Lithium drives IGO to record heights

PERTH (miningweekly.com) – Critical minerals miner IGO has posted a record financial performance for the year ended June, driven by record earnings from its lithium joint venture (JV).

IGO’s revenues in the full year increased by 13% to A$1.02-billion, with net profits after tax up 66% to A$549-million and underlying earnings before interest, taxes, depreciation and amortisation (Ebitda) up by 177% to A$1.98-billion.

The results for the year included an impairment charge of A$968-million against the Forrestania and Cosmos assets, which were acquired as part of the acquisition of Western Areas in June of last year.

IGO told shareholders on Thursday that the company’s investment in the Tianqi Lithium Energy Australia (TLEA) JV had delivered record earnings, with the company’s share of net profits reaching A$1.6-billion, up from the A$177-million last financial year.

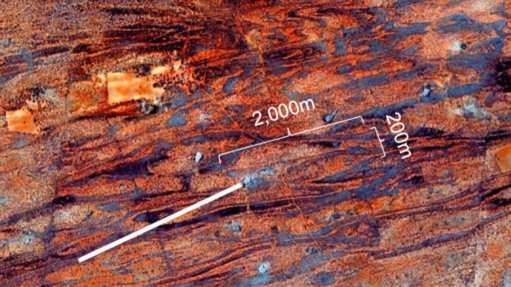

The Greenbushes operation, in which IGO holds a 24.99% indirect interest, recorded sales revenue of A$10.5-billion and Ebitda of $9.5-billion, on a 100% basis. Greenbushes’ full-year spodumene production was 1.4-million tonnes with unit cost of goods sold before royalties of A$279/t.

“FY23 was a year marked by both significant achievements as well as some notable challenges. Throughout, our people have shown outstanding resilience, determination and care, and importantly, have stayed true to our core values,” said acting CEO Matt Dusci.

“The sudden loss of our MD and CEO, Peter Bradford, in October 2022, was devastating to all who knew him, and his passing is a huge loss to his family, his colleagues and our industry more broadly. At IGO, he has left an indelible legacy that transformed our business into a globally significant clean energy metals business and shaped our unique culture, which is defined by innovation, care, fun and ultimately, making a difference.

“The delivery of record financial performance during FY23 has clearly demonstrated the transformation of IGO and our success in pursuing a strategy of being aligned to clean energy metals. In FY23, we have generated the strongest set of financial results in IGO’s 21-year history, with record revenue, Ebitda and net profit. This has enabled the declaration of a final dividend of 44c plus a 16c special dividend for FY23, bringing total dividends for FY23 to a record 74c per share, equivalent to A$560-million in dividend payments.

“Within our lithium business, excellent production and cost performance at the Greenbushes lithium mine, combined with exceptional realised pricing, drove record earnings and cash dividends of over A$1-billion to IGO, via our lithium JV. Meanwhile, performance at the Kwinana lithium hydroxide refinery is expected to improve over FY24 as progressive rectifications are made to improve operational performance,” said Dusci.

“Our nickel business also delivered with our operating assets, Nova and Forrestania, generating aggregate free cash flow of A$587-million for the year at an Ebitda margin of 56%. “Within today’s result, we have recorded a A$968-million non-cash impairment against the assets acquired from Western Areas. This impairment is disappointing, however, IGO remains committed to optimising value from the Western Areas assets as we work to grow our nickel business.

“At Cosmos, solid progress was made on project development over the year, including completion of several key work packages. Despite this progress, the project has been impacted by higher capital and operating costs, challenges to the mine production schedule and development delays. A review commenced in recent months, with the outcomes expected to be available during the December 2023 quarter.

“We are clear on what we need to do to continue to create shareholder value in FY24, including the execution of the continued expansion at Greenbushes, the ramp-up of lithium hydroxide production from Train 1 at Kwinana and demonstrating value at the Cosmos project. This will be coupled with safe and reliable delivery of production and costs within guidance at Greenbushes, Nova and Forrestania.”

For 2024, IGO is targeting nickel production of 29 000 t to 32 500 t, copper production of between 8 500 t and 10 000 t and cobalt production of between 700 t and 800 t. Furthermore, spodumene production is targeted at between 1.4-million and 1.5-million tonnes, while no guidance has been provided for lithium hydroxide production.

IGO is targeting a spend of between A$885-million and A$995-million in development, sustaining and improvement capital at its lithium business in 2024, and a further A$30-million to A$40-million at its nickel business.

A further A$65-million to A$75-million will be spent on exploration, excluding across the lithium assets.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation