Kurmuk gold project, Ethiopia – update

Photo by Allied Gold

Name of the Project

Kurmuk gold project.

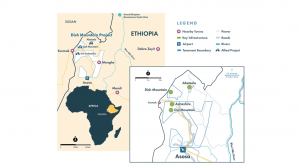

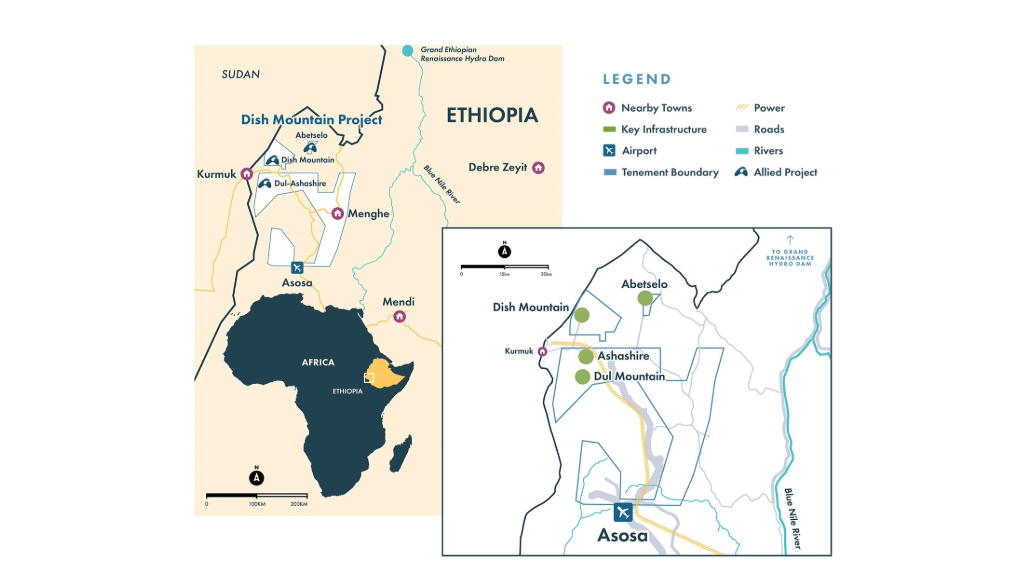

Location

Benishangul Gumuz region of western Ethiopia.

Project Owner/s

International gold miner Allied Gold.

Project Description

Kurmuk has been designed as a two-phase project.

The Kurmuk development plan proposes the upgrading of the processing plant’s capacity from 4.4-million tonnes a year to 5.4-million to 5.7-million tonnes a year. This expansion uses major equipment already owned by the company.

The expanded project aims to achieve average gold production of nearly 275 000 oz/y for the first four years and an average of over 240 000 oz/y over a ten-year mine life, based solely on mineral reserves. This compares favourably with the original project, which would have averaged gold production of 200 000 oz/y with similar capital costs.

Mining is planned as conventional shovel-truck openpit operations at Dish Mountain and Ashashire. Processing is designed as a conventional carbon-in-leach circuit and recoveries are expected to average 92% over the life-of-mine (LoM).

Power is planned to be supplied by the Ethiopian grid, and Allied has secured a ten-year power purchase agreement, with an average cost of 4 cents per kWh, aligned with the objective to deliver significant production at industry-leading costs.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

Not stated.

Capital Expenditure

Total capital is estimated at $500-million.

Planned Start/End Date

First gold is expected in the second quarter of 2026.

Latest Developments

Canadian multinational Wheaton Precious Metals’ (WPM's) wholly owned subsidiary Wheaton Precious Metals International (WPMI) has entered into a definitive precious metals purchase agreement with Allied Gold and its wholly owned subsidiary Allied Gold Services.

WPMI will pay Allied a total upfront cash consideration of $175-million in four equal installments during project construction, subject to certain customary conditions.

WPMI will buy 6.7% of the payable gold until 220 000 oz of gold has been delivered; WPMI will then buy 4.8% of the payable gold for the remainder of the project’s LoM.

During any period in which debt exceeding $150-million ranks ahead of the gold stream, the stream percentage increases to 7.15% and decreases to 5.25% once the dropdown threshold is reached.

Payable gold is calculated using a fixed payable factor of 99.95%.

Attributable gold stream production is forecast to average over 16 000 oz/y of gold for the first ten years of production.

WPMI will make ongoing payments for the gold ounces delivered, equal to 15% of the spot price of gold.

WPMI has obtained a right of first refusal on any future precious metal streams, royalties, prepays or similar transactions relative to the Kurmuk project.

In the event of a change of control prior to the earlier of completion and January 1, 2027, Allied will have an option to buy back one-third of the stream.

The gold stream will cover the existing mining licence for the Kurmuk project and until 255 000 oz of payable gold are delivered to WPMI.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Allied Gold, email IR@alliedgold.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation