Steelpoortdrift vanadium project, South Africa – update

Photo by VR8

Name of the Project

Steelpoortdrift vanadium project.

Location

Bushveld Complex, in Limpopo, South Africa.

Project Owner/s

Vanadium Resources Limited (VR8) 86.49% ownership.

Project Description

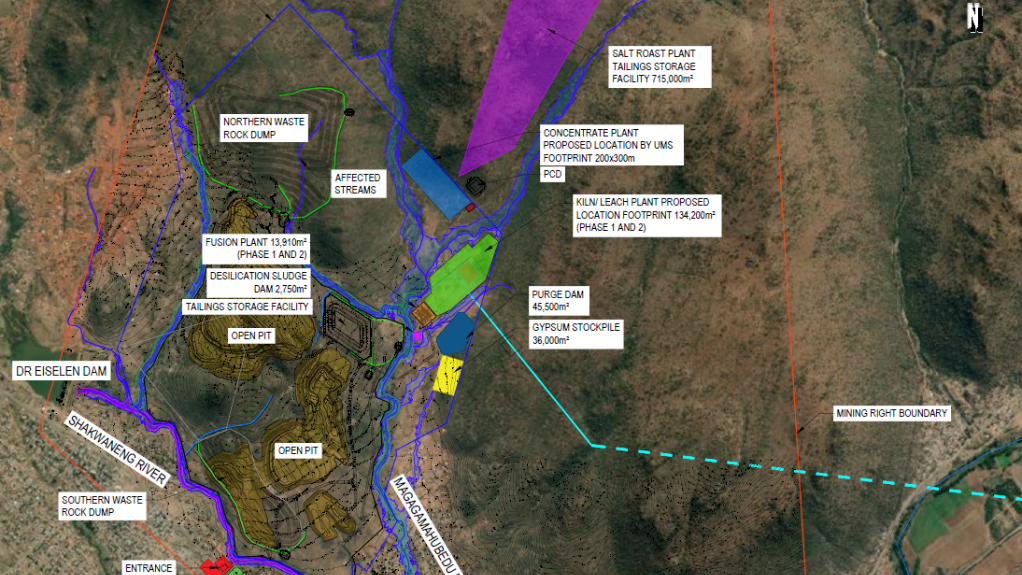

Steelpoortdrift has the potential to be a world-class, large-scale and low-cost vanadium producer with projected bottom-quartile global operating cost and capital expenditure (capex) metrics. Steelpoortdrift comprises the proposed Steelpoortdrift mine, concentrator and salt roast leach (SRL) operation.

The project involves the openpit mining of titaniferous vanadium ore and the treatment of run-of-mine (RoM) ore through an on-site concentrator, as well as the secondary treatment of concentrate through an SRL plant.

Definitive feasibility study (DFS)

A DFS, released in October 2022, concluded that the project could produce 484 000 t of vanadium pentoxide (V2O5) flake over an initial 25-year life-of-mine (LoM), with total concentrate produced estimated at 29.08-million tonnes. Total RoM ore and waste tonnes over the LoM are estimated at 80.32-million tonnes and 70.54-million tonnes respectively, giving the project an attractive strip ratio of 0.88. The total Joint Ore Reserves Committee-compliant resource of Steelpoortdrift is 680-million tonnes at 0.70% V2O5. Consequently, there is potential for the project to support an estimated 180-year mine life at the proposed mining rates.

The DFS illustrated how the project could be built in two phases.

Phase 1 (Years 1 to 4), is based on a mining rate of 1.6-million tonnes a year of vanadium ore at an average in situ grade of 0.83% V2O5. This will be processed through the concentrator and SRL plant to produce about 11 000 t/y of 98% V2O5 flake.

Phase 2 will entail the expansion of the plant and increase the mining rate to 3.5-million tonnes a year of ore at an average grade of 0.71% V2O5, with production almost doubling to about 21 000 t/y of 98% V2O5 flake.

Internal review and project optimisation

In September 2024, VR8 announced substantial technical enhancements to the project layout, concentrator and SRL plant, following an extensive in-house review of its DFS. These changes are expected to optimise the project further.

Notably, VR8 indicated that the concentrator is expected to be completed ahead of the SRL, potentially allowing for the production and sale of a vanadium concentrate product. This development could potentially provide VR8 with an additional revenue stream before the SRL becomes operational.

Net Present Value/Internal Rate of Return

The 2022 DFS estimates an after-tax net present value, at a 7.5% discount rate, of $1.21-billion and an internal rate of return of 42%, with a payback of 27 months.

Capital Expenditure

The 2022 DFS estimates preproduction capex for Phase 1 of the project at $211-million and at $188-million for Phase 2.

Potential Job Creation

Once the project has been funded, the project will create a range of job opportunities through the construction stages and then into production. The opportunities will be open to potential employees – including senior management, skilled technical and semiskilled staff, and unskilled workers – from within South Africa, the local region and the communities directly surrounding the project

Planned Start/End Date

Construction of the concentrator is expected to start during the second half of 2025 and be completed in the second half of 2026, after which production ramp-up for concentrate product will start immediately.

Construction of the SRL plant is expected to start during the first half of 2026 and be completed in the first half of 2028.

Latest Developments

In June 2024, VR8 announced that it had chosen to modify the back end of the SRL processing plant to produce 98% V2O5 for the steel market and 99.5% V2O5 for the vanadium flow battery (VFB) market (compared with the findings of the DFS, which assumed the production of only 98% V2O5).

This modification has been made in response to higher-than-expected demand for higher-purity forms of V2O5 required by the VFB market. The final split between 98% and 99.5% V2O5 produced is yet to be determined and will be driven by finalised offtake agreements. This modification is expected to enhance realised sales pricing by targeting higher-purity forms of V2O5.

VR8 announced in September 2024 that it had entered into an exclusive memorandum of understanding (MoU) with China Energy International Group Co (CEIG), a subsidiary of China Energy Engineering Corporation, for the supply of engineering procurement and construction (EPC) services, and assistance with financing for the project.

The MoU is expected to strengthen the relationship between the parties, paving the way for additional value-add opportunities that could potentially transform VR8 into a vertically integrated vanadium producer.

Key Contracts, Suppliers and Consultants

VR8 has engaged a project management consulting firm to assist with overall project execution. EPC packages have been prepared and delivered to CEIG.

Contact Details for Project Information

Vanadium Resources Limited, tel +61 8 6158 9990 or email contact@vr8.global.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation