Greenfield investment lagging badly, mining’s contribution to economy halved

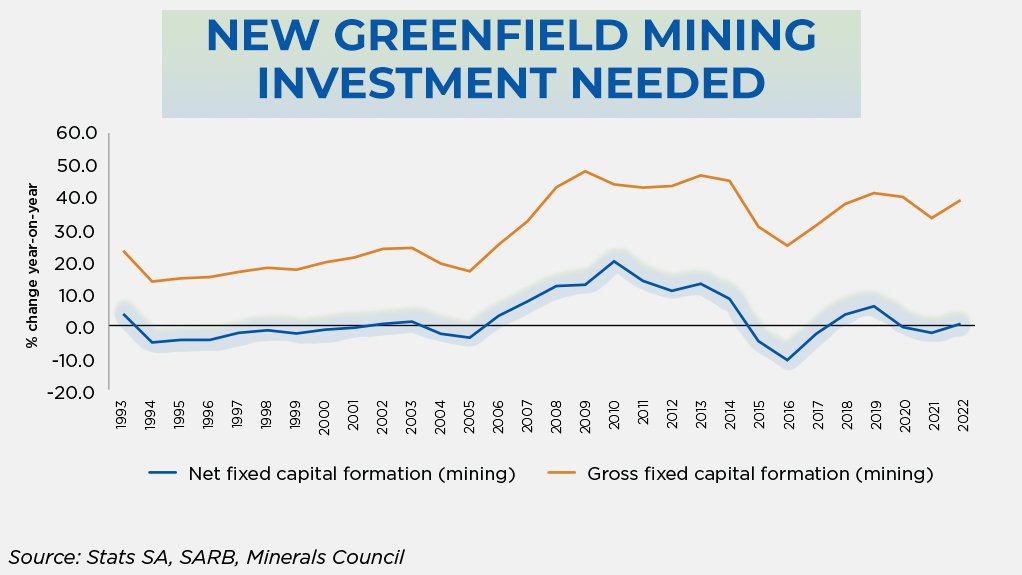

Mining's net fixed capital formation, shown in blue, must be boosted.

South Africa's big Mponeng gold mine.

JOHANNESBURG (miningweekly.com) – The growth of investment in fresh new greenfield mining projects is lagging badly and the contribution of the South African mining industry to the national economy has more than halved in the last two decades, Minerals Council South Africa’s latest Facts and Figures 2022 points out.

Net fixed capital formation figures show a mining industry bumping along a growthless greenfield path.

Investment in the mining sector has largely been directed towards maintaining current operations. This is reflected in the 30%-higher gross fixed capital formation investment, which centres on brownfield growth in existing lease areas.

In contrast, net fixed capital formation investment in mining averaged a low 4% from 1993 to 2022. (Also see attached graph.)

A major upturn in net fixed investment is required because what has been mined needs to be replaced by a new find.

In stark contrast to other sectors of the South African economy, mining has consistently struggled to achieve and maintain positive growth.

In fact, mining is the only sector of the South African economy that has averaged a negative 0.4% growth rate since 1994 in the face of all other sectors having grown, Facts and Figures 2022 highlights.

Stay-in-business brownfield investment in existing lease areas can only go on for so long, making new greenfield investment essential if mining is to continue to be a meaningful economic multiplier.

An indication of mining’s magnitude is provided by the sector's having remained a trillion-rand industry for the second consecutive year when measured in production value.

While the contribution to South Africa’s gross domestic product (GDP) was 1.9% higher at R483.3-billion, and direct payments into the fiscus totalled R99.1-billion, mining could have contributed 35% to 50% more to the fiscus in an environment of improved logistics performance and electricity security.

It would thus make the necessary cash flow available for the government to invest in much-needed socio-economic infrastructure, such as education, health, roads and railways to drive economic development.

Production in the year to December 2022 was 6.9% lower than in 2021. What is more, 2022 production performance was 6.7% lower when compared to pre-Covid levels.

“Our industry is in decline, a trend which should be of concern to the nation,” new Minerals Council CEO Mzila Mthenjane stated.

“The value at stake for the nation is too large for the Minerals Council not to play a leading role in reversing this trend,” Mthenjane added.

Minerals Council is working closely with its business peers, government and other stakeholders to ensure sustainable and pragmatic solutions to the infrastructural and logistics constraints faced by the industry – while addressing the deteriorating security environment.

“If these blockages are resolved, with the inclusion of the private sector, the mining industry’s role as a key contributor to the wellbeing of the South African economy and livelihoods of people of South Africa will be fully unlocked. We believe and will continue to uphold our vision of #MiningMatters because it really does,” Mthenjane emphasised in the release to Mining Weekly.

Needed ultra-urgently is an efficiently working proven cadastre as well as an incentive framework to ensure the promotion of mining exploration.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation