Kobada gold project, Mali – update

Photo by Toubani Resources

Name of the Project

Kobada gold project.

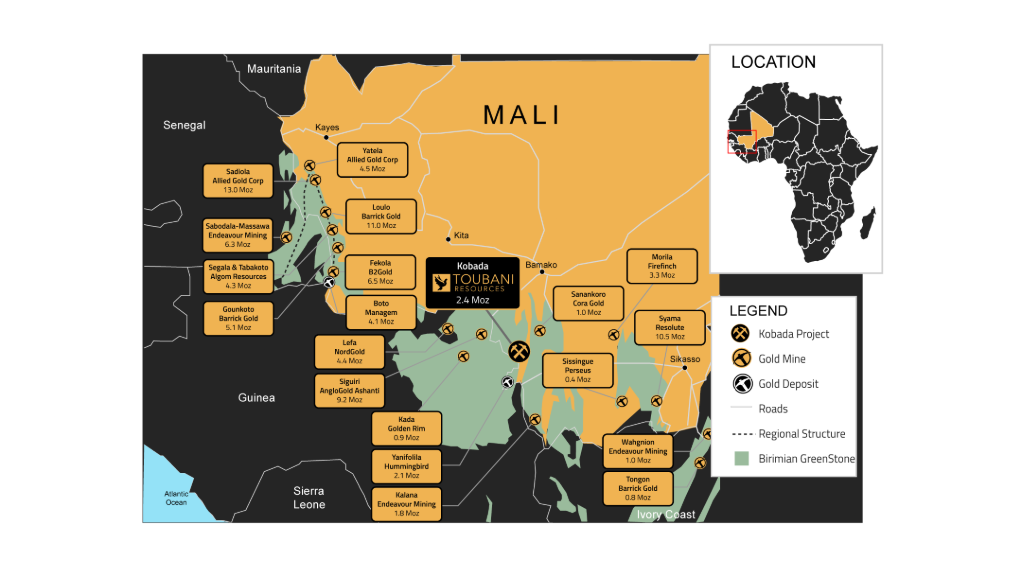

Location

Southern Mali.

Project Owner/s

Africa-focused gold developer Toubani Resources.

Project Description

A definitive feasibility study (DFS) completed in October 2024 has confirmed Kobada as a significant gold development asset underpinned by its large-scale, free-dig and open-pittable oxide resource.

The ore reserve estimate is 53.8-million tonnes at 0.90 g/t for 1.56-million ounces of gold.

The DFS proposes average production of 162 000 oz/y over the current 9.2-year life-of-mine for total gold production of 1.49-million ounces of gold.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $870-million and an internal rate of return of 72%, with a payback of 1.25 years.

Capital Expenditure

The October 2024 DFS estimates total initial development capital of $216-million.

Planned Start/End Date

First gold production is targeted for the third quarter of 2027.

Latest Developments

Toubani Resources announced a "company-defining" A$395-million funding package on October 10 to fully finance the construction of its flagship Kobada project.

The package comprises a $160-million (A$242-million) gold stream agreement with major shareholder Eagle Eye Asset Holdings (EEA), an additional A$26-million through the accelerated exercise of existing EEA options, and a A$125-million multitranche equity placement to institutional, sophisticated and professional investors at A$0.40 a share.

Toubani retains flexibility to draw down all, part or none of the facility, depending on progress with an alternative senior debt process under way.

The A$125-million placement will be completed in three tranches, including A$45-million from EEA (subject to Foreign Investment Review Board and shareholder approval). The placement price represents a 5.9% discount to Toubani’s last traded price of A$0.425.

EEA will exercise 78-million existing options at A$0.336, adding A$26-million in funds and increasing its shareholding to about 35%.

Funds will be used to cover Kobada’s $216-million development capital requirements, including $60-million for plant construction, $21-million in owner’s project costs and community initiatives, and $43-million for non-process infrastructure such as the tailings storage facility and roads. Additional allocations include $13-million for exploration and growth, $45-million for corporate and working capital, and $3-million for transaction costs.

The funding enables Toubani to progress towards a final investment decision in 2025, with early commitments for long-lead items expected in the near term. The funding follows the positive results the DFS.

MD Phil Russo has said the transaction has positioned Toubani to become the next significant gold producer in West Africa.

EEA will provide $160-million in exchange for 11.1% of gold production at a price equal to 20% of the prevailing spot gold price. Toubani retains flexibility to draw down all, part or none of the facility, depending on progress with an alternative senior debt process under way.

The A$125-million placement will be completed in three tranches, including A$45-million from EEA (subject to Foreign Investment Review Board and shareholder approval). The placement price represents a 5.9% discount to Toubani’s last traded price of A$0.425.

EEA will exercise 78-million existing options at A$0.336, adding A$26-million in funds and increasing its shareholding to about 35%.

Funds will be used to cover Kobada’s $216-million development capital requirements, including $60-million for plant construction, $21-million in owner’s project costs and community initiatives, and $43-million for non-process infrastructure such as the tailings storage facility and roads. Additional allocations include $13-million for exploration and growth, $45-million for corporate and working capital, and $3-million for transaction costs.

Key Contracts, Suppliers and Consultants

Minxcon Group South Africa (mineral resource estimate); DRA Americas (mining and mineral reserves); Maelgwyn Mineral Services (metallurgical testwork); ABS-Africa (environmental and social studies); Epoch Resources (tailings storage facility); SENET (processing plant and infrastructure, including economic valuation and report compilation); Knight Piésold (DFS – tailings dam design and costing); Global Commodity Solutions (DFS – geology and exploration); Entech (DFS – mineral resources); Oreology (DFS – pit optimisations, mine design and mine scheduling); Minero Consulting (DFS – mining operating and capital cost estimation, and ore reserves); Lycopodium (DFS – metallurgical testwork review, process plant design, process plant operating and capital cost estimation); ABS Africa (DFS – environmental and social impact); Anandarasa Advisory (DFS – financial modelling); and Cantilever Future Solutions (DFS – study management and environmental, social and governance oversight); and Endeavour Financial (financial adviser).

Contact Details for Project Information

Toubani Resources, email info@africangoldgroup.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation