Sorby Hills lead/silver/zinc project, Australia – update

Photo by Boab Metals

Name of the Project

Sorby Hills lead/silver/zinc project.

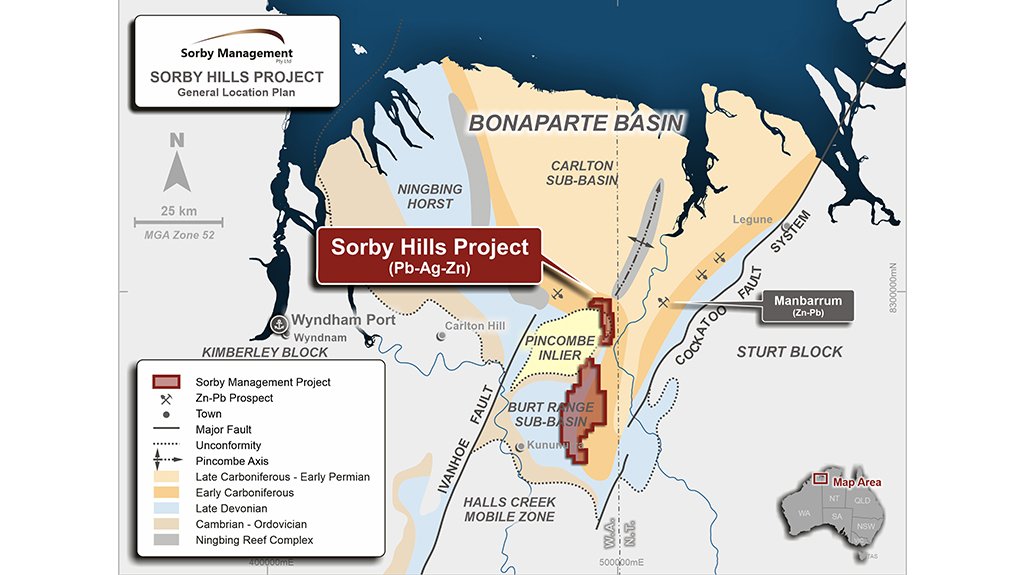

Location

About 50 km from the regional centre of Kununurra, in Western Australia.

Project Owner/s

Base and precious metals exploration and development company Boab Metals exercised its option to acquire 100% of the Sorby Hills silver/lead project in December 2025, taking full control of an openpit mining inventory of 18.3-million million tonnes at an average grade of 3.4% lead and 39 g/t silver.

The acquisition, from joint venture partner Yuguang, involves a completion payment of A$12.5-million, with deferred payments of A$5.5-million and A$5.0-million due 12 and 18 months respectively after the start of concentrate production.

Boab MD Simon Noon has said the deal gives the company full rights to sell the forecast 897 000 t of concentrate, and exposes shareholders to the increasing operating margins supported by a silver price that has more than doubled since Boab’s front-end engineering design study.

The project remains fully funded without requiring additional financing.

The move follows seven years of JV development with Yuguang, which Noon has acknowledged as crucial in bringing the project to a final investment decision. Completion of the acquisition is expected in January 2026, ahead of the planned ramp-up to first production in the second half of 2027.

Project Description

The project is the biggest undeveloped, near-surface lead/silver/zinc deposit in Australia. It comprises mining leases covering six known lead/silver/zinc deposits in the Kimberley region.

The project proposes an operation with a 2.25-million-tonne-a-year-capacity conventional flotation process plant, producing an average of 103 000 t/y of lead/silver concentrate containing 64 000 t of lead and two-million ounces of silver.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of A$411-million and an internal rate of return of 37%.

Capital Expenditure

Preproduction capital expenditure is estimated at A$264-million.

Planned Start/End Date

Boab is targeting the start of production for the second half of 2027.

Latest Developments

None stated.

Key Contracts, Suppliers and Consultants

CSA Global (resource assessment); Entech (mining studies); Strategic Metallurgy, ALS Metallurgy, MicroAnalysis Australia (metallurgical testwork); Primero (process plant); Tetra Tech Coffey (infrastructure and tailings storage); GHD Consulting Engineers (dewatering and water supply); Minerals to Market (product logistics); Animal Plant Mineral (environmental studies); Green Values Australia (approvals); and BurnVoir Corporate Finance (financial analysis).

Contact Details for Project Information

Boab Metals, tel +61 8 6268 0449 or email info@BoabMetals.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation