Panel unpacks key considerations for increased energy security

To watch a recording of the webinar, CLICK HERE

With the private sector’s combined 9 GW of solar, wind, gas and battery storage projects in the pipeline, persistent loadshedding and an electricity tariff increase of 18.65% from April 1, it is more important than ever that entities such as Eskom, the Independent Power Producer (IPP) Office and government work to enable self-generation and IPP projects for increased energy security in South Africa.

Eskom has listed its biggest priorities for the next two years as solving the systemic issues that have been plaguing the entity over many years, and doing so in a holistic manner.

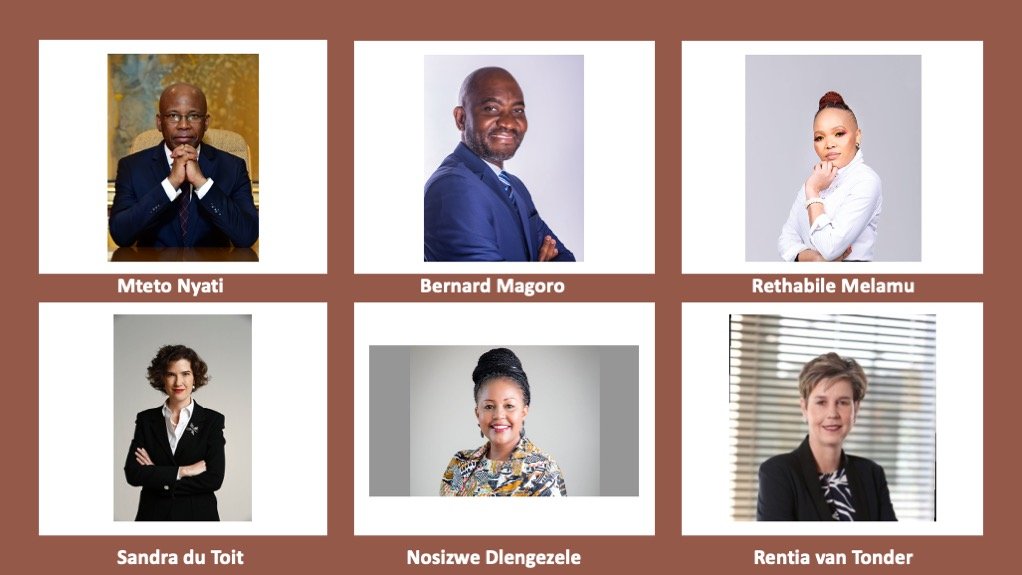

Eskom board member Mteto Nyati says many of Eskom’s problems relate to technical and engineering practices, but there are also human resource and funding challenges, as well as high levels of criminality and corruption.

The entity expects to expand its transmission capacity and improve grid stability within the next two years, by prioritising quality maintenance, upgrading an initial six power stations and contracting independent engineering firm WSP Africa to manage some of Eskom’s upgrade and maintenance programmes.

In terms of getting more IPPs connected to the grid, Nyati says he is encouraged by some of the strides government has been making to allow new capacity on to the grid.

Moreover, Nyati says Eskom has acknowledged that net billing frameworks and feed-in tariffs all need to be speedily finalised, among other initiatives. He also confirms that Eskom is in the “final stages” of its unbundling process into three separate entities for generation, transmission and distribution of electricity.

He lists other key issues that the Eskom board is giving attention to as debt, weak internal controls, poor governance, lack of accountability, poor discipline and poor implementation of standard operating procedures, which he vows will see positive progress in coming years.

IPP Office head Bernard Magoro says the IPP Office has also had its fair share of challenges in recent years, particularly as the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) experienced a lull between Bid Window 4, which was launched in 2015, and Bid Window 5, which was launched in 2021.

He explains in a webinar hosted by Creamer Media on January 25, titled South Africa’s Energy Outlook 2023, that the IPP Office has procured 5.6 GW of projects in the last two-and-a-half years, which are in different stages of procurement. Of that 5.6 GW, projects representing just over 1.9 GW have reached legal close, while 570 MW is under construction and will come online before the end of the year.

Magoro says the IPP Office will procure another 14.7 GW of power in the next few years, with a total 27 GW of capacity that has to be procured overall.

This while more bid windows await finalisation and launch, such as a 515 MW battery storage and 3 000 MW gas programmes. Magoro also confirms that Bid Window 7 is at an advanced stage and will be released to the market soon.

Responding to a question asked by moderator EY Africa corporate finance lead Sandra Du Toit on why there have not been more IPP connections to the grid, Magoro acknowledges that there have been grid capacity challenges and problems with risk allocation in IPP agreements.

However, he is confident that the IPP Office, together with Eskom and government, has solved many of the issues.

INDUSTRY VIEWS

South African Photovoltaic Industry Association (SAPVIA) CEO Dr Rethabile Melamu shares that about 2.3 GW of solar capacity has been installed under the REIPPPP and estimates there to be an equal amount of capacity installed at household and industrial operations.

This shows that installations are happening despite government’s policy and Eskom’s grid challenges, she says.

Notably, more than 1 GW of solar installations took place in 2020 alone, not related to REIPPPP. Melamu expects existing solar capacity to double again soon as further projects come online this year.

“We see momentum in that government is putting incentives on the table for renewable energy projects; however, the speed of implementation is concerning. As industry, we are itching to develop new projects, but too often they need more of an enabling environment to be unlocked and realised,” she notes.

Melamu considers the biggest brake on more solar installations to be transmission and distribution capacity on Eskom’s part. She says many parts of South Africa have excellent natural resources for energy generation, but it is often these remote parts of the country that lack transmission infrastructure, such as the Northern Cape.

She has urged Eskom to be more transparent in how projects are allocated for grid connection, which is often a headache for SAPVIA’s members. The association has regular meetings with Eskom and the IPP Office, which contributes to grid planning; however, Melamu says a full assessment of grid availability across the country is needed.

Melamu adds that wheeling frameworks and pricing have also been key issues, with IPPs keen to supply power to the grid.

A viewer of the webinar, Gcobani Mfuku points out in the comments section that the cost of producing solar energy is currently between 87c/kWh and R1.35/kWh on a sliding scale, with larger projects being able to generate electricity for cheaper. However, Eskom buys electricity for 39c/kWh, with particular variance depending on the energy source and province of generation. This makes it unviable for these projects to supply power to the grid at the moment.

Commenting on what investors such as Standard Bank would like to see government do differently, renewable energy, power and infrastructure head Rentia van Tonder calls for a “complete rethink” of the REIPPPP, particularly the format of the upcoming Bid Window 7 and how government goes about procuring energy at specific sites.

Magoro responds by stating that the IPP Office strives for investor confidence and that it shows in what was an oversubscribed Bid Window 6. More than 9 600 MW were tendered in what had been a 4 200 MW tender, therefore “demand is there”.

He says Eskom and government are trying to put the necessary effort into securing the support of local and international investors.

Moreover, Du Toit asks Van Tonder about the contribution that the private sector has made to power generation and their role in the energy crisis at the moment, to which Van Tonder says the private sector has pushed innovation over the past few years, in striving for affordability and reliability of power.

“What we are seeing is that bilateral processes are taking shape, with more and more companies signing power purchase agreements. Simultaneously, clients are sensitive to what they are signing up to. We guide clients on what is possible in terms of decentralised power, with multiple feedstocks and solutions.”

Responding to whether there is an open engagement and a receptive ear on everything the private sector needs to make its contribution to energy security and realise projects, Van Tonder says many clients are frustrated with local government processes and getting the necessary approvals in place. However, she adds that there is great momentum on getting the enabling environment right, but implementation of more solutions remains lacking.

“There is certainly room for improvement. How can we find a model that is doable and implementable?” she asks.

TRANSITION MATTERS

GE regional commercial leader Nosizwe Dlengezele deems it critical that government and Eskom focus more on the transitionary sources of energy the country needs to not only improve power availability and reliability, but to gear up for the clean energy transition.

She states that GE, as an energy equipment provider, has supplied into 65% of Eskom’s capacity. “Not only do we have a moral and technical obligation to ensure we stay close to Eskom as a key partner, but we also help it navigate the rigorous maintenance programmes it is putting in place to get South Africa in an energy secure state.

“As we do this for improved energy security from a business perspective, we also have the moral obligation to decarbonise. To this end, gas is a critical element for an energy mix perspective. How can we integrate gas on our transitionary journey?”

Dlengezele believes there is opportunity to consider the use of gas and gas technology to ensure the country is able to transition affordably and reliably.

There are also other feedstocks that can contribute to lower emissions, such as hydrogen. She lists carbon capture as another promising method of lowering emissions while ensuring energy security amid the transition.

Dlengezele is adamant that South Africa needs a mix of technologies to remedy its energy crisis and effectively transition to a cleaner energy economy. “The integrated combination of gas and renewables brings about flexibility and a decrease in emissions, while still providing society with the industrialisation capacity it needs.

“We have seen what the introduction of gas can do for sub-Saharan African countries and how it tilts the outlook on electricity tariffs and access, as well as industrialisation.”

Touching on Standard Bank’s perspective on the energy mix and the opportunities for waste-to-energy, Van Tonder agrees with Dlengezele that gas has an important role to play in the transition, particularly because it ushers in optionality and flexibility.

“We have embarked on a two-year process to finalise our climate policy and we have made strong commitments already to support gas-to-power and gas technologies. If South Africa is to roll out another 3 GW of renewable energy, gas is certainly critical in this regard.”

She adds that waste-to-energy is also an important technology to pursue. Standard Bank is open to finance any viable technology that mitigates climate change impacts.

Van Tonder does not foresee megascale waste-to-power projects coming on stream, but reiterates that the bank remains open to funding any bankable projects.

Magoro comments that the Integrated Resource Plan does not specify the “smaller” types of technologies such as waste-to-power just yet, but says the Department of Mineral Resources and Energy could consider including those in future.

“For now, there is no mandate to procure biomass or waste-to-energy projects, but the IPP Office will support any initiative that brings smaller generators on board. Our goal is ultimately to drive localisation.”

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation