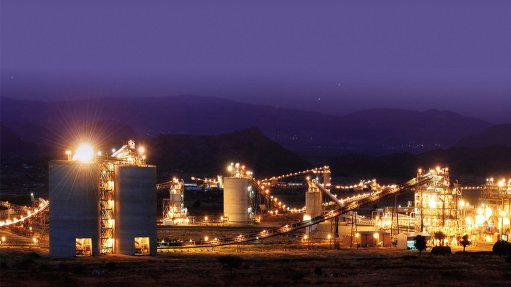

Ironbark gold project, Australia

Photo by ©Bloomberg

Name of the Project

Ironbark gold project.

Location

Near Meekatharra, Western Australia.

Project Owner/s

Mineral exploration company Great Boulder Resources.

Project Description

A scoping study has shown robust economics for a short mine life, and a high-grade, openpit mining opportunity at the Ironbark deposit, which falls within Great Boulder’s flagship Side Well gold project. Ironbark has mineral resources of 938 000 t grading at 3.3 g/t gold for 100 000 oz.

The Ironbark project has been divided into two stages.

Stage 1 is aligned along the strike of the orebody and is planned to exploit about 50% of the total ore within the mine plan. The upper 40 m of Stage 1 is proposed to be accessed through a dual-lane ramp, which transitions to a single-lane configuration at depth to reduce waste movement.

Stage 2 expands on Stage 1 by cutting back the southern and south-western walls while maintaining a common final wall at the north-eastern end. A portion of the Stage 1 ramp will be reused before being extended to access deeper ore zones. Stage 2 extends about 670 m along strike, with a pit crest width of 270 m.

As in Stage 1, a dual-lane ramp services the upper levels before narrowing to a single-lane configuration to depth.

This approach helps to maintain an acceptable stripping ratio and reduce additional waste movement associated with a larger ramp profile. Traffic flow within the single-lane section is assumed to be manageable for the remaining benches of the pit.

All material mined from Stage 1 and Stage 2 of the openpit is expected to be hauled either to a nearby surface waste dump, in close proximity to the pit crest, or to a local run-of-mine stockpile for subsequent surface haulage to the processing facility. Ironbark has a production target comprising 1.26-million tonnes at 2 g/t gold for about 79 000 oz – 648 000 t at 1.4 g/t gold, producing about 30 000 oz gold in Stage 1, and 615 000 t at 2.5 g/t gold producing about 49 000 oz gold in Stage 2.

The development of a mining operation at Ironbark remains contingent upon the grant of mining tenure.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The scoping study shows a net present value, at an 8% discount rate, of about $137-million and an internal rate of return of 152% at a spot gold price of A$5 064/oz

Capital Expenditure

Stage 1 capital expenditure is estimated at A$3.1-million.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Entech (mining consultants).

Contact Details for Project Information

Great Boulder Resources, tel +61 8 9321 6037 or email admin@greatboulder.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation