents per pound of refined metal produced.

The deal has been widely adopted as a benchmark, but Antofagasta later signed smaller contracts with some Japanese buyers carrying higher TC/RCs of about $25/2.5 cents, some of the people said.

As a result, Sumitomo and some other smelters have resisted using $21.25/2.125 as their contractual reference, creating strains in commercial negotiations and reigniting a long-simmering debate about the fairness and efficacy of the benchmark system.

A spokesperson for Antofagasta declined to comment.

In other markets like iron ore, annual benchmarks were ditched years ago in favor of contracts linked to spot prices. Some miners have pushed for a similar overhaul in the copper concentrates market, but moving away from the benchmark now would heap further pressure on smelters.

That’s because spot TC/RCs have fallen even more steeply, and are now in deeply negative territory, meaning the charges are typically being added to the cost of the ores, not deducted from them.

The rift over the benchmark also highlights a growing commercial divide between Chinese smelters — which tend to be well-financed, highly efficient and state-owned — and those in the rest of the world, which generally have thinner cash reserves, bigger overheads and less governmental support.

The disconnect has meant that China has continued to import record volumes of concentrates and turn out record volumes of metal in recent months, even after the collapse in benchmark fees. Meanwhile, smelters in the Philippines and Namibia have been mothballed, and other western plants have started to dial back output.

Japanese smelting groups may fare better than some western rivals, because over the past two decades they’ve sought to insulate themselves from periodic supply crunches by investing billions of dollars to support the development of some the world’s biggest copper mines.

In the process, they’ve acquired significant minority stakes in mining operations and secured long-term offtake agreements, giving them a stronger hand in commercial negotiations than standalone smelters that have entered the market more recently. But the dispute with Teck offers a reminder of how broadly the pain is now being felt in the smelting industry.

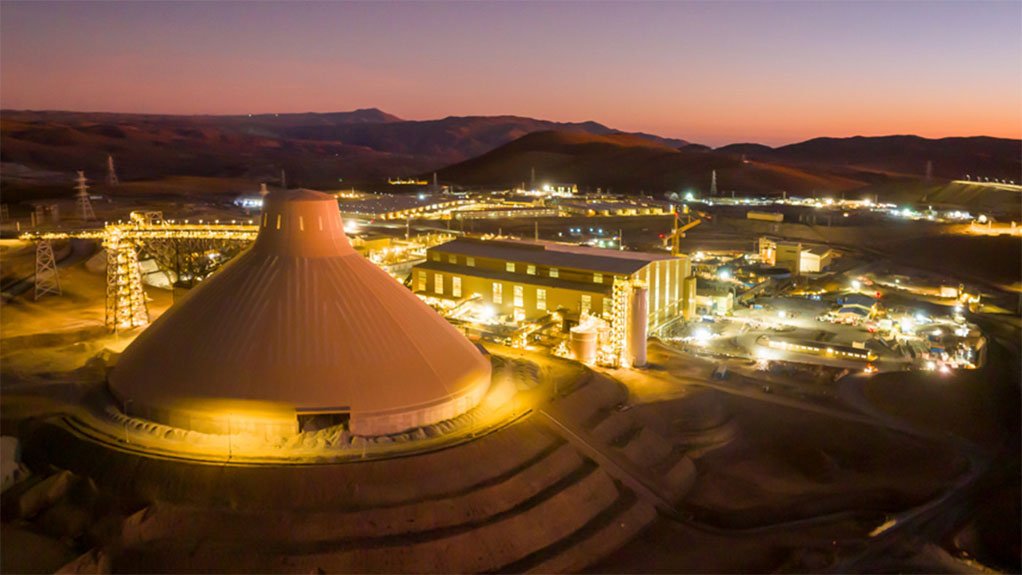

The disagreement partly relates to a major offtake deal that Sumitomo holds for supplies from the Quebrada Blanca mine in Chile, the people said. The operation is run and majority-owned by Teck, while Sumitomo Metal Mining and its parent, Sumitomo Corp., own a combined 30% stake.

Executives are seeking an independent referee to settle on a TC/RC, in a bid to avoid more formal arbitration proceedings, the people said. The two sides are also seeking to settle terms for supplies from Teck’s Highland Valley mine, they said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation