M&R retreats into a loss amid R622m Covid-19 hit

Engineering and construction group Murray & Roberts (M&R) estimates that the Covid-19 pandemic had a R622-million negative impact on its results for the 2020 financial year, during which the company retreated into a lossmaking position.

The JSE-listed group reported a loss before interest and tax of R17-million for the year to June 30, 2020, representing a sharp deterioration from the R847-million profit reported in the prior year.

M&R’s attributable loss was R352-million, down from a profit of R337-million in 2019, while its diluted continuing headline loss was 88c a share, compared with the 114c-a-share profit recorded in the previous financial year.

Revenue from continuing operations increased marginally to R20.8-billion, from R20.1-billion in 2019.

The M&R board decided not to declare a dividend, in order to preserve the group’s financial position amid ongoing pandemic-related uncertainty.

Besides the Covid-19 impact, the results were also negatively affected by several impairments, including an R80-million vendor-loan impairment relating to the sale of Genrec, now in business rescue, a R63-million goodwill impairment for two group companies and a R46-million impairment of uncertified revenue.

CEO Henry Laas said the combination of the pandemic, the impairments and disappointing execution on a few projects “created a perfect storm for the group”.

Expectations for economic recovery after Covid-19 were uncertain and revised frequently, he added in a statement released on Wednesday.

“However, the relevance of natural resources – of commodities, utilities, energy and infrastructure – to a post-pandemic world, and the group’s exposure to these markets, support our view of strong growth in group earnings, especially after the 2021 financial year.”

The value of M&R’s order book rose to R54.2-billion from R46.8-billion and ongoing order-book growth was listed as a priority for the 2021 financial year.

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

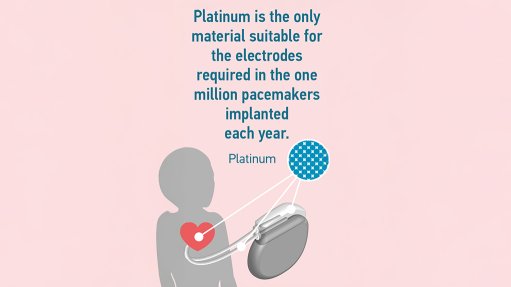

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation