Trade war saps Canadian share-sale market despite metals deals

Volatility from trade tensions with the US kept a lid on Canada’s market for equity deals in the first quarter, even as activity in precious metals perked up.

Canada-listed firms raised just $2-billion in the first quarter, compared to the $2.9-billion raised during the same period a year ago, data compiled by Bloomberg show. Investment bankers say market gyrations wrought by the US-Canada trade war have made dealmaking difficult.

“Whatever thesis you have for making your investment today could be very different from a month, an hour, a year from now,” said Grant Kernaghan, CEO and chairperson of Citigroup Global Markets Canada. “This is not, for the most part, a positive backdrop just because there’s too much volatility.”

The cooling market dashed the hopes of some dealmakers who saw green shoots in 2024, including an initial public offering that ended an 18-month dry spell and a steady flow of deals for existing shares.

Companies weighing a share sale today believe the price they’ll get might fluctuate wildly with every conflicting headline, and that uncertainty also dampens buyer sentiment, Kernaghan said. That’s why investment bankers have been very picky about when they bring deals to the market, and it’s also why deals that take longer to market — like IPOs — could be delayed, leading potentially to a further slowdown in activity.

“There have been some very good days,” said Daniel Nowlan, managing director of equity capital markets, corporate and investment banking at National Bank Financial Markets. He pointed to Swiss Re’s C$655-million ($455-million) sale of its 10% stake in Definity Financial Corp, a Canadian insurer, announced March 18.

“For a company that’s not very liquid, it went very well with great names in the book,” Nowlan said. “But it’s one of those things where we had to pick exactly the right day to be able to do it.”

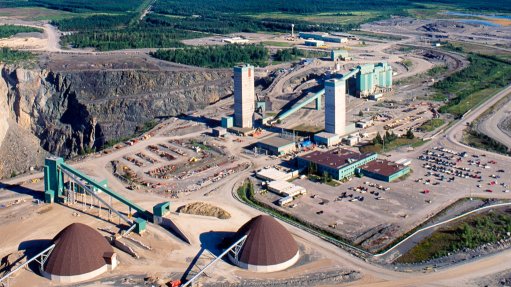

One bright spot in the market has been miners of precious metals. Precious metals companies raised $1.1-billion in Canadian markets in the first quarter, more than four times the amount in the same period last year, according to data compiled by Bloomberg. Discovery Silver Corp.’s C$247.5-million deal is Canada’s biggest equity raise so far this year.

“It hasn’t been a surprise given gold’s strength recently,” said Mike Wang, portfolio manager, ECM and options with Periscope Capital Inc. in Toronto. The increase in activity in materials has prompted the firm and its Periscope Capital Multi-Strategy Fund to focus on it, he said.

“There are certainly sectors within mining that would have no problem coming to market right now and raising equity, but outside of that, I think it’s certainly very challenging,” Citigroup’s Kernaghan said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation