Coronado shores up liquidity amid weak coal prices

Australia-based Coronado Global Resources has secured a $150-million asset-based lending (ABL) facility with an affiliate of Oaktree Capital Management, shoring up its liquidity as metallurgical coal prices remain under pressure.

The three-year facility, committed through a binding letter with Highland Park XII, an Oaktree affiliate, replaces the company’s existing ABL agreement.

Coronado will immediately draw $75-million upon financial close, with the remaining $75-million available over the next year in $25-million minimum increments. All drawn amounts will remain in place for the full term of the facility.

“This facility gives us the flexibility we need to provide an upfront cash injection and fund future working capital needs, while we continue executing on our broader liquidity plan,” said CFO Barrie van der Merwe. “Importantly, the way the covenant thresholds are designed, provides us with flexibility to navigate the challenging current commodity price environment.”

The facility is secured against receivables and inventory and includes a fixed mid-teens interest rate that is below the 18% yield on Coronado’s outstanding high-yield notes. The company can refinance or repay the facility at any time and will face no prepayment penalties after 18 months.

Van der Merwe said the agreement represents “an important first step in our strategy to stabilise and strengthen our financial position” and signals “a clear confidence from a credible lender in the underlying value of our asset base and business fundamentals".

While leverage and interest coverage covenants will not be tested in the June quarter, financial testing resumes in the September quarter with thresholds designed to provide operational breathing room.

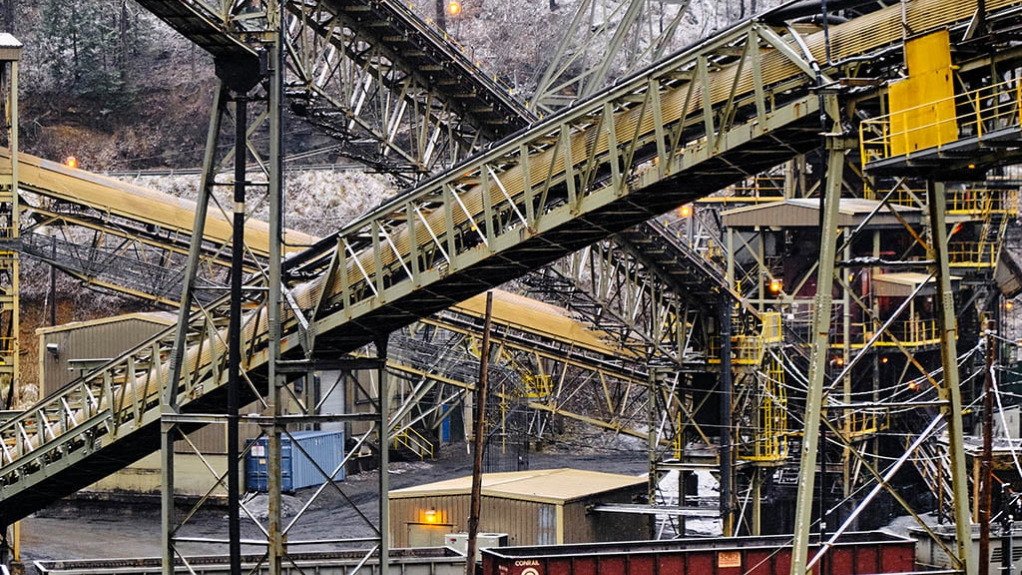

Coronado is advancing two expansion projects — Mammoth and Buchanan — that remain on schedule and on budget. The initiatives are expected to lift production capacity and cut costs in the second half of the year, with Mammoth forecast to reach a 1.5-million- to 2.0-million-tonne a year run rate by year-end and Buchanan adding 1.0-million tonnes.

Coronado has already spent $140-million in capital expenditure through the end of May and expects to spend another $80-million by year-end. The company ended May with about $160-million in cash, after accounting for $20-million in capital expenditure and $22-million in ABL-related guarantees during the month.

Cost-cutting initiatives, outlined in its first-quarter report, are expected to free up $100-million in liquidity over the course of 2025.

The ABL agreement remains subject to final documentation, board approvals from both Coronado and Oaktree, and standard closing conditions, including a third-party borrowing base assessment.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation