Bushveld falls to a loss on the back of funding constraints, but turnaround expected

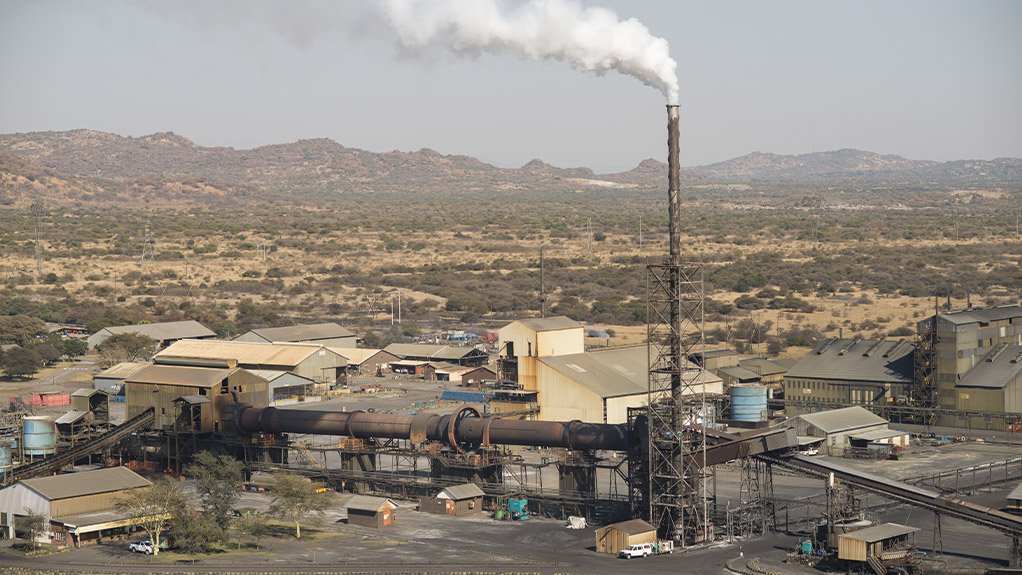

Aim-listed Bushveld Minerals’ results for the six months ended June 30 reflect a challenging start to the financial year, as severe funding constraints led to the inability to run its assets efficiently, CEO Craig Coltman says.

However, the company has remained steadfast in its commitment to rationalise assets and implement a range of cost-cutting measures in what is now its core asset, Vametco, he adds.

Bushveld recorded an adjusted loss before interest, taxes, depreciation and amortisation of $14.3-million, compared with earnings before interest, taxes, depreciation and amortisation of $12.6-million for the first half of 2023.

It also recorded an operating loss of $18.6-million compared with a $7.9-million profit in the prior comparable period.

The net loss for the period was $45-million, compared with a net loss of $12.5-million in the prior comparable period.

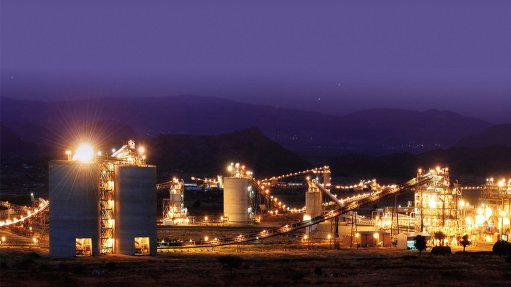

The sale of the Vanchem vanadium processing plant to Southern Point Resources (SPR) Fund, as previously announced, is expected to be concluded, with approval from the South African competition authorities, by end-October.

Meanwhile, Coltman points out that May was a standout month at Vametco, reaching its highest monthly output since the beginning of his tenure of 217 t, demonstrating the early success of some of the company’s turnaround efforts.

Moreover, Bushveld saw the successful receipt of the final instalment of $2-million from SPR, completing the total $12-million interim working capital facility initially secured in May.

“In a further boost to our position, we received the full $10-million of the matched funding facility from Orion. These milestones have enabled us to maintain momentum in our turnaround journey, but the company remains focused on managing our working capital situation and is dependent on a significant amount of funds from SPR for the balance of funds due in 2024,” Coltman explains.

The group remains focused on optimising operations and rightsizing the organisation to ensure that Vametco is a cash-generating asset.

Bushveld expects to achieve annualised savings of $8-million to $10-million by the end of 2025.

The cost-saving actions include, among other initiatives, reducing the current labour complement at Vametco and head office.

Bushveld is targeting production of 240 t of vanadium a month throughout the remainder of this year.

Bushveld is also working to complete the sale of certain noncore assets, namely Lemur Holdings and Bushveld Electrolyte Company (Belco).

It is in discussions with a joint venture partner for the transfer of liabilities from Belco and removal of a guarantee provided by Bushveld amounting to R28.75-million.

It has also received approval from the Development Bank of Southern Africa to dispose of Lemur, which will result in Bushveld no longer being liable for about $2.5-million in debt. The disposal remains subject to certain outstanding conditions being met.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation