Miner investing in operational improvements

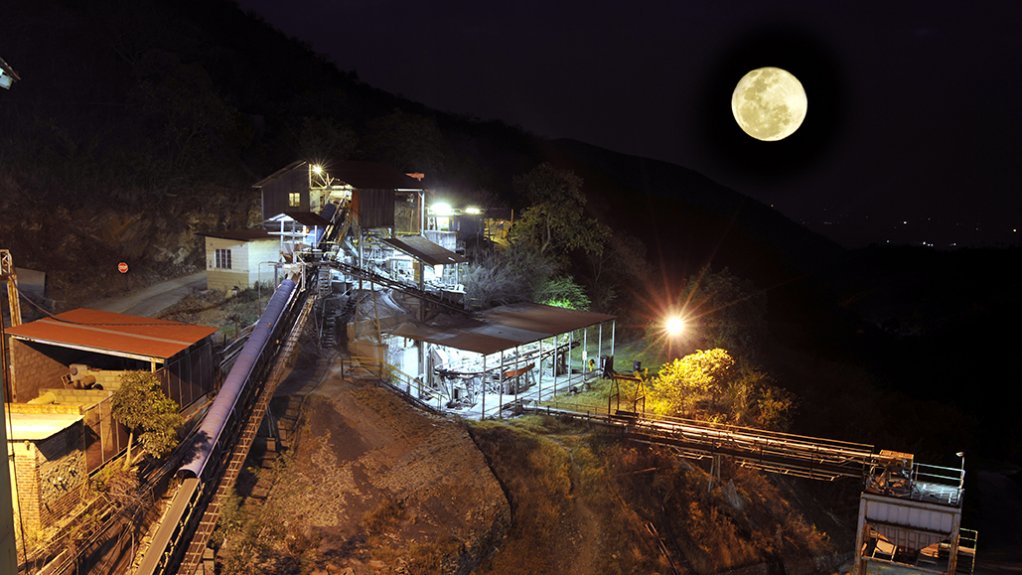

COBUS LOOTS Pan African is leveraging the existing underground and surface infrastructure at Evander to access new areas of the underground orebodies

MITIGATING COST INCREASES The company’s 10 MW solar photovoltaic plant will be commissioned at the Elikhulu operation in Evander towards the end of this year

ONGOING INFRASTRUCTURE IMPROVEMENTS Continually investing in its assets and seeking ways to improve operations are key focus areas for Pan African Resources

Gold miner Pan African Resources is continuing to invest in its assets locally and improve its operations, including its Barberton Mines Complex, in Mpumalanga; its Evander mine, in Gauteng; and its acquired Mintails’ gold tailings deposit, states Pan African Resources CEO Cobus Loots.

Production guidance for the 2021 financial year increased to 195 000 oz for the year ending June 30, which exceeds the previous guidance of 190 000 oz.

“At Barberton, we have developed additional mining platforms over time, and we now have production from four platforms at the Fairview operation. With exploration initiatives, we have also managed to expand the footprint of these mining platforms in the Main Reef Complex orebody.”

He emphasises that this approach allows for greater flexibility during production planning, while ongoing infrastructure improvements contribute to reducing production bottlenecks.

Evander

Production from Evander’s 8 Shaft pillar has improved in the second half of the 2021 financial year, with an average production of 3 400 oz a month for the past three months.

The pillar has a remaining life-of-mine (LoM) of more than two years and is expected to produce 80 000 oz of gold over this period.

Loots states that the difficulties of installing underground support pseudo-packs, which the company reported earlier this year, have been resolved, and the fracturing of the shaft lining has been repaired.

This installation, and no issues having been encountered since, have contributed to the company’s increased and consistent production, he adds.

“While we expect a reduction in unit costs, as underground mining has a high fixed-cost component, increased production will reduce these costs. Monthly production should remain constant over the pillar’s remaining LoM.”

As part of Pan African’s evaluation of the merits of its growth opportunities and capital expenditure priorities, the group has completed a Phase 1 study into the gold resources at the 24 level of Evander’s underground operations, with 100 000 oz recoverable, and accessible through the 8 Shaft’s number 2 decline.

This has been completed and the mine is expected to maintain production levels once the 8 Shaft pillar mining is completed in two-and-a-half years.

It is expected that the 24 Level project will produce 34 000 oz/y for an additional

two-and-a-half years, following which production from the company’s Egoli gold project could ramp up on the company’s yearly production profile.

“One of the key aspects of the study was the implementation of mitigating initiatives to alleviate the challenges encountered when previously mining these shafts. Improvements focused on addressing high temperatures while working, ore and waste separation, increased face time, as well as improvements to ore- handling infrastructure.”

A Phase 2 study also forms part of Pan African’s medium-term capital deployment strategy and will begin as the necessary improvements from Phase 1 are being implemented. Phase 2 will use a proven on-reef mining layout to minimise waste and focus on aspects that will reduce the time needed for orebody access development.

Mintails

Pan African has acquired the Mintails tailings facilities – one of the remaining gold tailings assets in South Africa – where the company is engaged in feasibility work.

It has “overhauled” its capital expenditure (capex) plans following results from a study into the Mintails’ tailings deposit, situated west of Johannesburg.

The project could produce about 533 000 oz of gold over 12 years at an all-in sustaining cost of about $800/oz (R11 167/oz).

“An independent fatal flaw analysis was commissioned to determine whether further capital was justified to progress to the prefeasibility study. This analysis was positive and followed up by a concept study, which included a financial evaluation.”

He states that capex for Mintails will depend on the positive results of the definitive feasibility study, expected to be completed in the first calendar quarter of 2022.

Options that would be considered would include debt funding or a “green bond”. The latter is a viable option, owing to environmental improvements following the removal and redeposition of the tailings, as well as the removal of contaminants in the water bodies.

This will result in environmental benefits for the surrounding communities and the increased availability of land for development.

The study indicates an optimal plant tailings throughput feed of about 800 000 t/m , with expected recoveries of 53%.

“The upfront capital required is estimated at R1-billion, and R1.7-billion capital over the LoM will be confirmed in the next stage of the project planning. The project has the potential to produce about 533 000 oz of gold over a 12-year LoM at an all-in sustaining cost of $800/oz.”

The company is aiming to safely maintain its yearly gold production profile of 195 000 oz at an all-in sustaining cost of between $1 000/oz and $1 200 /oz while providing returns for shareholders in dividends.

“With Egoli and Mintails potentially coming on stream, gold production could increase to over 250 000 oz/y. Our experienced management team is also evaluating growth opportunities outside South Africa, which would make the company truly pan African with its future asset base,” he concludes.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation