First merchant lithium refinery in final phase of EIS fundraising

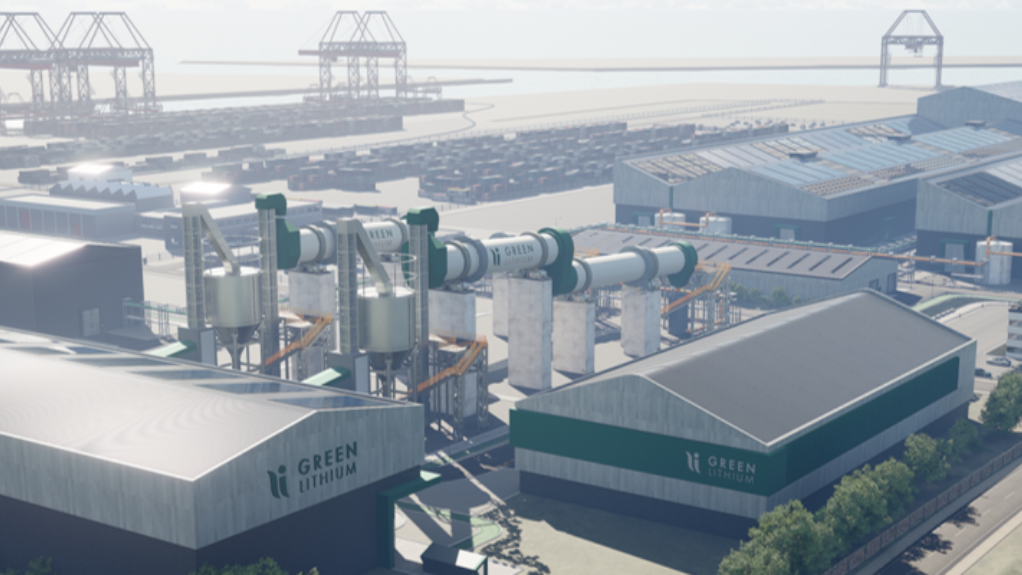

STRATEGIC MANOEUVRES The construction of the UK’s first merchant hard-rock lithium refinery is a strategic move to meet the projected surge in demand for battery-grade lithium chemicals by 2030

SEAN SARGENT Green Lithium's commitment to the environment is not just a promise; it is a tangible reality

Lithium processing company Green Lithium has partnered with UK-based private equity firm Prospedia Capital to raise up to £2.6-million of seed and venture capital covered under the UK’s Enterprise Investment Scheme (EIS). This scheme is designed to attract early-stage investment and offers efficient income, capital gains, and inheritance tax breaks for UK angel investors and taxpayers investing in venture capital funds.

The company notes that the construction of the UK’s first merchant hard-rock lithium refinery is a strategic move to meet the projected surge in demand for battery-grade lithium chemicals by 2030, driven by the transition of European carmakers to full-scale electric vehicle (EV) production. It presents a unique investment opportunity with the potential for high returns as the European market currently relies on China for its lithium chemicals supply.

“There is a mountain for Europe to climb if it is to compete. The bottleneck is in refining. Even with all existing potential European suppliers being successful, there will still be a 43% deficit in the supply of this crucial battery-grade material. It is a pressing issue requiring sustained government involvement alongside private investment,” says Green Lithium CEO Sean Sargent.

Green Lithium has taken significant steps to derisk its business model, having secured over £14-million in private investment and UK government grants for various aspects of its business model, such as bench-scale and pilot trials, engineering studies, independent life cycle analysis, and capital expenditure reports. It has also strategically chosen a Teesside site, brought on board critical partners and appointed an experienced high-calibre management team and a board of directors.

With over £1-million already pledged, this penultimate round of early-stage investment precedes an institutional funding round, enabling the construction of a scale-up plant, with further capital to be raised for a full-scale plant.

Sargent notes that Green Lithium’s commitment to the environment is not just a promise; it is a “tangible reality”. Its environmental credentials include its adoption of an alkali leach rather than acid roast process, using renewable electrical energy and hydrogen when available instead of natural gas, and other carbon-reducing strategies. This means it can aim for a 75% reduction in carbon emissions compared with existing Chinese refineries, according to a life cycle assessment by science-based consultancy Minviro.

Green Lithium is also working with the University of Sheffield to develop a patented process to commercialise its primary by-product. This strong environmental stance should further instil confidence in potential investors.

“We’re delighted at this opportunity to help Green Lithium with its fundraising efforts,” says Prospedia Capital chief strategy and investment officer Isobel Sheldon, who also serves on electrochemical research institute The Faraday Institution’s board of trustees. Renowned for her experience in EV battery technology and supply chains, she adds, “Green Lithium’s refinery is much needed in Europe. It will help carmakers localise their supply chains while scaling up battery production and reducing emissions from refining lithium hard rock to produce lithium hydroxide and carbonate.”

Prospedia highlights that Teesside is a prime location in Europe for such a facility owing to its industrial skills, sea, rail and road access, and strategic access to Net Zero Teesside – a globally significant carbon capture and storage scheme. The proposed development will include office and warehouse buildings, enclosed plants and structures across about 60 acres.

The first step for the company is to build a demonstration scale-up plant to derisk the business model even further. The plant will produce 1 250 t/y of high-quality lithium chemicals, which has the potential to generate revenues of £28-million before the completion of the full-scale plant, which will comprise two lines capable of producing 50 000 t of lithium chemicals, sufficient for 1.2- million battery EVs.

This £1.4-million (up to a maximum of £2.6-million) funding round will see the completion of the front-end engineering design for the scale-up plant, finalising operational readiness and planning permissions, and closing contracts with key suppliers while preparing for the high-level readiness demanded by institutional fundraising. This means the scale-up plant will be shovel-ready ahead of initial institutional investment supporting construction during 2024.

“This round is targeting an investment return of 15x. We anticipate achieving this once the scale-up plant is operational and at a point in time following the full-scale plant’s final investment decision on construction. While these returns are not guaranteed, the UK’s generous EIS scheme significantly mitigates the risk for early-stage investors with income tax liabilities. At the same time, on the upside, it protects investors from capital gains and inheritance tax liabilities,” says Green Lithium CFO Jo Charles.

Recognised by His Majesty’s Revenue and Customs as a knowledge-intensive company, Green Lithium can raise £10-million each financial year, capped at £20-million overall, using the EIS tax relief.

“We will work closely with our external advisers to ensure our future institutional equity fundraising aligns with the EIS status of our early-stage investors. So far, we have raised almost £10-million under this tax-efficient scheme from angel and retail investors, including a crowdfunding campaign in 2023 and an additional £4-million from government grants,” Charles concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation