Kamistiatusset iron-ore project, Canada – update

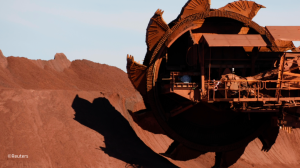

Photo by ©Reuters

Name of the Project

Kamistiatusset iron-ore project.

Location

Western Labrador, Canada.

Project Owner/s

Iron-ore mining and development company Champion Iron.

Project Description

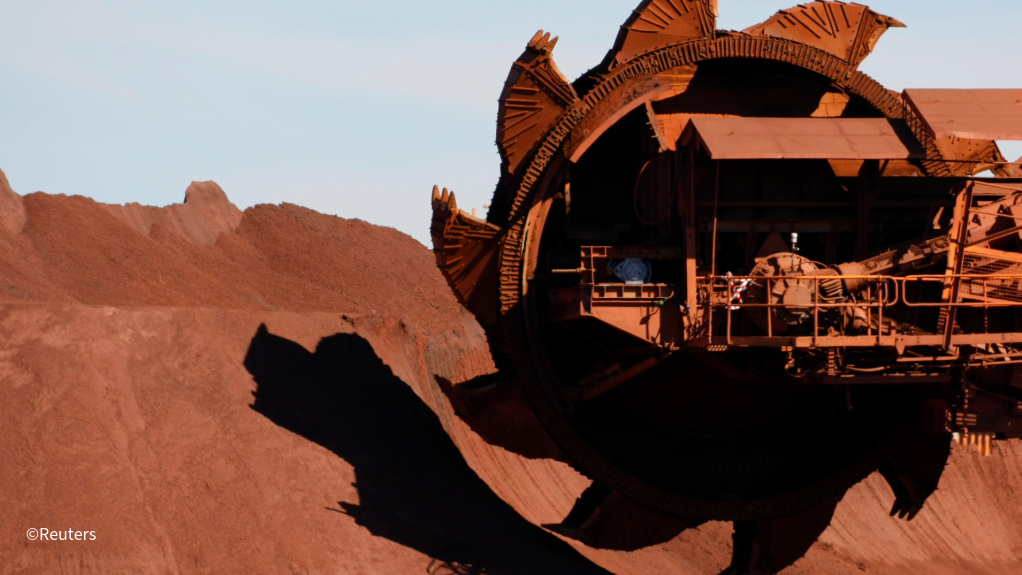

Champion Iron has evaluated the construction of mining and processing facilities to produce direct reduction- (DR-) grade pellet feed iron-ore from the mining properties of the Kami mine.

The prefeasibility study, completed in March 2024, details an operation with a 25-year life-of-mine (LoM), with average DR quality iron-ore concentrate production of about 8.6-million tonnes a year at more than 67.5% iron.

The project is planned as a conventional openpit mine, combined with an in-pit crushing system (IPCS) for waste rock. Mining operations will use drills and haul trucks, together with hydraulic shovels, and a semimobile waste IPCS, with the ore crusher located at the pit exit on the east side.

The project contains the Rose pit, which is to be divided into three phases. The peak mining rate is expected to be 81-million tonnes a year over the LoM.

A total of 643-million tonnes of ore will be mined at an average total iron-ore grade of 29.2%, with a total of 1.02-billion tonnes of combined waste and overburden, resulting in a stripping ratio of 1.6 t of waste per tonne of ore mined.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

A pretax net present value, at an 8% discount rate, of $1.48-billion and an internal rate of return of 12.1%, with a payback of seven years, have been estimated for the project.

Capital Expenditure

$3.86-billion.

Planned Start/End Date

The project is expected to take 48 months to complete, following a final investment decision.

Latest Developments

Champion Iron has reported that Japanese steelmaker Nippon Steel and trading house Sojitz will buy a 49% stake in the Kami project for A$245-million ($152-million).

Nippon and Sojitz will hold a 30% and 19% stake in the iron-ore project respectively, and share development and construction costs based on their share in the mine, according to a statement by Champion.

Kami is also expected to receive as much as A$490-million ($305-million) through future contributions from Nippon and Sojitz.

Nippon wants to optimise its supply chain from Kami. Nippon Steel, which has a global production capacity of 65-million tons a year, wants to raise that to 100-million tons a year in the long term.

It is trying to secure US approval for its acquisition of US Steel, a key part of that strategy, and has also been looking to buy stakes in coking coal and iron-ore mines to ensure a stable supply of essential raw materials.

Direct reduced iron, along with high-quality scrap, are necessary for the production of high-grade steel from large electric arc furnaces, which Nippon Steel aims to build to reduce carbon emissions.

Nippon will invest C$150-million ($104-million) for its stake in Kami while incurring about C$1.16-billion in development costs by the project's completion, the company has said. The costs will be subject to investor approval of the project's development and the results of a future feasibility study, expected be completed in mid-2026.

Construction will take about four years once the final investment decision has been made.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Champion Iron, tel +1514316 4858 or email info@championironmines.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation