De Beers is well positioned to thrive as market recovers, Anglo believes

Anglo's half-year presentation covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

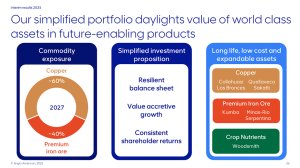

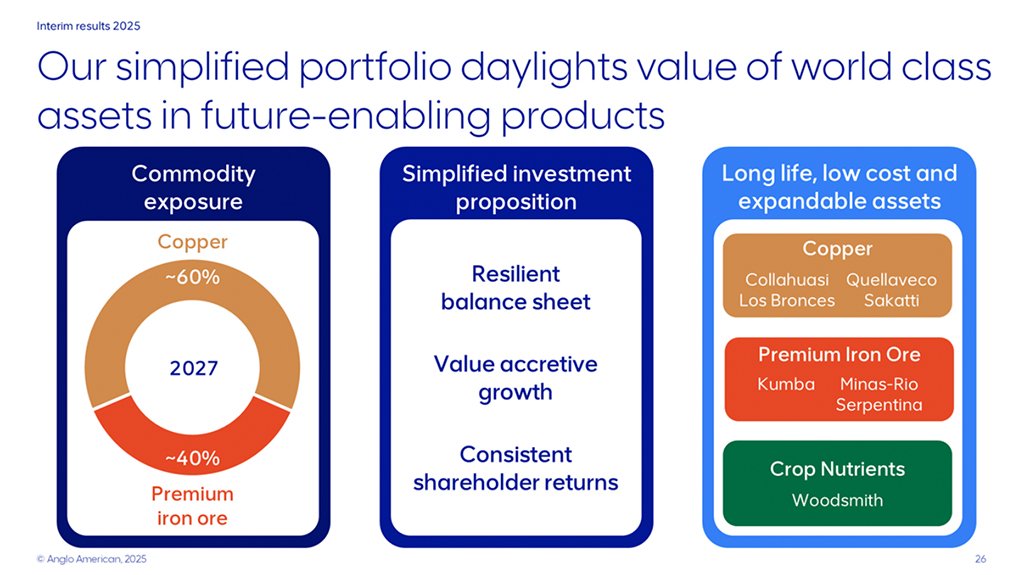

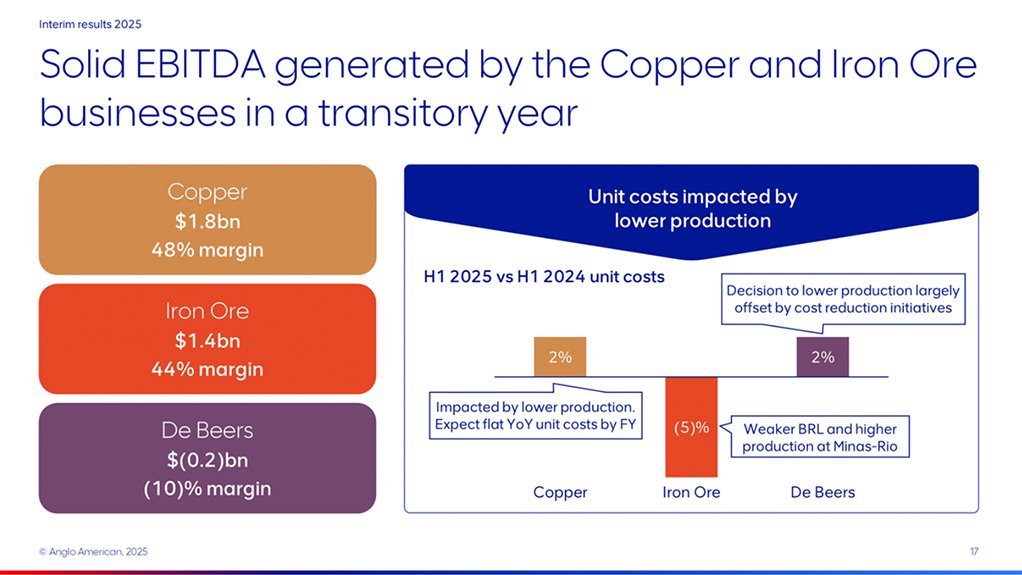

Anglo's go-forward businesses.

Photo by Creamer Media

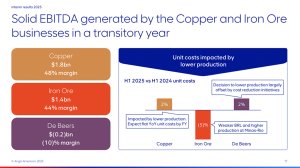

Anglo's portfolio earnings outlook.

Photo by Creamer Media

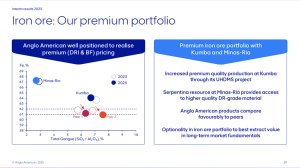

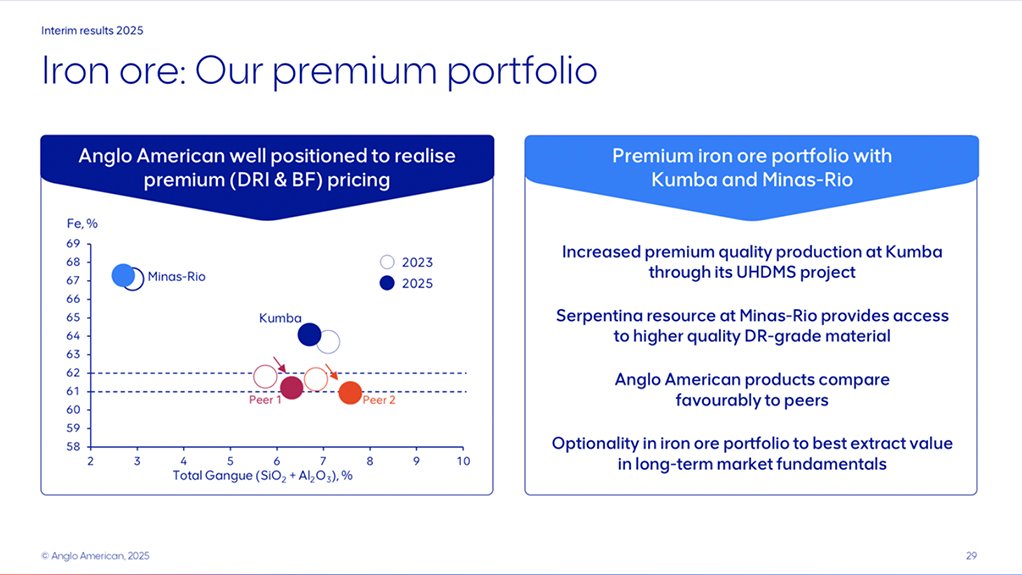

South Africa's quality iron-ore.

Photo by Creamer Media

JOHANNESBURG (miningweekly.com) – The commitment of Anglo American to exit De Beers is unwavering, despite the belief of this secondary-listed Johannesburg Stock Exchange company that its iconic diamond mining and marketing business is well positioned to emerge and thrive as the diamond market recovers.

As a consequence, Anglo is moving ahead with two exit options. Its preferred exit would be via a trade sale and its non-preferred exit would be by way of a stock exchange initial public offering (IPO) listing exit. But both exit routes are being advanced in parallel.

While pressing ahead on both fronts, it makes no bones about wanting a trade sale owing to the complexity of shareholding agreements and, more importantly, the tough rough diamond markets over the last couple of years.

To conclude a trade sale, Anglo is engaging in a formal process with what it describes as “a credible set of interested parties” as well as with the government of Botswana in respect of the interest of Botswana to increase its shareholding in De Beers.

“A trade sale absolutely remains our preferred exit route for the business, but only if we can find the right buyer on the right terms.

“In parallel, we’re progressing preparatory activities for a capital markets process should that become the preferred route for our shareholders.

“As far as diamond markets are concerned, we have started to see the early signs of stabilisation over the last six months.

“We continue to monitor the situation really closely and remain focused on managing the De Beers business to optimise the cash generation of this business, while at the same time preserving the value of the iconic nature of this business,” Anglo CEO Duncan Wanblad stated during Anglo’s presentation of half-year financial results covered by Mining Weekly. (Also watch attached Creamer Media video.)

Meanwhile, it was revealed that the De Beers team had what was described as “a clear response plan ready to ensure that cash generation would be preserved should the market take a lot longer to recover”.

“De Beers is such an important company to the country of Botswana, and indeed to the other countries where De Beers operates,” Wanblad noted.

South Africa’s largest diamond mine, the Venetia mine in Limpopo province, is owned by De Beers. Venetia is building out a major underground expansion to extend Venetia's lifespan beyond 2040. This involves investment and technological upgrades to transition from an opencast operation to an underground one.

Regarding the attention being given by Anglo to Venetia, Wanblad said: “Throughout the process, we’re engaging with all stakeholders on pathways forward, as you would expect us to do.

“With some of the best diamond mine resources and best marketing capabilities in the world, De Beers, I believe, is well positioned to emerge and thrive as the market recovers. We continue to believe strongly that there is significant upside potential in this business for the right combination of owners, and we'll continue to keep the market abreast of developments,” he promised.

Wanblad spoke of “the fair amount of very credible interest" that was being shown in De Beers by trade-sale suiters.

“It’s still a business that consists of some fantastic assets and despite the current turmoil in diamond markets, it stands out very well. But a trade sale has to happen with the right group of buyers and has to be for the right consideration on behalf of our shareholders.

“To the extent of that not coming together, we just have to keep our options open and therefore work is carrying on in parallel in terms of setting up the business for an IPO at the right time.

“Right now, I would say that good trade sale progress is being made. We’re already in a formal process with third-party buyers and we’re also engaging with the government of Botswana.

“In a month or so, we'll be moving into what is effectively the second round of the sales process,” he disclosed, while adding that should the IPO option materialise, the Johannesburg Stock Exchange would be among the stock exchanges that would be considered for the listing.

“We’re still considering the best home for a listing, be that London, Johannesburg, New York. It's a very special business and I think we’d attract enormous amounts of interest from the right types of shareholders, so it’s very important for us to get that right. We haven't made the decision on that at this point but we’re certainly looking at least at those three.

“From a timeline, I would suggest that certainly from a trade sale point of view, if we get the right buyer or the right consortia of buyers together for this, it's not impossible to have this done in the next six to nine months.

“An IPO would be much more a function of a timing associated to some strength coming back into the market, so probably early-to-mid next year, rather than this year,” Wanblad added.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation