IsoEnergy and Consolidated Uranium merge to create $900m company

TSX-V-listed firms IsoEnergy and Consolidated Uranium (CUR) on Wednesday announced a share-for-share merger to create company with an equity value of $903.5-million – ranking among the top ten publicly traded uranium-focused companies in the world.

IsoEnergy, a subsidiary of NexGen Energy, will acquire CUR for 0.500 of a common share for each CUR share held. Upon completion of the merger, IsoEnergy shareholders will own 70.5% and CUR shareholders 29.5% of the company.

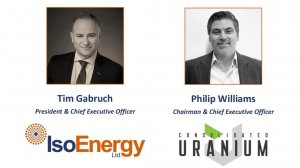

The transaction creates a diversified uranium development and exploration company, focused on the premier uranium jurisdictions of Canada, the US and Australia, said IsoEnergy president and CEO Tim Gabruch.

“The merger provides our existing shareholders and new investors with an even greater opportunity to participate in the tremendous upside potential of our asset portfolio at a time when sentiment and support around the nuclear sector and the uranium industry in particular are increasingly positive,” said Gabruch, who will be president of the new merged company.

CUR’s Philip Williams will become CEO of the merged entity, while Darryl Clark will be executive VP exploration and development, Graham du Preez is CFO, Marty Tunney is COO and Dan Brisbin is VP exploration.

The board of directors will consist of six directors, four of whom were selected by IsoEnergy from the existing IsoEnergy directors, consisting of Richard Patricio as chairperson, Leigh Curyer, who will be appointed vice chairperson, Chris McFadden and Peter Netupsky, and two of whom will be selected by CUR, consisting of Williams and one other director from the existing CUR directors.

According to a joint statement, the merged company would focus on building a globally significant, multi-asset, multi-jurisdiction uranium producer with a focus on restarting, developing and exploring its projects, while looking to further expand the portfolio through mergers and acquisitions.

The combined company’s assets are anchored by uranium resources in Canada’s Athabasca basin and fully-permitted, conventional mines in the US, ready for a rapid restart.

Further, the company is backed by corporate and institutional investors, including NexGen Energy, Energy Fuels, Mega Uranium and uranium ETFs.

IsoEnergy also announced a concurrent private placement of 4 667 000 subscritpion receipts for gross proceeds of $21-million. Each of NexGen, Mega Uranium and Energy Fuels have indicated their intention to participate.

The proceeds of the offering, which is set to close on October 19, will be used to advance exploration and development of its assets.

Article Enquiry

Email Article

Save Article

Feedback

To advertise email advertising@creamermedia.co.za or click here

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation