Premier gold project, Canada – update

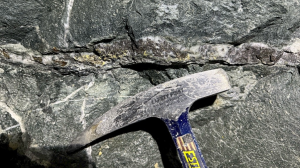

Photo by Ascot Resources

Name of the Project

Premier gold project (PGP).

Location

British Columbia, Canada, adjacent to the border with Alaska, in the US, in the Golden Triangle gold mining district.

Project Owner/s

Canada based gold and silver explorer Ascot Resources.

Project Description

An independent feasibility study has outlined a low-capital restart plan, based on a proven and probable reserve of 6.2-million tonnes grading 5.9 g/t gold and 19.7 g/t gold.

The study is based on four underground mining operations – Silver Coin, Big Missouri, Premier Northern Lights (PNL) and Red Mountain – feeding a centralised 2 500 t/d processing facility at the project. The mining operations will be sequenced over eight years to initially produce 1.1-million ounces of gold and three-million ounces of silver.

Mining will start from the Silver Coin and Big Missouri deposits, which will be followed by the Red Mountain deposit in Year 3, and then the PNL deposit.

In the four planned operations, access for production will be through new and existing adits (side hill portal access) using a combination of new ramp development and the refurbishment of existing underground infrastructure.

Mining methods will largely comprise low-cost longhole stoping for most of the ore, with limited use of inclined undercut longhole, room-and-pillar and cut-and-fill mining methods in specific shallow or flat-lying stopes. Ore will be trucked to the processing facility and mining waste will be used underground as a combination of rockfill and cemented rockfill.

The existing processing facility will be refurbished within a construction period of about 40 weeks. The process plant will use conventional crushing, grinding and gravity circuits, followed by a standard carbon-in-leach process to produce gold doré.

The plant refurbishment will comprise a combination of existing, new and repaired equipment and supporting plant infrastructure. Prior to ore from the Red Mountain project being treated, the plant will add an energy efficient fine grinding mill, as well as an additional preleach thickener, to accommodate the processing of harder-ore feed and the finer grind required for recovery purposes.

The project has an existing tailings storage facility (TSF) and water treatment plant. The independent feasibility study proposes two key enhancements to the existing infrastructure.

The first enhancement entails raising the tailings dam using centreline lifts throughout the mine life, with about 1.2-million cubic metres of nonacid-generating rock excavated from a nearby quarry.

The second enhancement entails modifying the water treatment plant to nearly double its existing capacity to accommodate additional water treatment from the Big Missouri and Silver Coin operations, and will also include an ammonia treatment plant, a water clarifier and a lime high-density sludge system.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The April 2020 feasibility study highlighted an after-tax net present value (NPV), at a 5% discount rate, of C$341-million and an internal rate of return (IRR) of 51% at $1 400/oz gold.

The project has an estimated after-tax NPV, at a 5% discount rate, of $546-million and an IRR of 73% at current gold prices of $1 740/oz gold.

Capital Expenditure

Capital costs, including mining costs, incurred as of December 31, 2023, are C$292-million. The remaining project construction capital required to achieve first gold pour is about C$47-million.

The total project capital cost will, thus, amount to C$339-million, which is slightly higher than the most recent total project budget of C$334-million reported in the third quarter.

Planned Start/End Date

Rock was introduced into the grinding circuit of the mill on March 31, 2024, and the first ore was introduced into the mill on April 5, 2024.

Latest Developments

Ascot Resources has announced a delay in the restart of milling operations at PGP, citing slower-than-expected underground development, owing to a shortage of trained labour.

The company has said that ore processing will now start only in July.

Ascot is finalising a revised schedule and budget to reflect the updated timeline.

The delay will result in a working capital shortfall.

The delay follows Ascot's decision in August 2024 to suspend operations at PGP, citing misalignment between mine development and mill capacity. At the time, development at the Big Missouri mine had fallen up to two months behind schedule, with the ramp-up of the PNL project also delayed. The company estimated that an additional three to six months of development work would be required, primarily at PNL, before full production could resume.

PNL development work resumed in December.

Key Contracts, Suppliers and Consultants

Sacre-Davey Engineering (overall coordination, infrastructure and the economic evaluation in the independent feasibility study); InnovExplo Inc and Mine Paste (mining); Sedgman Canada (metallurgy and processing); Knight Piésold (tailings and water management); SRK Consulting (water treatment plant); Paul Hughes Consulting (site geotechnical); McElhanney (access roads); Prime Engineering (electrical substation); Palmer Environmental Consulting Group (geochemistry, hydrology and water-quality modelling); Falkirk Environmental Consultants and EcoLogic Consultants (environmental studies); Farnell-Thompson Applied Technologies (semiautogenous grinding mill ball mills and related parts); and Procon Mining & Tunnelling (underground mining services).

Contact Details for Project Information

Ascot Resources, tel +1778725 1060 or email info@ascotgold.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation