Harmony Gold going ahead with R4.5bn Zaaiplaats project

Harmony Gold presentation of results covered by Mining Weekly’s Martin Creamer. Video: Darlene Creamer.

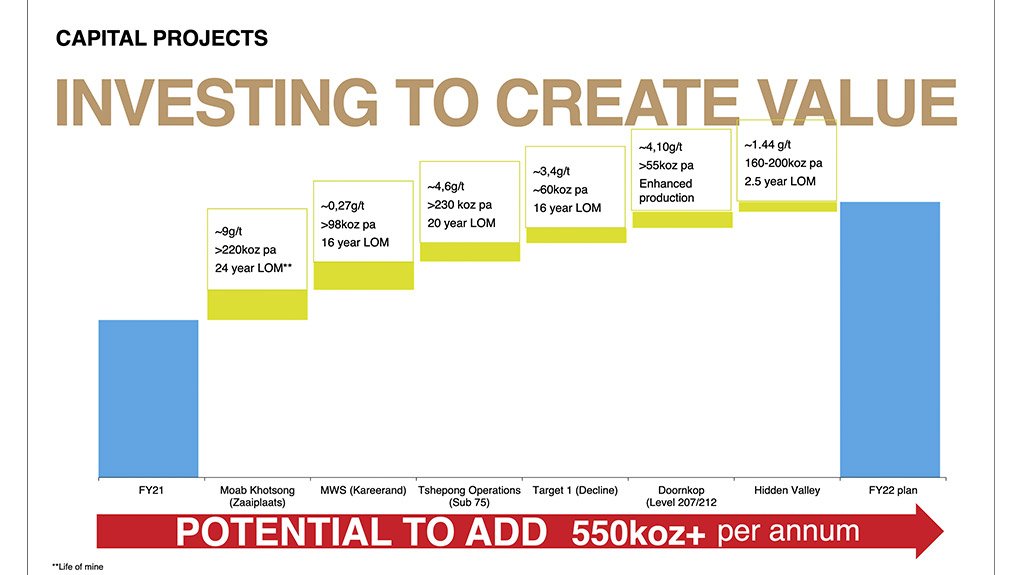

Harmony projects in ounces.

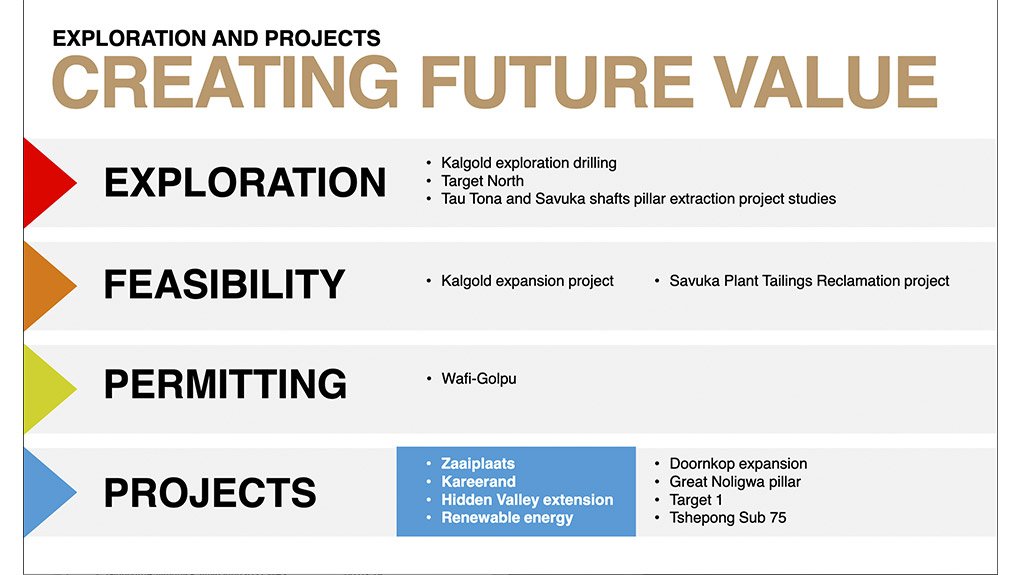

Harmony exploration projects.

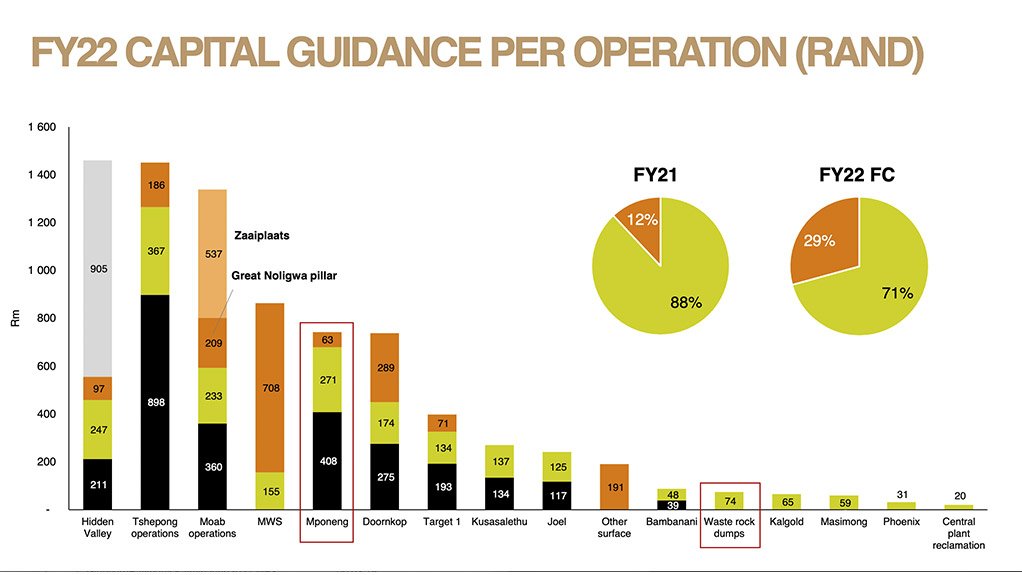

Harmony capital guidance.

JOHANNESBURG (miningweekly.com) – Gold mining company Harmony Gold is going ahead with its high-grade Zaaiplaats gold project at a capital cost of R4.5-billion.

Zaaiplaats is one of three Harmony projects that, with three others already under way, will collectively add 550 000 oz of gold a year to the Johannesburg- and New York-listed company, which produced a total of 1.54-million ounces of gold in the 12 months to June 30.

A second project to be built at a cost of R3.2-billion is an extension of the large Kareerand tailings facility at Mine Waste Solutions, cash flow from which will also help to fund the project. The third is a project providing another 2.5 years to the current life-of-mine of Hidden Valley, in Papua New Guinea. Collectively, close to R8-billion will be invested in all three over an extended period.

The total growth capital expenditure in South Africa for the 2022 financial year is R2.3-billion, with another R555-million in growth capital allocated for Papua New Guinea.

Most of the projects are being funded from internal cash flows, with Zaaiplaats funded through the Moab operations.

The projects will keep Harmony above the level of 1.4-million ounces of gold a year to its 2027 financial year.

Should the Wafi-Golpu copper/gold project come into play in Papua New Guinea thereafter, Harmony’s production profile will extend well into the future.

The important aspect of these latest projects is that they will significantly increase the profit margins of the company as lower-margin older shafts are closed and taken out of the portfolio.

Zaaiplaats, with a 24-year life-of-mine, has a rich 9 g/t orebody and an all-in sustaining cost (AISC) of just over R500 000/kg in today’s terms for what will be an output of 225 000 oz/y. Overall AISC for the 12 months to June 30 was a considerably higher R723 054/kg.

“It’s a very, very good project,” Harmony Gold CEO Peter Steenkamp said of Zaaiplaats. Of the Mine Waste Solutions project, he said: "It's a no brainer."

The largest part of the orebody mined as Moab is still in Zaaiplaats.

“It’s a high-grade orebody and obviously something we believe will add significant value,” said Steenkamp, who has led the company to a nigh five-fold increase in market capitalisation over the last five years to R32.5-billion.

A twin decline will provide 400 m deeper access to the Zaaiplaats orebody.

“We’re right there already on top of the orebody,” he added.

This year capital of R537-million will be spent on the project, with the total R4.5-billion expended over ten years.

First production will begin in financial year 2021 and more significant volumes will be reached the next financial year.

A second project to be built at a cost of R3.2-billion is an extension of the large Kareerand tailings facility at Mine Waste Solutions, cash flow from which will also help to fund the project.

“This will all be spent in a very short period of time,” Steenkamp said during an online media conference in which Mining Weekly participated.

The first R700-million will be spent next year, with the project enabling Mine Waste Solutions to operate for another 20 years.

With the Franco-Nevada streaming agreement coming to an end in 2025, Mine Waste Solutions is poised to become highly profitable.

“Those are the two big ones that we’ve approved,” he said.

The three smaller projects under way include the life-enhancing and production-lifting Sub 75 project at Tshepong Operations, Level 207/212 at Doorknob, and a decline at Target 1, all in the Free State.

Going forward, Mponeng’s attractive orebody is also offering potential growth options.

At the moment, studies are under way into the economic feasibility of mining the Tau Tona and Savuka pillars, particularly the shaft pillars, which are of significantly higher quality than the pillars already mined by Harmony at its Bambanani mine.

Harmony is involved with the chair of rock engineering at the University of Pretoria, which is helping to provide guidance on how the Tau Tona and Savuka pillars can be mined.

Later on, there will be an opportunity to deepen Mponeng by another two levels.

“That’s not a decision we have to make now. It’s something we can do in the future. Mponeng will add to greater ounces and increased profitability.

“We haven’t completed the feasibility studies yet and the moment we have, we’ll bring the deepening of Mponeng into our growth profile.

“Again, these are high-grade assets of much better quality than we’ve had before, so certainly, these are projects that we’d like to pursue,” Steenkamp said.

EXPLORATION

At Target North, two exploration drilling machines have been at work and the prospects are kindling excitement.

Considerable exploration drilling has also been done at Kalgold, where Harmony is intent on building a substantially bigger mine in the long term.

“We have a 1 g/t orebody and if you scale that up you can make a very big thing of that. We’ve done the flyovers for prospecting rights and infill drilling in our current mining rights to sustain a bigger operation for ten years or so,” Steenkamp told Mining Weekly.

Harmony reported a 66% increase in profits to R12-billion for the 12 months to June 30 on a 26%-higher production of 1 535 352 oz.

A final dividend of 27 c a share was declared on a 83% increase in operating free cash flow to R6.5-billion on a 758% increase in net profit of R5.6-billion from a loss of R850-million and a 60% reduction in net debt to R542-million.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation