Northam warns of full-year profit slump, despite strong operational performance

Platinum group metals (PGM) miner Northam Platinum says it expects to report a year-on-year decrease of between 76.6% and 86.6% in headline earnings per share (HEPS) to between R3.24 and R5.66 for the financial year ended June 30.

That compares with the HEPS of R24.15 reported for the 2023 financial year and comes on the back of lower revenues and higher cost of sales.

Sales revenue decreased by 22.2% year-on-year to R30.8-billion, as a result of a 35.5% decrease in the rand basket price of platinum, palladium, rhodium and gold (4E) to R24 178/oz. This was despite a 7.3% year-on-year increase in 4E sales volumes.

This resulted in a gross profit of R4.8-billion, compared with R15.4-billion in the 2023 financial year, and a gross profit margin of 15.7%, compared with 39.1% the year before.

Northam expects to report earnings before interest, taxes, depreciation and amortisation of R6.3-billion for the financial year under review, compared with Ebitda of R16.5-billion reported for the 2023 financial year.

The miner states that, during the 2024 financial year, further progress was made towards the group's strategic goal of growing safe and sustainable production down the sector cost curve.

"Challenges remain, particularly in respect of metal prices, mining inflation and the potential for Eskom load curtailment events. Our capital growth programmes remain on track, despite temporary pauses to specific project modules that were delayed without these having a detrimental impact on the overall programme.

"The impact of our ongoing production growth on operational resilience continues to demonstrate the long-term contribution of our counter-cyclical investments made over the past decade in pursuit of establishing a very competitive and sustainable production base, which is able to withstand potential medium- to long-term cyclical downturns. Key features of the year have been the consistently strong production and safety performances delivered by all operations," Northam points out in a trading statement ahead of the publication of its financial results on August 30.

The company achieved a 10.3% year-on-year increase in equivalent refined metal from own operations to 892 876 oz of 4E.

Northam's operations generated cash of R3.5-billion, before cash capital expenditure (capex) of R4.7-billion, impacted by negative working capital movements amounting to R2.4-billion relating to a build-up of inventory to the value of R1.2-billion and the settlement of trade and other payables of R1-billion, which included the payout of profit share schemes across the group.

In addition, the group paid R2.7-billion in dividends and settled Domestic Medium-Term Notes to the value of R4.3-billion.

At year-end, the cash balance amounted to R7.5-billion.

The sale of Northam's noncore investment in Impala Platinum shares contributed to a reduction in net debt to R3.1-billion, from R9.4-billion at the end of the 2023 financial year.

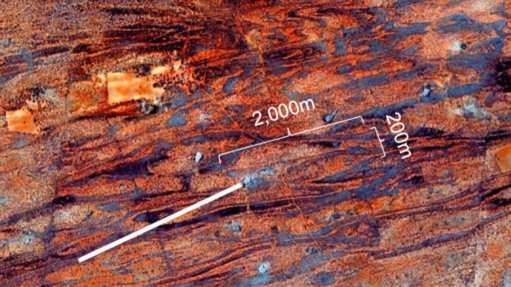

Northam's capex of R4.6-billion related to significant activity on the Western extension project at Zondereinde, together with the ongoing ramp-up at Eland. Further development activity at both sites is planned over the coming 18 months.

The company says a raft of global geopolitical and macroeconomic issues has the potential to cause further disruption to the PGM markets and metal prices, while the possibility of further Eskom load curtailment events could lead to additional operational disruption and challenges.

"We continue to monitor the market and have recently commissioned additional on-demand self-generation capacity at all our operations," it says.

It adds that the current price environment may last for some time and this, combined with higher general inflation, is placing pressure on the entire PGM sector.

"Relative positioning on the industry cost curve, and the ability to retain operational flexibility and balance sheet strength, are becoming increasingly important. In light of the prevailing PGM market uncertainty, Northam remains internally focussed and places full emphasis on operational excellence, particularly surrounding safe, sustainable production and efficient mining at the right cost.

"Cash generation and preservation will remain particular focus areas for the group in the coming financial year," the company says.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation