Great Bear gold project, Canada – update

Photo by Kinross

Name of the Project

Great Bear gold project.

Location

Red Lake, Ontario, Canada.

Project Owner/s

Kinross.

Project Description

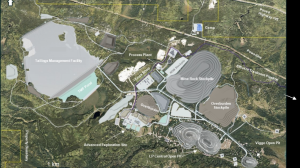

Based on mineral resources drilled to date, a preliminary economic assessment (PEA) has outlined a high-grade combined openpit and underground mine.

The initial mine plan outlines concurrent openpit and underground mining over the first eight years, followed by combined underground mining and stockpile processing in years 8 to 12. The decision to mine the openpit and underground concurrently from the outset provides significant production flexibility and time to continue exploration drilling from underground to further expand the resource and mine life, the PEA states.

The PEA demonstrates an initial life-of-mine (LoM) of about 12 years with total production of 5.3-million ounces of gold over the LoM.

The openpit will be mined using a dual fleet strategy to provide selective mining of the high-grade material and lower-cost mining of the waste, mining a peak of 26-million tonnes of material, and providing a peak of 9 000 t/d of mineralised material. For the underground, longhole open stoping with paste backfill and cemented rock fill has been selected as the primary mining method. First stope production is expected to start in 2029, subject to permitting, and to continue for 12 years.

Peak production is estimated at 6 000 t/d and to average 327 000 oz/y, with the potential to expand beyond this run rate as extensions to the underground resource are targeted. For the PEA, a conventional milling circuit for free milling mineralisation has been proposed, targeting an average processing rate of 10 000 t/d.

Potential Job Creation

The project is expected to create an estimated 900 jobs during its operational life, with peak employment reaching 1 000 workers. Thousands of additional construction and indirect jobs will also be created during the build-out phase from 2027 to 2029, delivering new economic opportunities to the region.

Net Present Value/Internal Rate of Return

Based on a gold price of $1 900/oz, the project has a net present value (NPV), at a 5% discount rate, of $1.9-billion and an internal rate of return (IRR) of 24.3%, with a payback of 2.7 years. At a gold price of $2 500/oz the project has an NPV, at a 5% discount rate, of $3.3-billion and an IRR of 35.5%, with a payback of 1.7 years.

Capital Expenditure

The project requires a capital investment of more than $5-billion.

Planned Start/End Date

Major construction is expected to start in 2027, with first production targeted for 2029.

Latest Developments

The government of Ontario has earmarked the project for accelerated development under its new ‘One Project, One Process’ (1P1P) permitting framework.

Gold Bear is the first gold mine, and the third project overall, to be accepted under the regime launched in October.

Announcing the move, Energy and Mines Minister Stephen Lecce said on February 17 that the province was seeking to fast-track strategic mining developments amid global economic volatility.

Kinross CEO Paul Rollinson said the 1P1P designation would help streamline the path to commercial production.

The 1P1P framework establishes the Ministry of Energy and Mines as a single point of contact to coordinate provincial approvals and Indigenous consultation, with the province aiming to reduce review timelines by up to 50%. The Crown’s duty to consult remains in place under the framework.

The designation also aligns with broader regional infrastructure initiatives, including consultation on the proposed Red Lake Transmission Line, which would run from Dryden to Red Lake, to support new mines and expanding communities.

Key Contracts, Suppliers and Consultants

Not disclosed.

Contact Details for Project Information

Kinross, tel +1 416 365 5123 or email info@kinross.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation