Ferrochrome venture’s 2025 output 63% lower, Merafe reports

JOHANNESBURG (miningweekly.com) – Ferrochrome output from the Glencore-Merafe Chrome Venture was 63% lower in 2025 than in 2024, Merafe Resources reported on Tuesday, January 20.

Attributable production fell from 301 000 t in 2024 to 112 000 t in 2025. Contributing significantly to this major production decrease for the year ended December 31 was the venture’s very low 147 t output in the last three months of 2025, which took place against the backdrop of smelter production being suspended owing to adverse market conditions.

On the chrome-ore front, Merafe’s attributable fourth-quarter chrome-ore production from the venture was a mere 2% lower at 222 000 t, a decrease resulting mainly from temporary equipment breakdown.

Total chrome-ore production for 2025 was 932 000 t compared with 948 000 t in 2024.

Meanwhile, Merafe’s attributable fourth-quarter platinum group metals (PGMs) concentrate production from the venture was a 5%-higher 4 000 oz and PGMs for the year also 1 000 oz higher at 15 000 oz.

The main focus of Merafe, which listed in the general mining sector on the Johannesburg Stock Exchange and Johannesburg’s A2X, is on its 20.5% participation in the Glencore-Merafe Venture, in which Glencore has a 79.5% participation. The wholly owned Merafe Ferrochrome and Mining participates in the earnings before taxes, depreciation and amortisation of the venture.

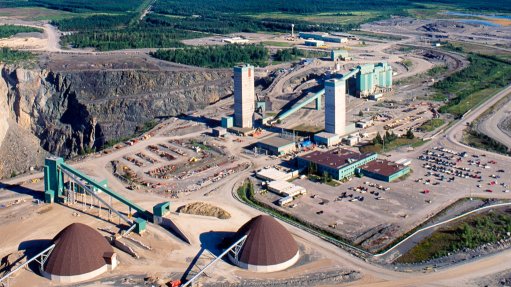

What is important to note is that South Africa’s private-sector ferrochrome industry is continuing to struggle because of high public-sector electricity tariffs, which has prompted an electricity tariff proposal by South Africa’s State-owned power utility Eskom to support operation at the venture’s flagship lower-energy Lion ferrochrome smelter in Limpopo province.

But unfortunately work is still underway to bring about economic sustainability for the venture’s Wonderkop and Boshoek ferrochrome smelters in the North West province.

Although beneficiation of chrome ore into the five-times higher valued ferrochrome is a job-creation cornerstone, and the closure of smelters is not good for South Africa, arriving at economically viable solutions has become a long drawn out battle in a low ferrochrome price environment.

While for decades much more was made from mining the chrome ore and beneficiating it into ferrochrome product, it is now being found that more can be made from exporting chrome ore in unbeneficiated form.

As reported by Engineering News in December, Eskom has signed a memorandum of understanding with the venture as well as with Samancor Chrome in a bid to finalise an electricity tariff solution that prevents the closure of additional smelting capacity, and averts the threat of widespread job cuts in the sector.

What is being sought now is electricity that is cheap enough for South African ferrochrome smelting to be competitive, as well as smelter inclusion into special economic zones, and the elimination of illegal mining of chrome ore, which accounts for about 10% of exports.

Taking 10% of the chrome units out of the market by stopping chrome crime would benefit the industry, which is well aware of the benefit of beneficiation. More South African beneficiation means more revenue, more jobs and less logistical pressure.

Also, capital investment in the new lower-energy SmeltDirect technology that slashes power needs by 70% will be taken up if there is more industry certainty.

Trade union Solidarity has expressed the belief that a win-win agreement is possible and that decisions can be made that will be beneficial to all parties.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation