Steenkampskraal Monazite Mine CEO lays out development plan to 2027

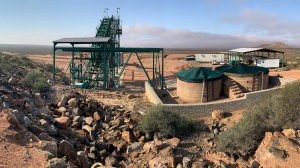

Mining company Steenkampskraal Monazite Mine CEO and mine manager Graham Soden has outlined the mine’s planned development strategy to December 2027 to bring the mine into production.

In a release published on October 23, setting out the company's presentation at the recent Critical Minerals Africa Conference, which was held in Cape Town, Soden explained that the strategy covered producing monazite concentrate with the construction of a monazite concentration plant, followed by the construction of a cracking plant to produce mixed rare earth carbonate and thorium. This will be followed by the construction of a separation plant to produce mixed rare earth oxides.

He said that, to date, about R1-billion had been invested in infrastructure for the mine, which was in the Western Cape.

“The first of three phases will involve the mobilisation of the mining and processing plant and equipment to the site, refurbishment of the decline and shaft area, and re-equipping the headgear and infrastructure,” he said.

Soden added that material and loose ore from underground would be reclaimed, followed by the construction of the monazite concentration plant and the start of underground mining.

“The first monazite concentrate is expected to be produced by December 2024,” he said.

The second phase will involve increased mining volumes and monazite concentrate production and all metallurgical test work, design and planning for the construction and commissioning of a monazite cracking plant. This will produce mixed rare earth carbonate and thorium. In this phase the design and planning of a rare earth separation plant will also be undertaken.

In phase three, the construction and commissioning of the separation plant will be completed to produce mixed rare earth oxides. The period from January to December 2026 will see the cracking plant commissioning and initial production of mixed rare earth carbonate and thorium.

From January 2027 onwards, the steady-state production of monazite concentrate to the cracking plant with the production of mixed rare earth carbonate and thorium will be carried out, with plans to produce individual rare earth oxides.

To finance the project, from August to January 2024, the mine will raise $2-million in capital. This will cover planning, design and metallurgical test work for phases 2 and 3. From January to July 2024, $15-million to $20-million in capital will be raised for working capital, project mobilisation and ongoing metallurgical test work for phases 2 and 3.

The period from August to December 2024 will see the commissioning of Phase 1, the first production of monazite concentrate and ongoing phase 2 and 3 metallurgical test work.

Between January 2025 and December 2025, there will be a further capital raise of $15-million to $20-million for the steady-state production of monazite concentrate, and cracking plant design and construction. The period from January 2026 to December 2026 will see an increase in run-of-mine (RoM) production, the cracking plant commissioning and associated increase in monazite concentrate production to the cracking plant, and the initial production of mixed rare earth carbonate and thorium.

From January 2027 onwards, an additional $15-million to $20-million in capital will be raised. This will be for the steady-state production of monazite concentrate, increased RoM production and monazite concentrate for the cracking plant and the production of mixed rare earth carbonate and thorium. Following this, individual rare earth oxides are planned to be produced.

Soden said the market for rare earth elements was projected to triple by 2035, according to an Adamas Intelligence report, with a compound annual growth rate (CAGR) increase of 8.3% in total market demand. Rare earth prices are expected to have a CAGR increase of between 3.2% and 3.7%. The market value of rare earth is projected to be about $46.2-billion by 2035 globally.

“The problem the industry is currently experiencing is that rare earth prices are dependent on Chinese national policies. China can control rare earth prices simply by adjusting the supply. China exercises lower levels of environmental and legislative control and, as a result, 40% to 50% of rare earth production is grey or illegal. Currently, 80% to 90% of rare earth elements come from China, which poses significant geopolitical and environmental risks,” Soden explained.

He said the Steenkampskraal mine deposit was rich in neodymium and praseodymium (NdPr), dysprosium, terbium and other rare earth minerals. The primary elements at the mine are neodymium at 56.59%, dysprosium at 14.19%, praseodymium at 12.43%, terbium at 9.62%, gadolinium at 2.12% and cerium at 1.95%.

He added that mining major Anglo American developed the mine to an average depth below surface of 100 m along a 400 m strike, with three mining levels and access through a 140 m decline and 28 m vertical shaft. Much of the reef drives and stopes have been left unmined.

“Ground conditions are geotechnically competent, enabling rapid recommissioning of mining operations. Large volumes of blasted ore have been left underground, ready to be reclaimed. The orebody varies in thickness and dip and will be mined conventionally by employing a combination of mining methods. The planned optimised techno-economic development plan will be ongoing to further improve efficiencies. Due to existing face availability, minimum development will be required initially,” Soden said.

He added that a minimum of 5 000 t/y of monazite concentrate would be produced in the first phase. A proven conventional gravity separation and flotation processing plant would be used based on the successful Anglo American process in 1952.

Steenkapmskraal is fully licensed to begin mining and to produce monazite concentrate, mixed rare earth carbonate and thorium, and separated rare earth oxides.

BASE CASE REVENUE

Net present value (NPV) assumptions are based on the production of 5 000 t of monazite concentrate a year at an average price of $6 000/t. In the first phase, the value of monazite concentrate will generate an NPV greater than $200-million.

In Phase 2, the value of mixed rare earth carbonate – excluding thorium – will be $5 200/t with an expected NPV greater than $300-million. Phase 3 expected revenue for separated rare earths based on an average price of $37 000/t will generate an NPV of more than $620-million.

Soden added that the mine would be 100% dependent on renewable energy within two years of commissioning.

“As an underground mine it will have negligible surface impact, with all environmental approvals in place with ongoing rehabilitation of the historical footprint,” he explained.

Soden noted that rare earths were a critical contributor to the low-carbon energy industry, while thorium was a clean energy fuel of the future and could be used in molten salt reactors.

“The mine’s ongoing social and labour plan projects are geared to leaving a lasting legacy with a broad-based employee equity partnership of 26% through the company’s broad-based black economic empowerment structure, and management is committed to transparent and sustainable governance principles,” he said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation