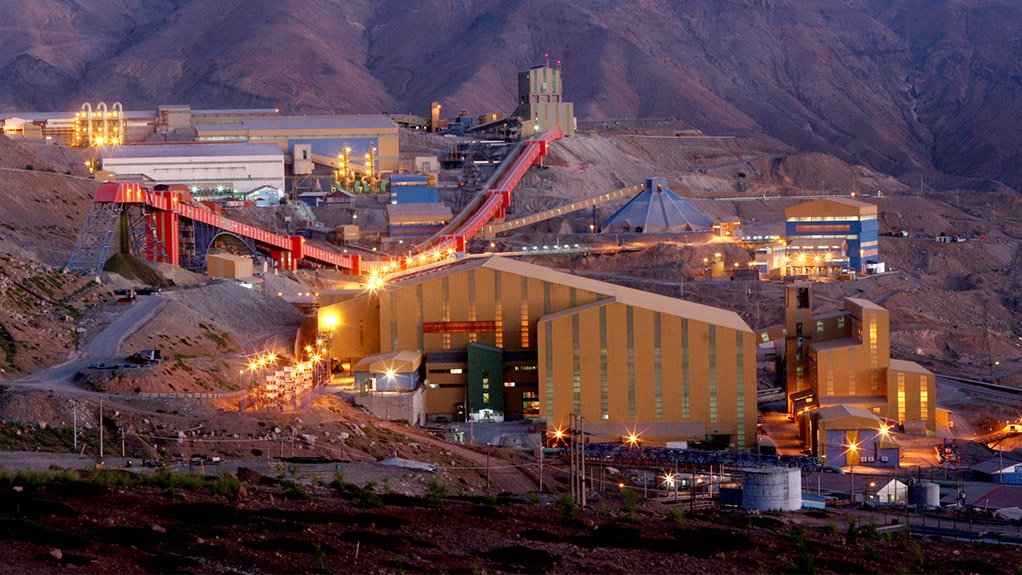

Codelco's record China copper offer sparks threats to walk away, sources say

Chilean copper heavyweight Codelco's record high offers to Chinese copper buyers are leading some to declare they will opt out of next year's term contracts as questions grow about the relevance of the benchmark for Chinese buyers.

The Codelco premium, which is paid on top of London Metal Exchange copper prices, is often used as a reference for global copper supply contracts, as Codelco is the world's largest copper producer and China the largest consumer.

Codelco has offered Chinese buyers a $350/t premium over London Metal Exchange prices, according to two sources familiar with the matter, an increase over the $89/t agreed during last year's negotiations.

But at least three of Codelco's Chinese customers have said they are now prepared to walk away from term contracts this year and opt for spot deals instead, according to sources with knowledge of the matter.

A fourth customer, who has yet to receive an offer, said when asked about the premium: "Who will buy at this price?"

Codelco did not immediately respond to emailed questions about the offers.

The willingness to eschew the closely watched term deals underscores growing questions about the benchmark's relevance for China among delegates gathered in Shanghai for the World Copper Conference Asia.

The premium for Codelco copper partly reflects how cargoes are deliverable to the US Comex exchange, where prices have soared this year, a factor which is less relevant for some Chinese buyers, according to two traders who spoke on condition of anonymity.

A third trader said the current offer suited big trading houses with easy access to the US able to take advantage of arbitrage opportunities, an opportunity some Chinese traders would struggle to execute.

At the same time China's imports of refined copper from Chile have fallen steadily since 2023 both in absolute terms and as a share of total imports, Chinese customs data shows. Imports hit 255 334 t in the first ten months of this year, half of the level from the same period last year.

The hike in the premium comes after fears of copper shortages next year pushed LME copper to an all-time peak of $11 200/t in late October. The metal traded at $10 868/t as of 0703 GMT.

Codelco, the world's biggest copper miner, has already offered its European customers refined copper at a record high premium of $325/t in 2026, a 39% jump year-on-year, Reuters reported last month.

Some Chinese buyers might eventually accept the high premium on bets of a widening arbitrage between the London Metal Exchange and the Comex exchange, according to four other traders and analysts.

"That's a level far beyond the acceptable level of Chinese consumers, so those who accept it will likely re-transport to Europe and the United States to cash in the lucrative arbitrage," one of the sources said.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation