Waterberg project, South Africa – update

Photo by Platinum Group Metals

Name of the Project

Waterberg project.

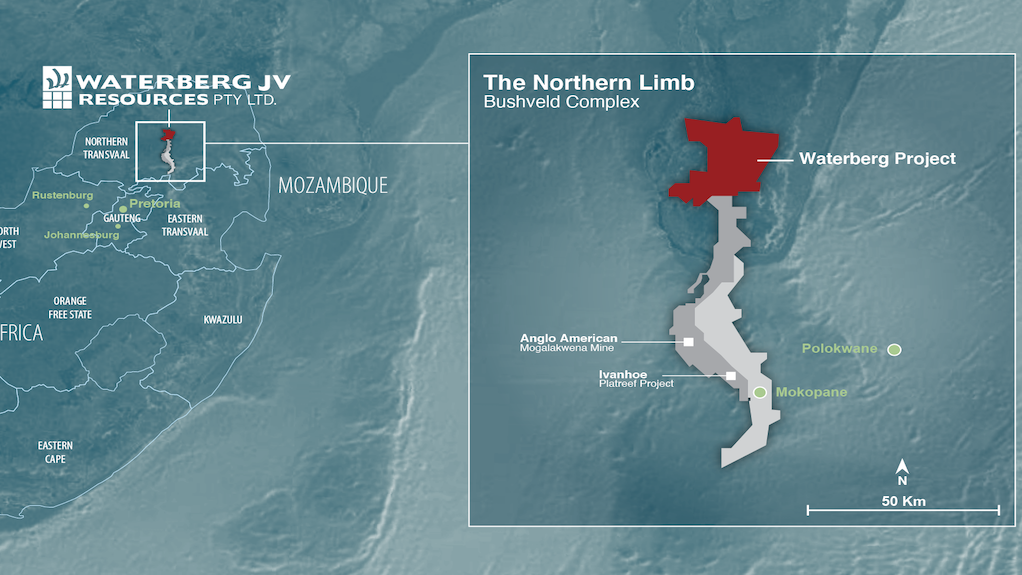

Location

Limpopo, South Africa.

Project Owner/s

Platinum Group Metals (PTM) and Waterberg JV Resources, representing owners PTM (37.19% held directly by PTM RSA) plus 12.97% held indirectly through PTM RSA’s 49.9% interest in Mnombo Wethu Consultants, Mnombo (26.0% direct), Impala Platinum (14.86% direct) and HJ Platinum Metals Company (HJM – 21.95% direct). HJM is a special-purpose entity established in 2023 to hold and fund the equity interests of the Japan Organization for Metals and Energy Security, and Hanwa Co.

Project Description

An independent definitive feasibility study (2024 DFS) has updated the original positive results of the independent DFS published in September 2019 (2019 DFS) for a safe, large-scale, shallow, decline-accessible and mechanised platinum, palladium, rhodium and gold (4E) mine.

Proven and probable mineral reserves have increased by 20% to 23.41-million ounces 4E (246.2-million tonnes at an average grade of 2.96 g/t 4E, 0.08% copper, and 0.17% nickel) as at August 31, 2024.

The life-of-mine (LoM) has increased from 45 years in the 2019 DFS to 54 years in the 2024 DFS.

The 2024 DFS mine plan models steady-state production at 4.8-million tonnes of ore a year and an LoM average of 353 208 oz/y 4E in concentrate, versus an LoM average of 390 796 oz/y 4E in concentrate in the 2019 DFS, when calculated in the same manner.

Maximum production is estimated at 432 950 oz/y 4E in concentrate in the 2024 DFS. The mine initially accesses the F-Central Zone orebody using a single set of twin decline tunnels (service and conveyor declines) with mining of 400 000 t a month using fully mechanised longhole stoping methods.

The Central-F steady-state ore-to-waste ratio in the 2024 DFS is a favourable 14.8%, and about 47% of waste rock will be placed underground as backfill, with the balance to be trucked or conveyed to surface. Ore will be mucked to one of several underground rock breakers, from where it will be sized and then transported to surface by conveyors.

Paste backfill will be used, allowing for a high mining extraction ratio, as mining can be completed next to backfilled stopes with few internal pillars.

After about 26 years of mining, once production in the Central Complex starts to ramp down, the T-Zone and F-South Zones are scheduled for access by development of twin drives from the F-Central Zone infrastructure. Mining is to continue using fully mechanised longhole stoping methods and paste backfill.

As in the 2019 DFS, a separate boxcut and portal to access the North Complex, with twin declines, is also scheduled later in the mine plan. Once established, the South Complex (100 000 t a month) and North Complex (300 000 t a month), are scheduled to ramp up to maintain 400 000 t a month production for the balance of the LoM.

The North Complex mine design and grade profile is unchanged from the 2019 DFS.

Metallurgical recovery and smelter assumptions are based on the plant designs, metallurgical recoveries and costing on a standard South African flotation mill-float-mill-float circuit.

Potential Job Creation

Two thousand jobs are expected to be created during construction and 1 425 permanent jobs as steady-state mining is achieved.

Net Present Value/Internal Rate of Return

The 2024 DFS shows a robust after-tax net present value, at an 8% real discount rate, of R11.56-billion and an internal rate of return of 14.2% using average long-term consensus metal prices as of May 2024.

Payback from first production is estimated at 5.8 years.

Capital Expenditure

The total capital expenditure (capex) in the 2024 DFS is estimated at R18.86-billion, including 8.5% for contingencies, and peak capital is estimated at R15.43-billion.

Planned Start/End Date

Under the 2024 DFS financial model, construction is expected to start in December 2025, with first production forecast for September 2029. Ramp-up to steady state is expected by May 2032.

Latest Developments

PTM’s near-term focus remains advancing the Waterberg project to a development and construction decision. Financing and offtake discussions have been under way since the project’s DFS was updated in September 2024.

Alongside Anglo American Platinum and Florida International University, PTM is also working through Lion Battery Technologies to develop lithium battery technologies using platinum and palladium.

In February 2025, the Waterberg JV board approved a R42-million ($2.2-million) interim budget to continue work until August 31, including site preparation and engineering, as well as a DFS on a proposed PGMs smelter and base metals refinery in Saudi Arabia.

Funding will also come from an equity distribution agreement with BMO Nesbitt, BMO Capital Markets and Beacon Securities, signed in December 2024. The agreement allows for up to $50-million in at-the-market share issuances. Between December and February, PTM raised $1.1-million through share sales and issued a further $900 000 in shares thereafter.

Expenditure on the project for the six months to February 28 totalled about $1-million, with cumulative spend reaching $90-million since inception.

In November 2024, PTM signed an MoU with Ajlan & Bros and the Saudi Ministry of Investment for the proposed Saudi refinery. The $4-million DFS cost will be shared equally between PTM and Ajlan.

A key condition is long-term South African government approval to export unrefined concentrate. PTM is engaging with authorities to assess beneficiation opportunities and potential impacts on the local value chain.

Ajlan and PTM are also exploring the development of a matte furnace near the Waterberg project. This would allow for local smelting, with converter matte shipped to Saudi Arabia for further refining. The refinery could also co-process spent autocatalysts and other PGM-bearing materials.

The partners are conducting a trade-off study and developing cost estimates for the required engineering work. Shipping matte instead of concentrate could reduce transport volumes from 130 000 t/y (14 trucks/d) to 8 000 t/y (1 truck/d).

Key Contracts, Suppliers and Consultants

Stantec Consulting International and DRA Projects (independent definitive feasibility); and Fraser McGill (engineering oversight and project management).

Contact Details for Project Information

PTM, tel +27 11782 2186 or email info@platinumgroupmetals.net.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation