Perseus sets five-year production guidance at up to 535 000 oz/y

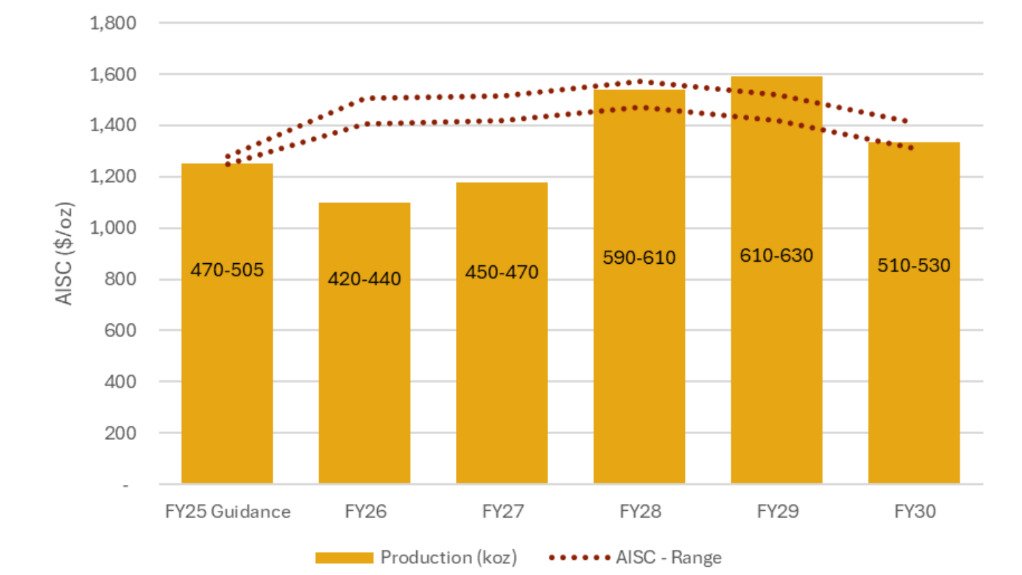

ASX- and TSX-listed gold miner Perseus Mining has set its production guidance for the 2026 to 2030 financial years at between 515 000 oz/y and 535 000 oz/y, for total output of 2.6-million to 2.7-million ounces over the five-year period at an all-in sustaining cost (AISC) of between $1 400/oz and $1 500/oz.

The company's Yaouré mine, in Côte d'Ivoire, is expected to contribute 34% of the output over the five years, while the Edikan mine, in Ghana, will contribute 28% and the Sissingué mine, in Mali, 10%. The Nyanzaga mine, in Tanzania, which Perseus acquired in 2024 and is developing at an estimated cost of $523-million, will provide about 28% of the group's production over the five-year period.

The gold miner states that the five-year outlook delivers on the company's strategy of building a sustainable, geopolitically diversified, Africa-focused gold business of three to four operating mines that produce between 500 000 oz/y and 600 000 oz/y of gold.

Perseus CEO and MD Jeff Quartermaine points out that the company reached production of 500 000 oz/y for the first time in the 2022 financial year, which set its ambition to maintain or exceed that production level on a consistent basis going forward.

"Perseus’s decision in 2023 to defer development of its Meyas Sand gold project, in Sudan, and pivot towards the acquisition and development of the Nyanzaga gold project, will lead to a short-term shortfall in 2026 and 2027 relative to this target. From the five-year outlook published today, it is clear that this is a temporary setback and that Perseus’s strategy of consistently producing between 500 000 oz/y and 600 0000 oz/y of gold at a cash margin of not less than $500/oz, is eminently achievable.

"With cash and undrawn debt capacity currently exceeding $1.1-billion, Perseus is fully funded to not only deliver the five-year outlook as presented today but also consider a prudent mix of future growth opportunities beyond the current plan, as well as generous returns to shareholders,” he comments.

The company says it has strong confidence in its ability to deliver on the five-year outlook, which is underpinned by a mine plan with high geological and technical certainty, with 93% of the production ounces forming part of the existing ore reserves and the remaining 7% from measured or indicated mineral resources.

"Incremental production included in the mine plan at Yaouré, Edikan and Sissingué comes from well-understood deposits with a proven operating history. This production does not require significant additional infrastructure or capital beyond the investment necessary to access the mineralisation," Perseus points out.

The gold miner expects to invest $878-million in development capital at the four operations over the five-year period, with Nyanzaga accounting for the majority of that capital.

Development capital at Yaouré is estimated at $170-million and relates to capitalised underground development. Perseus will also invest about $180-million at Edikan over the five-year period, with the capital relating to capitalised waste stripping costs at the Esuajah North and Fetish deposits and development capital for the Esuajah South Underground deposit.

Development capital at Sissingué is estimated at $5-million.

OPERATIONAL BREAKDOWN

Nyanzaga, which is expected to produce first gold early in 2027, is forecast to be the lowest-cost operation in Perseus’s portfolio.

Over the five-year period to 2030, it will produce between 725 000 oz and 750 000 oz of gold, at a weighted average AISC of between $1 230/oz and $1 330/oz.

Yaouré, meanwhile, will continue to be a cornerstone asset in Perseus’s portfolio, producing between 870 000 oz and 905 000 oz of gold at an average AISC of $1 480/oz to $1 580/oz over the five-year period.

The mine's production for the 2026 financial year will be lower than in previous years in line with expectations as a result of a combination of factors, including a change in ore characteristics and material sources.

Following a final investment on the CMA underground operation at Yaouré, in January, the project is due to cut the first of four underground portals in the first quarter of the 2026 financial year.

"The expansion to include underground operations allows further exploitation of the CMA deposit, which has proven to be a reliable and well understood geological domain of the Yaouré operation to date. At steady state production, it is planned that underground ore will represent approximately 20% of the tonnes of ore mined on the site from both open cut and underground operations," Perseus points out.

At Edikan, production will range between 720 000 oz and 750 000 oz at an AISC of $1 450/oz to $1 550/oz over the five-year outlook period.

The plan combines mining from the existing Nkosuo deposit and the start of a cutback of the Esuajah North pit, along with the second phase of mining at the Fetish pit, following completion of mining of the first phase in April this year.

"Both Fetish and Esuajah North cutbacks have been incorporated into the updated five-year plan, reflecting the opportunity to extend Edikan’s mine life at an incremental AISC. Together, the Fetish and Esuajah North cutbacks attract capitalised waste stripping costs of $168-million but contribute about 200 000 oz of production to Edikan’s mine life.

"In addition to these openpit sources, Perseus is progressing an updated feasibility study for the Esuajah South underground deposit, with a view to bringing this project into production later in the decade. If approved through to development, Esuajah South would become the company’s second underground mine and its first such operation in Ghana," Perseus notes, adding that the combination of Fetish, Esuajah North and Esuajah South Underground has extended Edikan's life-of-mine plan out to the 2032 financial year.

Lastly, Sissingué is expected to produce between 265 000 oz and 275 000 oz of gold at an average AISC of between $1 580/oz and $1 680/oz over the five-year outlook period. Mining will continue at the Stage 4 openpit.

Mining is also due to start at the Bagoé and Airport West areas during the 2026 financial year, while production in the 2027 financial year will also come from the Sissingué Stage 5 openpit cutback.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation