Jaguar nickel sulphide project, Brazil – update

Photo by Centaurus Metals

Name of the Project

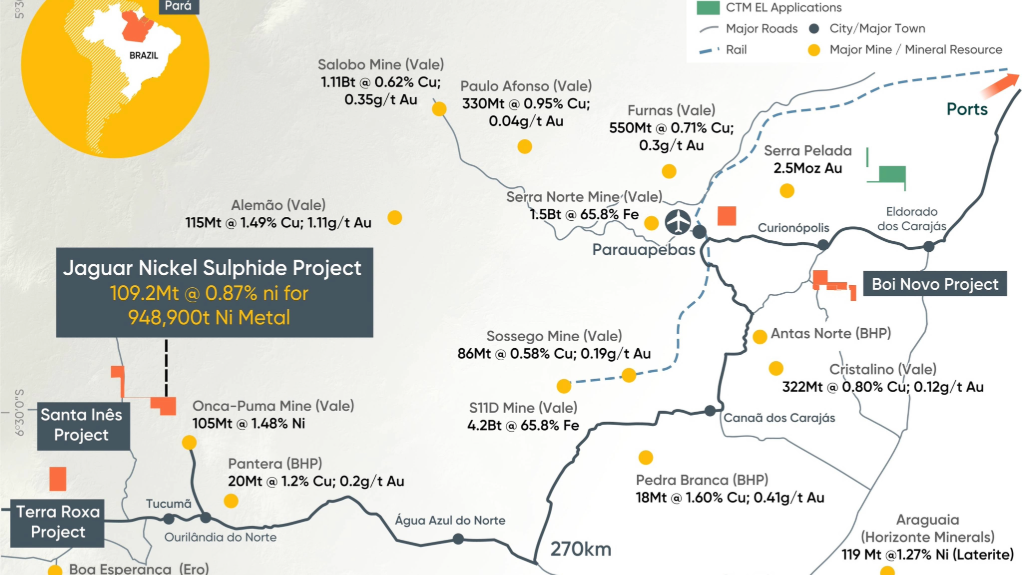

Jaguar nickel sulphide project.

Location

Carajás, Brazil.

Project Owner/s

Aliança Mineração, a wholly owned Brazilian subsidiary of Centaurus Metals.

Project Description

A value-add scoping study has been undertaken to evaluate the potential development of the project.

The project is expected to have a low-carbon emission footprint and generate strong financial returns while delivering significant long-term social and economic benefits for the local communities around it.

The scoping study envisages the development of openpit and underground mines supplying a 2.7-million-tonne-a-year nickel sulphate plant over an initial 13-year mine life.

The mine is expected to produce more than 20 000 t/y of recovered nickel in sulphate and more than 9 600 t/y of mixed sulphide precipitate.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has an estimated pretax net present value, at an 8% discount rate, of $1.03-billion and an internal rate of return of 60%, with an after-tax payback period of 1.8 years.

Capital Expenditure

The project will require preproduction development capital of $288-million.

Planned Start/End Date

First production from Jaguar is currently targeted for 2025.

Latest Developments

Centaurus Metals has deferred plans for a nickel sulphate refinery in Brazil and will instead focus on a concentrate-only project for now.

The board has decided to reshape the current feasibility study, postponing parts of the study relating to a fully integrated downstream nickel sulphate project and focusing instead on completing the study, based on an initial project only. This approach will significantly lower capital costs and will ensure the Jaguar project remains robust.

The board estimates that it will be able to release the concentrate feasibility study by the end of June 2024.

The company says the concentrate study is expected to show robust economics underpinned by low operating costs which are globally competitive, including with Indonesian nickel supply, in large part owing to the clean, low-cost power that is available to the project from the 230 kV national grid in Brazil.

Centaurus has noted that investor sentiment towards ASX-listed nickel companies has significantly declined and that this has had an impact on market capitalisations and funding options.

Key Contracts, Suppliers and Consultants

Entech; Re-Metallica; and DRA Global (value-add scoping study); and Ausenco (DFS).

Contact Details for Project Information

Centaurus Metals, tel +61 8 6424 8420 or email office@centaurus.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation