Ausgold raises A$35m for Katanning development

Gold developer Ausgold has secured A$35-million in funding through a placement to institutional investors, as the company moves to accelerate the development of its flagship Katanning gold project (KGP) in Western Australia.

The capital raise, priced at A$0.57 a share, attracted strong demand from new and existing shareholders, including several “highly credentialled offshore and domestic institutional investors", the company said in a statement on Thursday.

The placement involves issuing about 61.4-million new shares, with Ausgold directors also committing to participate. Executive chairperson John Dorward will subscribe for A$50 000, and nonexecutive director Paul Weedon for A$100 000, subject to shareholder approval.

Proceeds from the raise will fund the acceleration of the KGP toward a final investment decision (FID), exploration of near-mine and regional targets, and the acquisition of freehold land, including parcels already under option. Funds will also support early procurement of long lead-time items and general working capital.

Dorward said the placement came at a critical juncture in the company’s transition toward production. “The recent on-time and on-budget successful completion of the definitive feasibility study (DFS) for Katanning was a major milestone on the road to Ausgold becoming Australia’s next midtier gold producer,” he stated.

“This new capital stands us in good stead to progress works in relation to our next goal of rapidly accelerating the development of the KGP to an FID and continuing to explore our extensive tenement holding. I am delighted with the support of many of our existing shareholders and welcome a few new high-calibre institutional investors to the Ausgold register,” Dorward added.

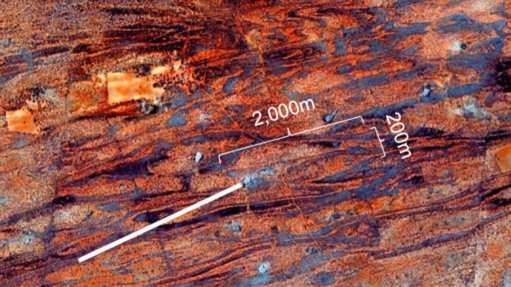

The June 30 DFS outlines plans for a 3.6-million-tonne-a-year gold mining and processing facility at the KGP, producing an average of 140 000 oz/y in the first four years. The project boasts an aftertax cashflow of A$1.37-billion and an internal rate of return of 53% at A$4 300/oz of gold.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation