Tumas uranium project, Namibia – update

Photo by Deep Yellow

Name of the Project

Tumas uranium project.

Location

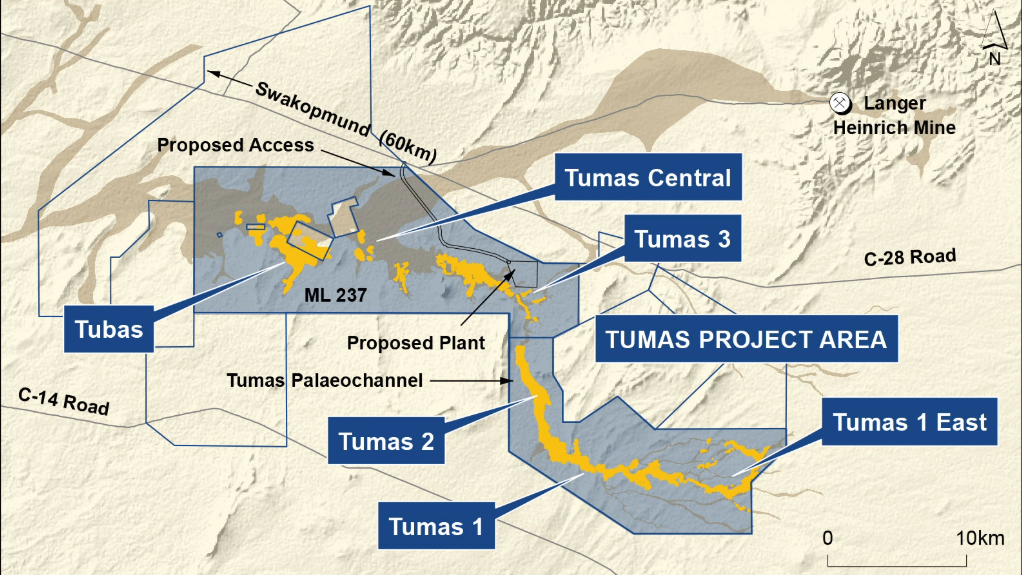

The Tumas palaeochannel system is located within Deep Yellow’s 100%-owned Reptile project, in Namibia.

Project Owner/s

Deep Yellow.

Project Description

The objective of the project is to develop a facility to treat ore from the Tumas 1, Tumas 2, Tumas 3, Tumas 1 East and Tubas ore resources.

Envisaged is an operation treating 4.15-million tonnes a year to produce up to 3.6-million pounds of uranium and 1.15-million pounds of vanadium by-product a year over a projected mine life of 22.25 years, based on existing ore reserves.

Additional resources will likely increase the life-of-mine to more than 30 years.

The mine will be a conventional, shallow opencut, truck-and-shovel operation using contract mining.

The process route comprises a beneficiation process to reject barren material, leaching, solid liquid separation, pregnant leach solution concentration, vanadium recovery, uranium recovery and uranium barren liquor treatment.

The project also includes the construction of a 13.5 km site access road, a 45.1 km, 132 kV powerline and a 65 km water supply pipeline.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

A definitive feasibility study (DFS) review completed in December 2023 found that the base case uranium price had increased from $65/lb to $75/lb, owing to market-strengthening conditions, which resulted in a post-tax net present value (NPV) increase of 68% to $570-million, or A$838-million, with an internal rate of return (IRR) of 27%.

In a more optimal scenario of the uranium price reaching $90/lb, the project’s NPV increases to $878-million and its IRR to 36.1%.

Capital Expenditure

The DFS review has validated a lower initial capital cost for Tumas of $360-million, or A$529-million, down 64% from the initial estimates in the DFS.

Recosting work has identified further potential gains to be made during the detailed engineering phase of the project, with more gains to be made across beneficiation, washing and concentration as demonstrated by metallurgical testwork not having been incorporated into the recosting effort.

Planned Start/End Date

Production startup is expected in 2026.

Latest Developments

Deep Yellow has announced an updated mineral resource estimate for the Tumas 1, Tumas 1 East, Tumas 2 and Tumas 3 deposits, at its Tumas project, with measured and indicated mineral resources estimated at 102.1-million pounds of equivalent triuranium octoxide, grading 268 ppm.

The mineral resource upgrade follows the completion of a resource drilling programme and an update of the Tumas project's mineral reserve is in progress.

Deep Yellow says it is confident that the reserve update will extend the operating life of the flagship Tumas project to more than 35 years.

Key Contracts, Suppliers and Consultants

Ausenco Services (DFS and engineering, procurement and construction management).

Contact Details for Project Information

Deep Yellow, tel +61 8 9286 6999 or email info@deepyellow.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation