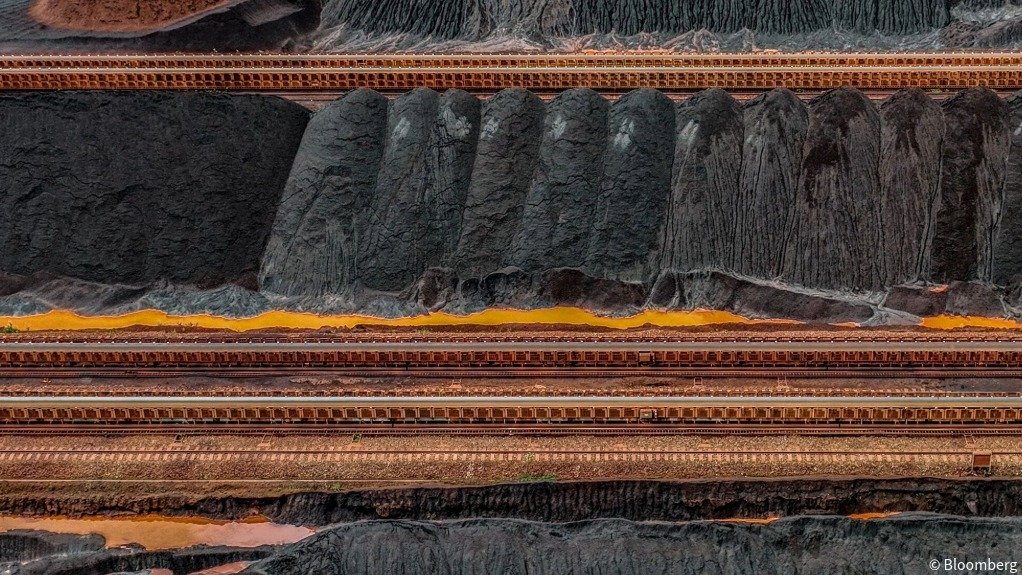

Iron-ore rises on China restocking demand from steel mills

SINGAPORE - Iron-ore futures rose on Monday, supported by strong restocking demand from steel mills in China amid healthy profit margins and low inventories, although expectations of production cuts in northern China capped the gains.

The most-traded September iron ore contract on China's Dalian Commodity Exchange (DCE) DCIOcv1 traded 0.82% higher at 796.5 yuan ($110.89) a metric ton.

The benchmark September iron ore SZZFU5 on the Singapore Exchange was 1.32% higher at $103.45 a ton, as of 07:03 GMT.

Healthy margins and low inventories have led steel mills to restock, contributing to higher iron ore demand, though futures pared some gains as investors expect steel production cuts in the north of China ahead of a military parade on September 3, said analysts from ANZ.

In July, China's blast-furnace steel mills achieved better profits on finished steel sales despite a rise in production costs, mainly due to a fast recovery in domestic steel prices, Chinese consultancy Mysteel said in a note.

Still, seasonal declines in consumption persist, with high temperatures and heavy rains significantly impacting downstream construction and resulting in steel inventory accumulation, said Hexun futures, adding that firm raw material prices lent support to steel prices.

In Japan, major steelmaking companies are witnessing a fall in quarterly steel output and could see the lowest annual output since 1968, amid lower prices and the potential impact of US tariffs on car production.

This is compounded by a surge in cheap steel exports from top producer China, exerting downward pressure on prices.

Other steelmaking ingredients on the DCE gained ground, with coking coal DJMcv1 and coke DCJcv1 up 2.99% and 1.97%, respectively.

Steel benchmarks on the Shanghai Futures Exchange all rose. Rebar SRBcv1 increased 1.09%, hot-rolled coil SHHCcv1 climbed 1.29%, wire rod SWRcv1 edged up 0.17% and stainless steel SHSScv1 strengthened 1.38%.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation