Southern Africa is now Anglo’s only business region not on renewable energy

Anglo American half-year presentation covered by Mining Weekly's Martin Creamer. Video: Darlene Creamer.

Anglo American products.

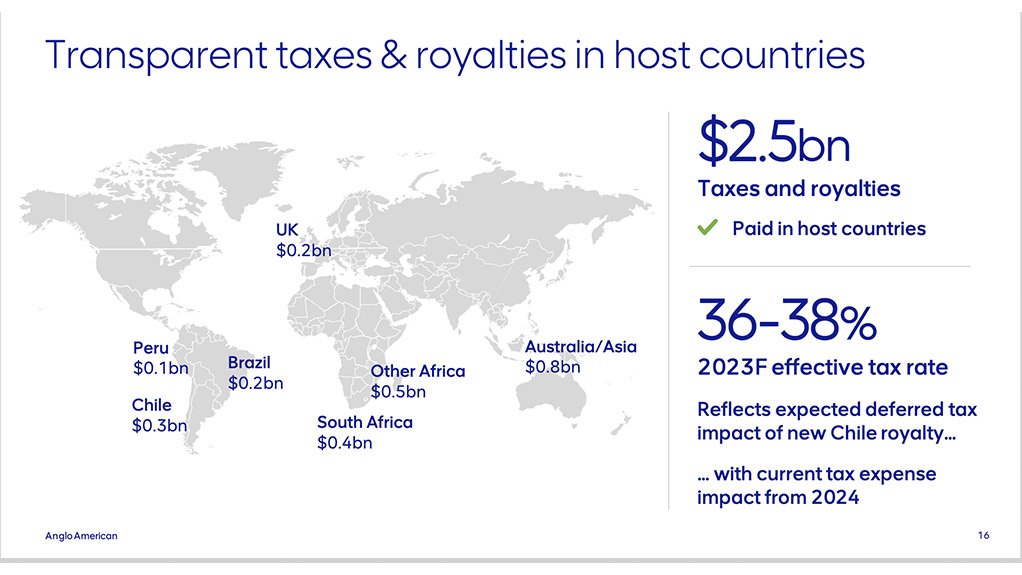

Anglo paid biggest half-year taxes in Southern Africa.

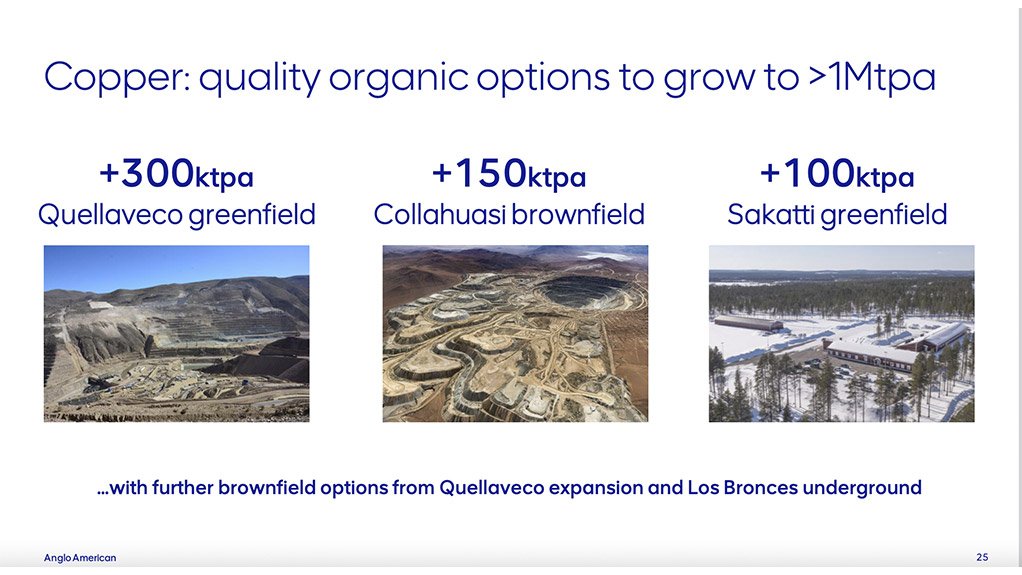

Greenfield copper option at Sakatti in Finland.

JOHANNESBURG (miningweekly.com) – Southern Africa is now the only region in the Anglo American business fold that is not on renewable energy because the company cannot go to a market and acquire that energy in the same way that it has been able to do in many of the other jurisdictions in which it does business, the mining and marketing company reported on Thursday.

“So Southern Africa needs a different solution,” Anglo CE Duncan Wanblad told the half-year results presentation covered by Mining Weekly. (Also watch attached Creamer Media video.)

“You’ve heard me speaking about Envusa quite a lot, which is our joint venture with EDF Renewables, and the purpose of that joint venture is to stand up somewhere between 3 GW and 5 GW of energy in Southern Africa,” said Wanblad after reporting a 49% decrease in half-year earnings to $5.1-billion.

The London- and Johannesburg-listed company has now reached the point in Southern Africa where it is almost ready to financially close on the first of its renewables projects, which involves three sites for solar and wind energy generation in the Northern Cape.

It is also about to commence work on two large solar sites in Sishen, where Anglo’s Kumba Iron Ore is operational, and at the Mogalakwena platinum group metals mine, in Limpopo.

“These projects don’t only remove up to two-million tons of carbon from our operations, but they also have a very meaningful and financially positive benefit to the business, particularly our South African business,” Wanblad revealed.

Notwithstanding that, all the renewables contracts that Anglo has swopped out across the world have all had a very positive net present value benefit to the business so far.

“The team is continuing to work very hard on delivering these projects into Envusa and getting the work done to complete the stability of our energy supply situation, particularly in South Africa, and renew our focus on carbon reduction across the portfolio,” Wanblad said.

“We remain committed to delivering our products to our customers in the most sustainable way that we possibly can,” he added.

Anglo’s copper operation in Peru, Quellaveco, is now 100% on renewable energy and with the steelmaking coal business in Australia converting its energy supply contracts to renewables by 2025, that will put 60% of the whole of Anglo’s portfolio on clean forms of energy, a great step forward given where the company was just a few years ago.

As the only outstanding region in business that is not on renewable energy, Southern Africa also received Anglo's the biggest combined half-year tax and royalty payouts, totalling $9-billion. (Also see attached tax payment diagram.)

During Anglo’s sustainability performance report covered by Engineering News & Mining Weekly last month, getting the first wave of 680 MW of renewable energy ecosystem projects under way in South Africa was cited as a 2023 priority.

It was said at the time that construction of the 130 MW behind-the-meter on-site project at Mogalakwena is expected in the last quarter of this year.

At Sishen, a 70 MW photovoltaic installation is being put in place, with site stabilisation and construction activity predevelopment under way.

MACRO HEADWINDS

Macro headwinds – principally, weaker prices for products and input cost inflation – have weighed on Anglo’s first-half financial performance in the six months to the end of June.

Lower earnings reflect a 19% lower product basket price and a 1% unit cost increase, partially offset by a 10% volume increase compared with the first half of 2022.

Net debt increasing to $8.8-billion reflects the growth investments that Anglo is making through the cycle in line with its belief in the strong long-term fundamentals.

A $0.7-billion half-year dividend of $0.55 a share is in line with the company’s 40% payout policy.

While the nearer term macro picture presents challenges, the longer term demand outlook for future-enabling metals and minerals is seen by Anglo as compelling.

As most major economies accelerate their decarbonisation programmes and as the global population grows by up to two-billion people over the next 25 years, with an associated need for higher living standards, Anglo’s objective is to grow the value of its business into that demand.

Anglo is on track to deliver on its full year production guidance, which includes an anticipated step-up in second-half volumes.

SHAPING BEHAVIOUR

Anglo has made it obligatory for its leaders to spend more time at the work face.

“The whole idea here is that they get to talk to the people actually doing the work, not running the work from an office, not running the work from the board room, but actually properly engaging.

“They get an opportunity to understand what’s working and what’s not working and how we might be able to change things for the better, more deliberately than perhaps we have been able to do in the last little while,” said Wanblad, who reiterated the company’s cycle of ‘plan, do, check and act’.

“If you get the planning right, the rest tends to be a lot better, and that’s never more true than in safety operations. I hate to be standing up here and telling you that we’ve had another fatality in the group, which we had in February of this year at the Kolomela iron-ore operation in South Africa.

"We’re also investigating an aviation incident that occurred in Angola, where the pilot who was doing some work for us on exploration on our De Beers leases, lost his life in a plane accident. We will never stop working on finding a way to eliminate fatalities,” Wanblad affirmed.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation