Davis expects platinum price to be ignited in next few months

David Davis

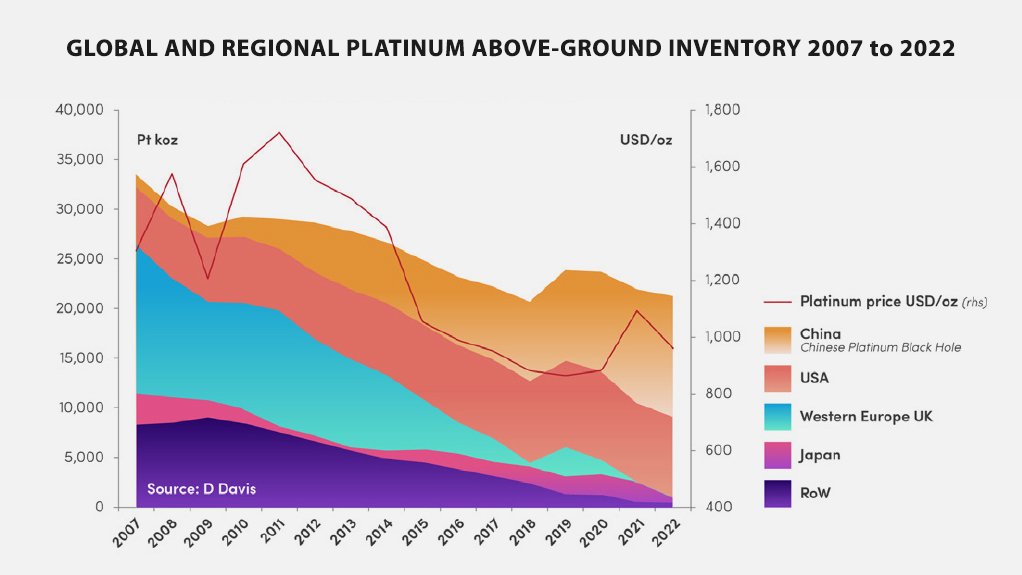

Illustration showing sharply dipping platinum stocks.

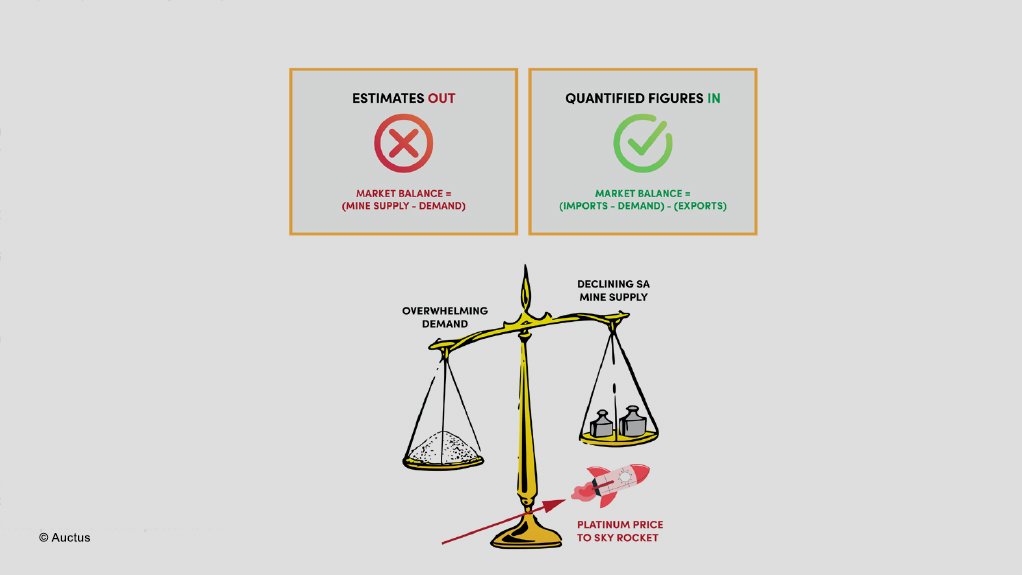

Method of calculating above-ground inventories.

JOHANNESBURG (miningweekly.com) – Overwhelming demand and declining South African mining supply are poised to result in a very substantial rise in the price of platinum, Dr David Davis forecasts.

Davis has been associated with the South African mining industry and mining investment industry for the past 45 years in mainly platinum-group metals, gold and uranium, and he reaches this conclusion in a 25-page review for Auctus Metal Portfolios of Singapore.

His calculations imply that the platinum quantum of above-ground platinum inventory, in Western Europe and the UK, has entered a critical red zone.

He notes that China, which has been buying volumes of platinum that exceed its demand since 2009, does not export platinum. Therefore, supply support can come only from the above-ground platinum inventory of the US, at a price; or from an increase in primary mine supply, which is in decline; or from a significant increase in recycling, which is unlikely.

He expects these trends to ignite the price of platinum within the next few months: “It’s only a matter of time before the impact of this growing global supply-demand deficit bites and we see a very substantial rise in the price of platinum”.

He calculates China’s above-ground inventory to have absorbed 12-million ounces of platinum, which represents 57% of the apparent global platinum above-ground inventories of 21.2-million ounces.

As China’s above-ground inventory is not accessible by the Western world, Davis concludes that the rate of global decarbonisation will be negatively affected.

He calculates US above-ground inventory at 8.1-million ounces and Japan’s above-ground inventory at 1.8-million ounces, with Western Europe, the UK and the rest of the worlds’ above-ground inventories all on their last legs.

“Given these scenarios . . . it is imperative for the industry to significantly advance its current timeline and replace the obsolete and simple supply-demand equation with a real market balance equation,” Davis states in the review released to Mining Weekly.

He denounces as “mind-boggling” the impact of using simple supply-demand market balance and above-ground inventory estimates and highlights that using real-world equation trends in above-ground inventories reveals vital information concerning the regional distribution and the quantum of platinum contained in these inventories.

Davis believes that the platinum-group metals and the investment industry, as well as research organisations and other interested parties, do not have an accurate understanding of the structural changes in the above-ground inventories of platinum between 2007 and 2022.

The geographic location and mobility of vaulted above-ground inventory stocks are an important factor when considering platinum’s supply life and price, he argues.

Davis emphasises that platinum stocks have entered a critical low-level stage

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation