Mineral Resources sees worst day in 16 yrs on production woes, higher costs

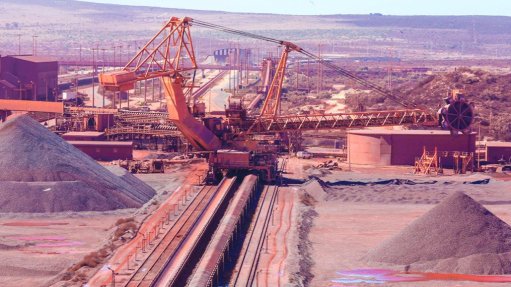

Shares of Mineral Resources (MinRes) plunged to their worst day in 16 years on Wednesday after the Australian miner cut its fiscal 2025 production volumes and raised costs for its Onslow iron project in Pilbara due to weather disruptions.

The company's shares fell as much as 22.1% to A$23.75, the lowest since late July 2020, and logged their biggest single-day decline since October 10, 2008. The stock was the top loser on the benchmark ASX 200 index, which was down 0.7%.

The miner trimmed its forecast for iron ore volumes to 8.8 to 9.3 metric tons (Mt) for financial year 2025 from 10.5- to 11.7 Mt estimated previously. It also hiked its free-on-board costs, or the charges incurred to transport iron-ore, to $60/ton-$70/ton from $58/t-$68/t.

"The cyclone (Sean) dropped an extraordinary amount of rain on parts of the Pilbara and the deluge was exacerbated days later by a low-pressure system that dumped more heavy rain inland. These weather events caused significant flooding that damaged parts of the Onslow Iron haul road," founder and managing director Chris Ellison said.

Record rainfall on Western Australia's Pilbara coastline as well as a slew of tropical cyclones have affected shipments for iron ore miners including Rio Tinto.

Late on Tuesday, MinRes reported a 55% drop in its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) to A$302-million ($192.13-million), but still beat an estimate of A$205-million provided by Visible Alpha.

Analysts at Jefferies estimate the company's capital expenditure for fiscal year 2025 at A$2.1-billion, an increase of about A$340-million from their previous expectations.

"The medium-term downside risk presented from (MinRes's) elevated debt in an environment of falling iron ore, soft lithium, higher capex and lower lithium production prevents us from turning more constructive."

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation