Deep Yellow defers final investment decision on Tumas to March 2025

Following delays in receiving final costing and quotes for detailed engineering work, ASX-listed uranium miner Deep Yellow has decided to defer a final investment decision on its Tumas project, in Namibia, to March 2025.

The company explains that the deferred decision will also allow for the completion of project optimisation works, which is in the best interest of the project and shareholders in the longer term.

Moreover, expected higher uranium prices on the back of an emerging supply shortage will be a primary pre-condition to starting construction of the Tumas processing plant as the current long-term uranium price does not justify greenfield developments.

Deep Yellow foresees that global nuclear activity will strengthen owing to governments opting for nuclear to generate clean and reliable baseload power – for example, the twenty-ninth Conference of the Parties conference, held in November 2024, had 31 countries commit to increase nuclear output by 2050.

The company says it has a clear outlook from both a project and uranium market standpoint on how to best ensure the right platform is established for long-term success.

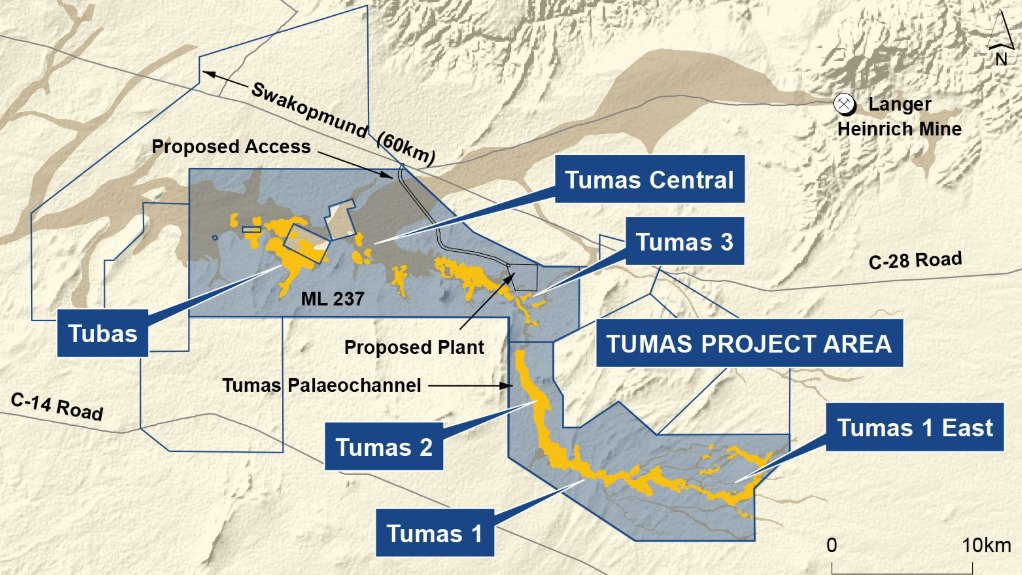

Deep Yellow continues with early works on non-processing infrastructure on site in the meantime and increasing the project’s proven and probable ore reserves. The reserves increased by 18% to 79-million pounds of uranium oxide, grading 298 parts per million in the quarter ended December 31, which is sufficient for a 30-year mine life.

There is significant further potential to increase the life-of-mine by upgrading the remaining inferred mineral resources, with 30% of the Tumas paleochannel system being untested.

The company is also advancing contracts for the supply of water and power from Namibia’s utilities, as well as project financing arrangements with strong indicative support from potential lenders having been garnered.

Meanwhile, Deep Yellow has completed a diamond core drilling programme on the Mulga Rock project, in Australia, having gathered a 3.6 t bulk sample for metallurgical testwork.

The company had A$238-million of cash and no debt at the end of December.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation