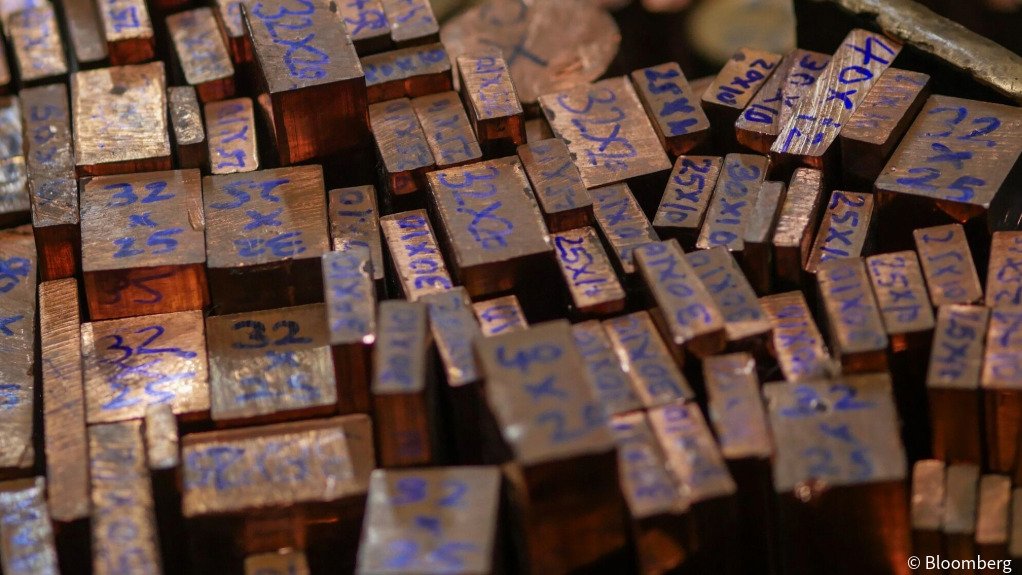

Yellowhead copper project, Canada

Photo by ©Bloomberg

Name of the Project

Yellowhead copper project.

Location

Thompson-Nicola area of British Columbia, Canada.

Project Owner/s

Taseko Mines Limited, through its wholly owned subsidiary Yellowhead Mining Inc. (YMI), is the 100% owner of the project.

Project Description

The openpit mine development aims to produce copper concentrate with payable gold and silver credits.

A technical report update, published in July 2025, has revised the project’s economics to incorporate updated metal prices, and revised capital and operating costs.

Gold recovery projections have also been updated, and a new transmission line design is included. The technical report has suggested the development of an openpit mine using conventional truck-and-shovel mining techniques, supplying the concentrator with 90 000 t/d of ore over a 25-year life-of-mine (LoM). Total LoM production is estimated at 4.4-billion pounds of copper, 282 000 oz of gold and 19.4-million ounces of silver.

The sulphide concentrator will include three stages of comminution, followed by three stages of flotation and a final concentrate dewatering stage. The final concentrate will be trucked off-site to a nearby rail load-out facility for subsequent transport to the Port of Vancouver or direct rail to other North American markets.

The mineral resource estimate as of June 1, 2025, includes a measured and indicated mineral resource of 1.3-billion tonnes grading 0.25% copper, 0.028 g/t gold and 1.2 g/t silver at a 0.15% copper cutoff grade. An additional 111-million tonnes averaging 0.24% copper is classified as inferred. The proven and probable mineral reserve is estimated at 817-million tonnes grading 0.28% copper, 0.030 g/t gold and 1.3 g/t silver at a 0.17% copper cutoff grade.

Potential Job Creation

The technical report projects that the project will support about 590 direct jobs and about 1 120 indirect and induced jobs in the area.

Net Present Value/Internal Rate of Return

The pretax net present value (NPV), at an 8% discount rate, is estimated at $2.8-billion, with an internal rate of return (IRR) of 22%. Pretax payback is estimated 3.7 years.

Capital Expenditure

C$1.99-billion. This includes C$295-million for mine and support infrastructure, C$623-million for concentrator and support infrastructure, C$213-million for tailings and water management infrastructure, C$143-million for on-site ancillary infrastructure and C$153-million for offsite infrastructure.

Planned Start/End Date

Not stated.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

Cohesion Consulting Group (drillhole database audit); SGS Canada Inc (metallurgical testing); G&T Metallurgical Services (2011/2012 programme); FLSmidth Laboratories (comminution testing); and Knight Piésold (site investigation/geotechnical studies).

Contact Details for Project Information

Taseko Mines, tel +1 778 373 4533 or email investor@tasekomines.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation