Victory delivers economic case for North Stanmore rare earths project

ASX-listed Victory Metals has completed a scoping study for the North Stanmore rare earths project in Western Australia, confirming the project is a world-class opportunity for the critical minerals sector.

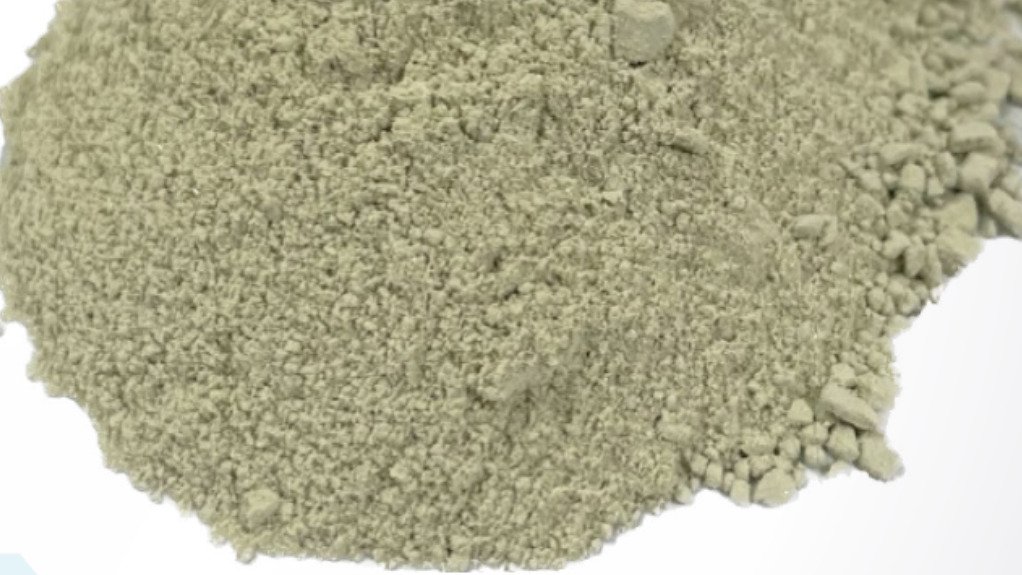

North Stanmore, in Western Australia, stands out as one of the biggest heavy rare earths and scandium clay projects globally, the company reports.

The scoping study demonstrates that the project offers robust economic returns, with a projected net present value exceeding A$1.2-billion and an internal rate of return of 52% post-tax, based on conservative price forecasts.

Even with lower case price assumptions, the study highlights the project’s strong financial viability and low-cost advantages over traditional rare earth projects.

CEO and executive director Brendan Clark said the completion of the scoping study was a "defining milestone" for Victory.

“Heavy rare earths, particularly dysprosium and terbium along with emerging defence metals such as scandium and hafnium, are in growing global demand due to their critical importance and emerging supply constraints. As industries increasingly look for sustainable, high-performance and defence materials, the outlook continues to strengthen in these markets, presenting another compelling and diversified offtake opportunity for Victory Metals," he said.

"The combination of a globally significant resource, low capital expenditure (capex) and strong market fundamentals sets North Stanmore apart as a unique and highly strategic project. We are now focused on advancing towards production while continuing discussions with potential partners to further de-risk development and maximise shareholder value," added Clark.

The scoping study, led by independent engineering consultants Mincore, outlines several key financial and operational metrics that showcase the project’s strong economic outlook. These include a capex estimate of A$337-million (including a 30% contingency) and low operating costs of A$25.5/t of run-of-mine material over the life-of-mine.

The study also highlights the project’s outstanding metallurgical recovery, with a 94% recovery rate for magnet rare earth oxides.

The North Stanmore project benefits from its location on crown land with no private landowners and no existing royalties, which provides significant project savings. Furthermore, the mineralisation remains open in all directions, and the recent identification of a strong exploration target outside the current resource suggests that the resource is likely to expand rapidly.

Victory is now focused on advancing the North Stanmore project towards production while continuing to engage with potential partners and offtakers. The company has already entered into a nonbinding memorandum of understanding with Sumitomo to negotiate an offtake agreement, further strengthening the project’s prospects.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation