Kangankunde rare earths project, Malawi – update

Photo by Lindian Resources

Name of the Project

Kangankunde rare earths project.

Location

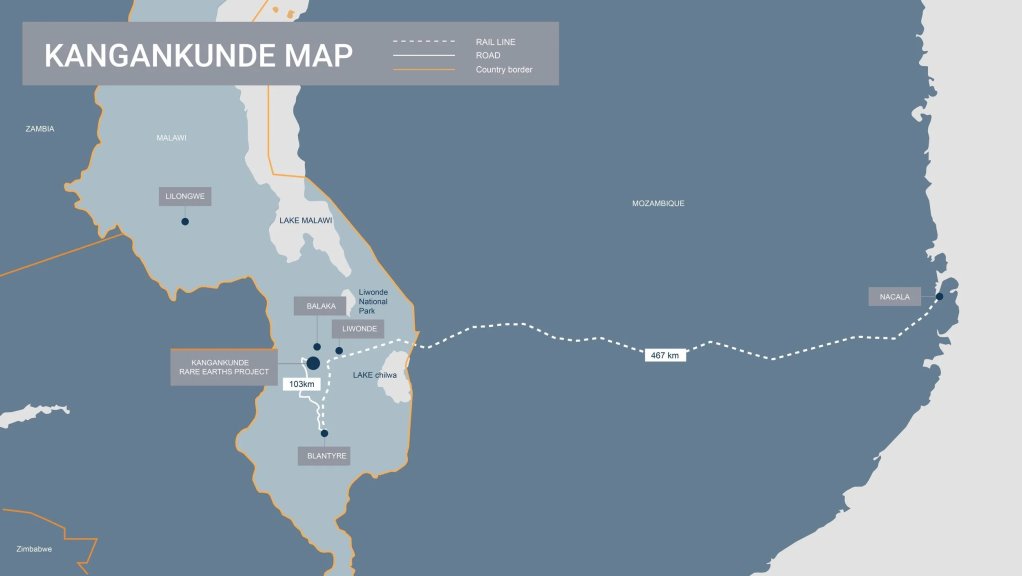

About 90 km north of Blantyre and 13 km south of Balaka, in Malawi.

Project Owner/s

Australia-based Lindian Resources.

Project Description

A feasibility study on the Stage 1 development of the project has confirmed a technically low-risk and economically robust project, with maiden ore reserves of 23.7-million tonnes at 2.9% total rare-earth oxides (TREOs) supporting a Stage 1 life-of-mine of 45 years.

Lindian will produce a premium monazite concentrate at 55% TREO grade with no deleterious elements. Operating costs will be in the lowest-cost quartile globally, establishing it as one of the largest, most promising underdeveloped rare earths deposits in the world.

Stage 1 envisages average production of about 15 323 t/y of premium concentrate with 55% TREO grade, with low levels of radionuclides (thorium and uranium) and limited acid-consuming minerals.

The premium concentrate will contain an estimated 8 400 t/y of rare-earth oxide (REO) and about 1 640 t/y of neodymium/

praseodymium.

The unique mineralogy of the Kangankunde’s ore makes it amenable to relatively high levels of REO recovery, mainly through a physical process of gravity and magnetic separation.

As a result, the project’s flowsheet only requires a small flotation circuit at the back end of the plant to reduce impurities such as sulphides.

The very strong economics of Stage 1 and the large resource endowment of the project, together with robust market demand forecasts, provide confidence for a potential Stage 2 expansion to significantly increase yearly production.

Potential Job Creation

The project will require more than 200 full-time equivalent site roles during the construction phase, and more than 100 full-time equivalent site roles during the operational phase.

Net Present Value/Internal Rate of Return

The project has a pretax net present value, at an 8% discount rate, of $794-million and an internal rate of return of 99%, with a payback of less than two years.

Capital Expenditure

Preproduction capital is estimated at $40-million, which includes 12.5% contingency, making it one of the lowest capital cost rare earths projects under development.

Planned Start/End Date

First production is targeted and on track for the fourth quarter of 2026.

Latest Developments

Lindian Resources has confirmed A$91.5-million from institutional investors and approved a final investment decision (FID) to build the first stage of the mine.

The two-tranche equity raising, at 21c a share, was strongly supported by new domestic and international investors. The issue price represented a 6.7% discount to Lindian’s closing price of 22.5c on August 15, but a premium to the company’s recent volume-weighted averages.

With the placement completed, Lindian now has full funding in place to bring Kangankunde into production by late 2026. The company is targeting about 15 300 t/y of monazite concentrate in its first stage, with a feasibility study projecting a pretax net present value of A$1.18-billion and an internal rate of return of 99%.

Executive chairperson Robert Martin has said the raising has shown global recognition of the project’s scale.

“To be able to declare the FID sets Lindian on the pathway to being the world’s next rare earths producer, a truly remarkable position for your company to be in. We now have a very clear, fully funded and unencumbered pathway to first production,” Martin has indicated.

The new funding will enable the company to move quickly on procurement and contracting.

Stage 2 expansion plans are also under way, with Lindian holding approvals to lift output to as much as 50 000 t/y.

Proceeds from the placement will partly fund engineering work and infrastructure for the expansion, alongside increasing Lindian’s ownership of Kangankunde to 100%.

Key Contracts, Suppliers and Consultants

None stated.

Contact Details for Project Information

Lindian Resources, tel +61 8 6557 8838 or email info@lindianresources.com.au.

Article Enquiry

Email Article

Save Article

To advertise email advertising@creamermedia.co.za or click here

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation