Witwatersrand Basin Project – Qala Shallows, South Africa – update

Photo by West Wits Mining

Name of the Project

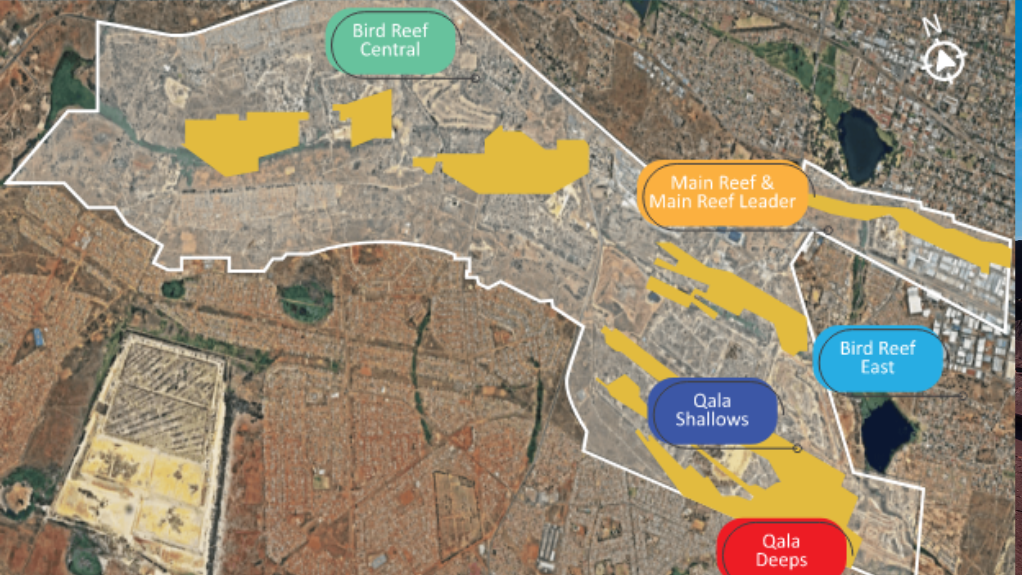

Witwatersrand Basin Project (WBP) – Qala Shallows.

Location

The project is situated about 15 km west of the Johannesburg central business district, in South Africa's Gauteng province.

Project Owner/s

Explorer, developer and producer of high-value precious and base metals West Wits Mining.

Project Description

Qala Shallows is an integral part of the WBP. An updated definitive feasibility study (DFS), released on July 23, 2025, highlights improved results and reinforces the project's robust value and strong economic fundamentals.

The reefs to be processed during the life of the project are the Kimberley reefs – K9A and K9B.

The total Joint Ore Reserves Committee- (Jorc-) compliant mineral reserves are estimated at 4.6-million tonnes grading at 2.60 g/t for 383 934 oz of gold. The total Jorc-compliant mineral resources for the K9A reef are estimated at 8.1-million tonnes grading at 4.8 g/t gold for 1.2-million ounces of gold, and 10.5-million tonnes at 4.5 g/t gold for 1.5-million ounces of gold for the K9B reef.

The mine plan has been optimised with a lower cutoff grade of 1.31 g/t (reduced from 2 g/t in 2023), allowing for the inclusion of additional ore and accelerating the production profile. The project uses a conventional breast mining method in an underhand configuration, considered optimal for the Qala Shallows deposit.

The stopes will be accessed by strike drives developed on the K9B reef horizon and K9A and K9B stopes will be accessed from this infrastructure. The strike drives will connect to a decline system developed from the existing Qala adit boxcut, located centrally in the mining area and in the footwall of the K9B reef.

Steady-state gold production is estimated at 70 000 oz/y over a 12-year period, an increase from nine years in the 2023 DFS.

Total gold production over the 16.8-year life-of-mine is projected at 944 000 oz, up from 924 000 oz over 17.7 years in the 2023 DFS. The maximum production rate is estimated at 860 000 t/y (2023 DFS: 839 000 t/y), with an average gold production of 56 000 oz/y (2023 DFS: 51 000 oz) and peak production of 75 000 oz in Year 6. The total run-of-mine tonnes are estimated at 10.7-million (2023 DFS: 10.2-million tonnes).

Ore processing will be conducted at the Ezulwini process plant, a subsidiary of Sibanye-Stillwater, on a toll treatment basis. The plant uses carbon-in-pulp for gold recovery.

Potential Job Creation

Not stated.

Net Present Value/Internal Rate of Return

The updated DFS shows a pretax net present value, at a7.5% discount rate, of $719-million (compared with $367-million in 2023) and an internal rate of return of 93% (compared with 61% in 2023). Payback from the end of the peak funding period is estimated at eight months and at 3.3 years from the start of development.

Capital Expenditure

Peak funding is estimated at $44-million over a 2.6-year period, a reduction from $54-million over three years in the 2023 DFS.

Planned Start/End Date

The first gold pour at Qala Shallows is slated for the first quarter 2026.

Latest Developments

West Wits Mining has secured firm commitments to raise A$17.5-million before costs through a share placement to institutional, sophisticated and professional investors.

The placement will involve the issue of 437.5-million new fully paid ordinary shares at A$0.04 a share.

The proceeds from the placement, together with the company’s existing cash and facilities, will fund mine development, operating and financing requirements, and general working capital to accelerate gold production.

The company has also recently secured a R875-million loan facility from the Industrial Development Corporation and Absa, as well as a $12.5-million tranche of funding from Nebari, which, together with the placement, strengthen the company’s balance sheet and position it to deliver near-term gold production.

The funds raised will specifically be applied to capital expenditure and contingency costs for developing the project, operating expenditure and financing costs, as well as general working capital and corporate costs.

Key Contracts, Suppliers and Consultants

Bara Consulting (independent mining engineers, undertaking the DFS review and update); Modi Mining (mining contractor); Industrial Development Corporation of South Africa and Absa Bank (lenders for the syndicated loan facility); and Sibanye-Stillwater's Ezulwini process plant facility (toll treatment agreement for ore processing).

Contact Details for Project Information

West Wits Mining, tel +61 3 8692 9049 or email info@westwitsmining.com.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation