Akobo expects to deliver positive cash flow from operations in the third quarter

Scandinavian gold producer Akobo Minerals, which is ramping up development at its Segele mine, in Ethiopia, has reported revenues of SKr9.6-million for the second quarter of this year.

The company expects revenues to continue increasing in the third quarter and anticipates delivering positive cash flow from operations for the first time.

The miner reported a loss of earnings before interest, taxes, depreciation and amortisation of SKr3.1-million for the second quarter of this year.

The company covered part of its operating costs in the quarter, holding a cash position of SKr7-million at the end of the period.

Akobo noted that the gold price continued to remain historically high, surpassing $3 700/oz.

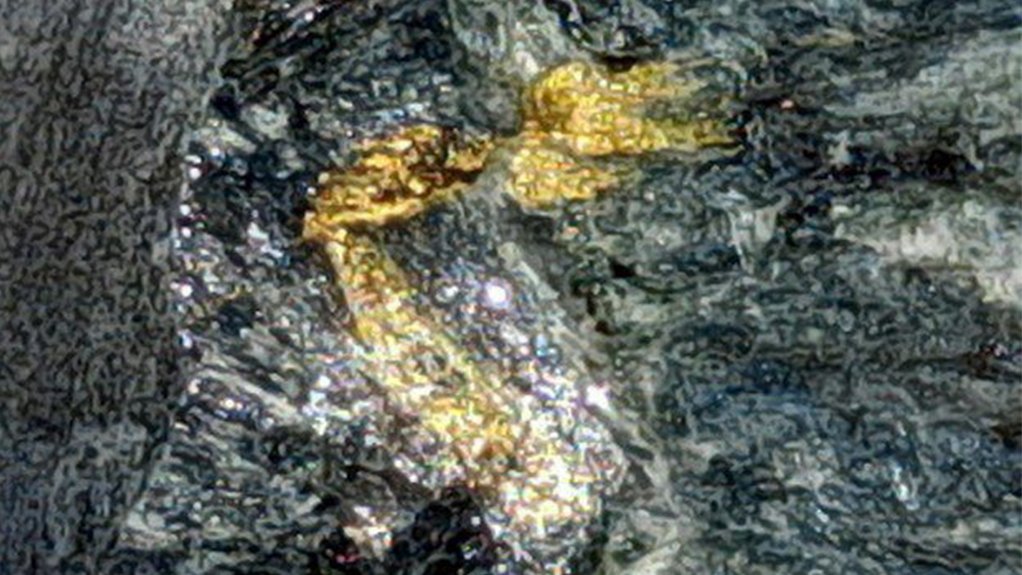

The company said July production delivered a “world-class” average grade of 45 g/t, with gold purity above 90%.

With regard to mining progress and vertical shaft development, the company noted that two new large shaking tables had been installed and successfully tested.

Additionally, headgear for the new vertical shaft, identified as a long-lead item, is in production.

Akobo said heavy machinery had also arrived on site to support the start of vertical shaft work and the vertical shaft team had mobilised, with preparatory work in progress.

Meanwhile, Johnny Swanepoel from Sutton Global joined as the new operations manager at the Segele site.

Akobo sayid he had extensive experience in mining and processing, with a proven record of maximising gold recovery.

Further, the company noted that Ethiopian Investment Holdings (EIH) became a shareholder in Akobo through a $3-million private placement, subscribing for 15-million new shares at $0.20 a share.

As the sovereign investment arm of the Federal Democratic Republic of Ethiopia, EIH supports strategic projects in the mining sector, contributing to employment, foreign exchange generation and national economic growth.

Akobo completed its financial restructuring by amending and restating the loan agreement with Monetary Metals and converting remaining convertible bonds into shares.

Key elements include a reduced interest rate from 30% to 22% a year, with an interest-free period from August 15 to February 15, 2026.

The company explained that quarterly repayments were expected to begin in March 2026, with loan maturity extended to July 31, 2027.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation