Implats improves units costs during full-year, but production volumes decrease

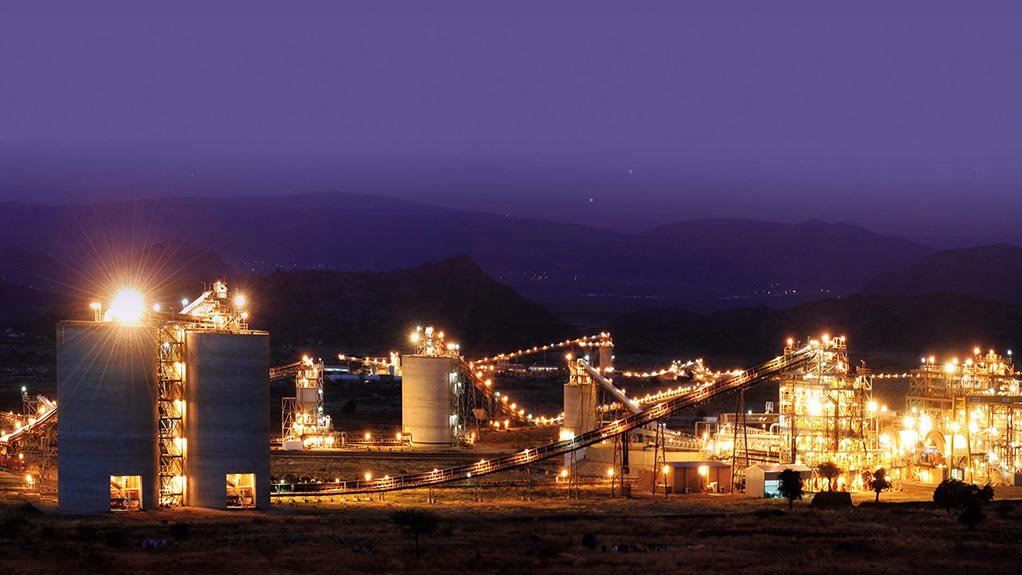

JSE-listed Impala Platinum (Implats) says it delivered a “commendable” performance across its mining and processing assets for the full-year ended June 30.

Unit costs benefitted from easing input inflation and rand appreciation, but faced headwinds from lower production volumes.

Group capital expenditure reduced as various projects were completed and commissioned in the period.

The group generated positive free cash flow and closed the period with an improved net cash position.

Gross group production decreased by 3% to 3.55-million ounces ruthenium, rhodium, palladium, osmium, iridium and platinum (6E), from 3.65-million 6E ounces in the prior financial year.

Production from managed operations declined by 4% to 2.80-million ounces of 6E, as detailed below.

Stock-adjusted production at Impala Rustenburg decreased by 1% to 1.28-million ounces of 6E.

Impala Bafokeng delivered stable production of 481 300 6E oz in concentrate, with the benefit of improved efficiencies at Styldrift offset by safety stoppages.

Performance at Marula was challenged by constrained mining flexibility and organisational restructuring implemented in the period. 6E concentrate production declined by 10% to 201 900 oz.

Also, 6E production in matte at Zimplats decreased by 6% to 606 300 oz, owed primarily to poor fleet performance and compounded by the lock up of concentrates during the commissioning of the expanded smelter complex.

At Impala Canada, 6E concentrate volumes were 15% lower at 237 400 oz, reflecting the operation’s revised operating parameters and lower underground grade.

Production from joint ventures (JVs) declined by 1% to 542 400 6E oz, as detailed below.

Two Rivers recorded a 1% decrease in 6E in concentrate production to 288 500 oz, with improved operational delivery at the UG2 operations offset by inclement weather and safety stoppages.

At Mimosa, 6E in concentrate volumes retraced by 1% to 253 900 oz as operating momentum was impeded by intermittent regional power disruptions.

Concentrate receipts from third parties were 9% higher at 208 600 oz of 6E, reflecting better-than-expected deliveries from underlying contractual agreements.

Refined 6E production, which includes saleable ounces from Impala Bafokeng and Impala Canada, was indicated to be stable at 3.37-million ounces of 6E.

Processing capacity was impeded by required maintenance at the group’s South African smelters, while its base and precious metals refineries faced interruptions to both water and hydrogen supply.

Implats ended the period with excess inventory of 420 000 oz of 6E.

Sales volumes declined by 2% to 3.37-million 6E ounces, including saleable production from Impala Canada and Impala Bafokeng.

US dollar commodity pricing strengthened in the period, the impact of which was offset by rand appreciation. As a result, the group’s sales revenue was stable at about R25 170/6E oz sold.

Group unit costs per 6E ounce are expected to increase by 7% to about R22 500 on a stock-adjusted basis.

Moderating input inflation was offset by lower production volumes, the transfer of capital spend to working costs at Impala Canada and ex gratia employee payments incurred in the period.

Implats generated earnings before interest, taxes, depreciation and amortisation of about R9.9-billion in the period.

Group capital expenditure is expected to have decreased to about R7-billion owing to lower levels of growth and replacement capital during the year as projects neared completion and spend at Impala Canada was transferred to working costs.

Implats generated positive free cash flow of about R2.4-billion in the period and its closing adjusted net cash improved to about R8.1-billion at period end, from R6.9-billion in the comparable period.

Implats will release its audited results for period on or about August 29.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation