Cyclone and Vale ink $138m deal for Canada iron-ore project

ASX-listed Cyclone Metals on Monday announced a binding commercial agreement with Vale for the joint development of the Iron Bear iron-ore project in Canada.

Under the terms of the agreement, Vale would provide up to $138-million in funding for the project in two phases, earning a 75% interest in Iron Bear. Should Vale proceed to a decision to mine, the company would have the option to acquire the remaining 25% at fair market value or carry Cyclone to production without dilution.

Cyclone Metals CEO Paul Berend stated that the agreement provided a clear path for the project to reach production. He noted that Vale's dominance in the low-carbon and direct reduction iron-ore market made the group an ideal partner and future operator for the project.

Vale’s investment is structured in two phases. In Phase 1, Vale would contribute $18-million to fund a preliminary feasibility study, mineral resource drilling, and environmental baseline studies. Completion of this phase would allow Vale to elect to proceed with Phase 2, at which point a joint venture (JV) would be formed, granting Vale an initial 30% equity interest in Iron Bear.

Phase 2 involved Vale funding an additional $120-million towards a bankable feasibility study, environmental-impact assessments, and impact benefit agreements with First Nations. Once the full Phase 2 contribution was expended or Vale decided to proceed with the decision to mine, its stake in the JV would increase to 75%. During this phase, governance of the JV would be shared, with both companies holding equal board representation until Vale secured its majority interest.

Following the decision to mine, Vale would have the right to acquire Cyclone’s remaining 25% equity stake, subject to shareholder approval if required under ASX listing rules. Alternatively, Vale could fund the project's capital expenditure (capex) on a non-dilutionary basis, allowing Cyclone to retain its 25% interest. If Cyclone’s shareholders rejected a buyout offer, the company must fund its share of production capex or be diluted.

Vale also secured a right of first refusal on any third-party offers for Cyclone’s stake in the Iron Bear JV.

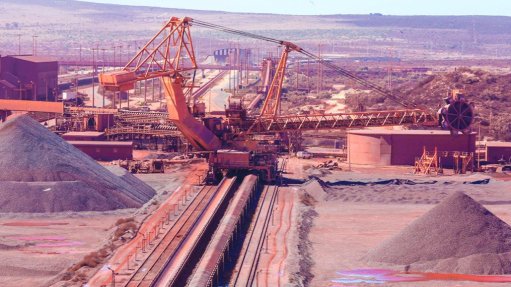

The Iron Bear project is located in Canada, less than 25 km from an open-access heavy haul railway connected to an iron-ore export port at Schefferville. The project hosts an iron-ore resource of 16.6-billion tonnes at 29.3% iron, with pilot plant production confirming a high-quality direct reduction concentrate grading 71.3% iron.

Development is progressing, with bulk samples of direct reduction and blast furnace concentrates expected to be available for steel mill clients in the first quarter of 2025, followed by pellet production in the second quarter.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation