Thermal coal miner New Hope seeks acquisitions as funding options improve

Australian coal miner New Hope is on the hunt for acquisitions, said CEO Rob Bishop, and given improving investor appetite for New Hope debt he had no worries about financing growth in metallurgical coal.

A climate-related push to exclude thermal coal producers from financial services meant that New Hope, which produces more than 90% thermal coal, was challenged to find even bank guarantee facilities for rehabilitation 18 months ago.

But now that push has receded, eclipsed by concerns over energy security and the sector's profit potential. Investor appetite for its debt has grown, Bishop told Reuters as the miner posted a rise in first-half profit on Tuesday, beating analyst expectations.

"There are sources of capital out there, so we're not too concerned about whether we can obtain capital for an acquisition, for example. And if it was a met coal acquisition, then obviously that broadens your availability for funding," he told Reuters.

Some banks including Macquarie are reversing restrictions around financing coking coal because alternatives to make steel are not yet commercial

Private equity house EMR, which is undertaking a sales process for its Kestrel coal mine in Queensland state, is one that New Hope plans to review, he said.

"We've been approached by banks about that opportunity coming up, and yes, for sure, we will look at it," he said.

EMR last year hired Macquarie and Bank of America to run the sale process for the mine which analysts estimated could fetch as much as $3 billion.

New Hope has seen steady demand for its convertible notes in the secondary market, where investors purchase the securities from other investors, it noted.

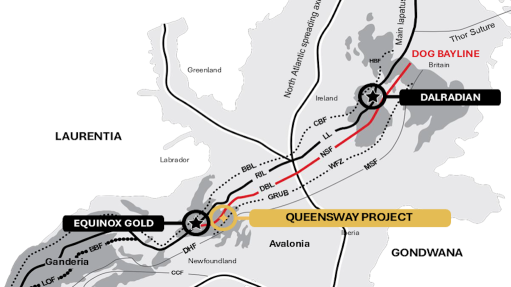

The miner has also crept up its ownership of Malabar Resources in New South Wales to 22.97%. It is looking for high quality, low cost, cash generative assets without big rehabilitation liabilities. It has reviewed opportunities in the Americas and Europe but it sees Australia's Eastern seaboard as an attractive region, Bishop said.

For the half year ended January 31, New Hope posted a net profit after tax of A$340.3-million ($217.2-million), up from A$251.7-million a year earlier, which beat the Visible Alpha consensus forecast of A$302.2-million. Its shares jumped as much as 8.6% on Tuesday.

Total coal sales for the period rose 44% to 5.4-million metric tons, driven primarily by the restart of its New Acland mine in Queensland, where production rose tenfold.

The boost in volume helped offset lower average realised prices for coal during the reported period. Backed by the jump in profit, New Hope announced a share buyback program of A$100-million, set to commence around April 1, 2025, and to be completed within a year.

It declared an interim dividend of 19 Australian cents, above 17 Australian cents last year.

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation