US Export-Import Bank considers $120m loan for Greenland rare earths project

Critical Metals has received a letter of interest from the US Export-Import Bank (EXIM) for a loan worth up to $120-million to fund the company's Tanbreez rare earths mine in Greenland, in what would be the Trump administration's first overseas investment in a mining project.

The loan, if approved, would boost US access to minerals increasingly at the center of global economic trade and help offset the country's reliance on market leader China. It also comes after President Donald Trump openly mused earlier this year about acquiring the Danish island territory, an overture that has been repeatedly rejected.

In a letter dated June 12 and reviewed by Reuters, New York-based Critical Metals has met initial requirements to apply for the $120-million EXIM loan and, if approved, would have a 15-year repayment term, longer than the company likely would have with private financing.

The project would have to be "well-capitalized with sufficient equity from strategic investors" to receive the loan, the letter said.

EXIM, which acts as the US government's export credit agency, said in the letter that Critical Metals qualifies for a loan program designed to support companies that compete with China.

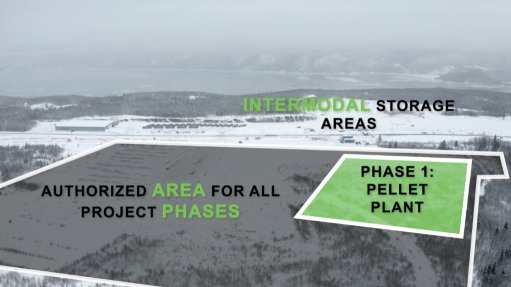

The Tanbreez project is expected to cost $290-million and the EXIM funds would be used to fund technical work and get the mine to initial production by 2026. Once fully operational, the mine is expected to produce 85 000 metric tons per year of a rare earths concentrate and two minor metals.

"This funding package is expected to unlock significant value for our project and our stakeholders," said Tony Sage, the company's CEO.

Representatives for EXIM were not immediately available to comment.

The move is the latest in a series of supportive actions by Washington toward the Tanbreez deposit and Greenland's mining sector. Reuters reported in January that former President Joe Biden's administration had successfully lobbied privately held Tanbreez Mining not to sell to a Chinese developer and instead sell to Critical Metals.

Biden officials were visiting Nuuk as recently as last November trying to woo additional private investment in the island. Trump sent Vice President JD Vance to the island in March.

The island's mining sector has developed slowly in recent years, hindered by limited investor interest, bureaucratic challenges and environmental concerns. Currently, only two small mines are in operation.

Rare earths have strong magnetic properties that make them critical to high-tech industries ranging from electric vehicles to missile systems. Their necessity has given rise to intense competition as Western countries try to lessen their dependence on China's near-total control of their extraction and processing.

Beijing in April put export restrictions on rare earths as part of its trade spat with Trump. The two countries earlier this month reached a truce, although Beijing's control of the sector has exacerbated the West's over-reliance and sparked a global hunt for fresh supplies.

Despite the loan potential, Critical Metals would still have to either build a processing facility or find an existing site with spare capacity. The company told Reuters that its goal is to process the material inside the SS, a goal the EXIM loan would make more achievable.

Last year, Critical Metals had applied for funding to develop a processing facility from the US Department of Defense, but the review process stalled ahead of Trump's January inauguration.

For the EXIM loan's additional funding requirements, Critical Metals said it is considering offtake agreements, royalty streams and funding from other US governmental agencies.

Critical Metals told Reuters earlier this year that it has held supply talks with defense contractor Lockheed Martin, among others.

Critical Metals' 10th-largest investor is brokerage firm Cantor Fitzgerald, which was formerly led by Howard Lutnick before he joined Trump's cabinet as secretary of the US Commerce Department. Sage told Reuters in January he had never met or talked to Lutnick, but acknowledged Cantor's investment was a positive for his company.

EXIM last year extended a letter of interest to Perpetua Resources for a loan worth up to $1.8-billion for its antimony and gold mine in Idaho.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation